Technical analysis recommendations for EUR/USD and GBP/USD on April 29

Economic calendar (Universal time)

Among the important news in today's economic calendar are expected:

12:30 GDP (United States),

14:00 pending sales index on the real estate market (USA),

14:30 crude oil reserves (USA),

18:00 interest rate decision and FOMC press conference.

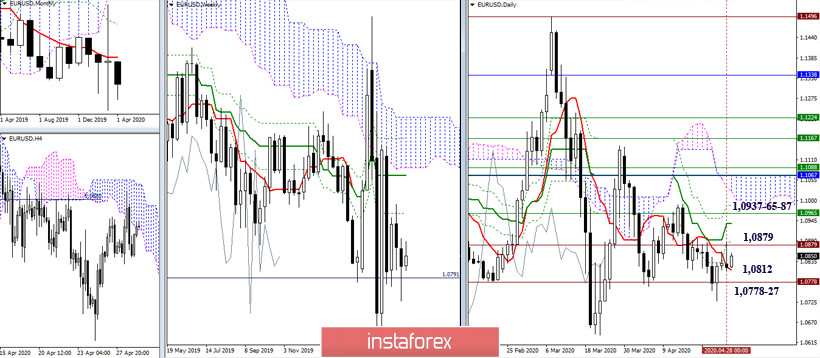

EUR / USD

Players on the rise tested the resistance of 1.0879 yesterday, but by the close of the day, the pair returned to the area of attraction of the daily short-term trend to the minimum of the previous day. As a result, the situation has not undergone significant changes and uncertainty and lack of obvious preferences prevail. The center of attraction is now the daily Tenkan (1.0812), the resistance can be designated at 1.0879-87 (historical level + daily Fibo Kijun) and 1.0937-65-87 (weekly Fibo Kijun + final levels of the daily dead cross). The supports that can be broken to strengthen bearish opportunities that are still located within the range of 1.0778-27 (historical level + minimum extreme).

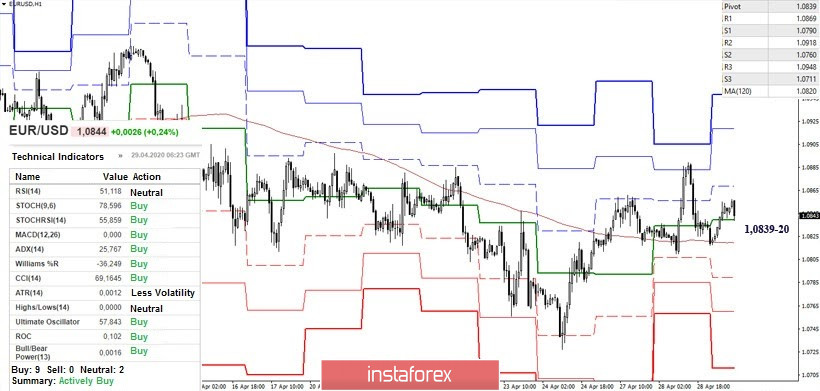

At the moment, the advantage in the lower halves is on the side of the players is to increase, although the pair is in a deep correction. To restore the upward trend on H1, updating yesterday's maximum (1.0889) and consolidating higher is necessary, while inside the day, the direction will open to the classic Pivot levels R2 (1.0918) and R3 (1.0948). The loss of the current balance of forces and the strengthening of the bearish sentiment may occur when the pair consolidates under the key supports of the lower time intervals, which are located today in the area of 1.0839-20 (central Pivot level + weekly long-term trend). The following support for classic Pivot levels expects a pair at 1.0790 - 1.0760 - 1.0711.

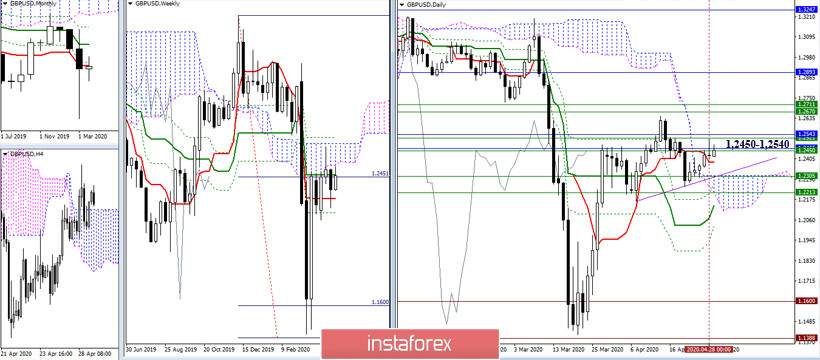

GBP / USD

Yesterday, the pair tested the resistance zone they met (1.2450-1.2540), but closed the day below, casting only a long shadow of the afternoon candle towards the resistance. Today, interaction with resistances continues. As a result, the main conclusions and expectations at this stage in the development of the situation remain. The players to increase need a breakdown of the zone and a solid hold above. On the contrary, players to decline will seek to strengthen their moods by breaking through the supports combining the daily cloud and the levels of the daily and weekly crosses (1.2305 - 1.2214 - 1.2142 - 1.2023) in the event of an opponent's failure and the formation of rebound from the resistance encountered.

Thanks to the support of all the analyzed technical instruments, the main advantage in the lower halves remains on the side of the players to increase. At the same time, the pair is in the correction zone, the further development of which will lead to the next testing of support for the central Pivot level (1.2447). Now, consolidating below may affect the balance of strength, in which case the weekly long-term trend (1.2386) will become the next bearish reference point. Reliable consolidation below the key supports of the lower halves, as well as the preservation and development of this result in the daily format, can serve as the beginning for the formation of the rebound from the resistance met in the higher halves.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)