Technical analysis recommendations for EUR/USD and GBP/USD on April 30

Economic calendar (Universal time)

Fairly extensive statistics on the Eurozone are observed in the morning today. Among the data, one can single out the most significant indicator - the consumer price index (9:00). Further, decisions and news from the ECB at 11:45 (+ ECB press conference at 12:30) will be important. Meanwhile, among statistics from the United States, the number of initial applications for unemployment benefits (12:30) can affect the market to a greater extent. In addition, the closing of the month should not go unnoticed today. The result of April is very significant in many respects.

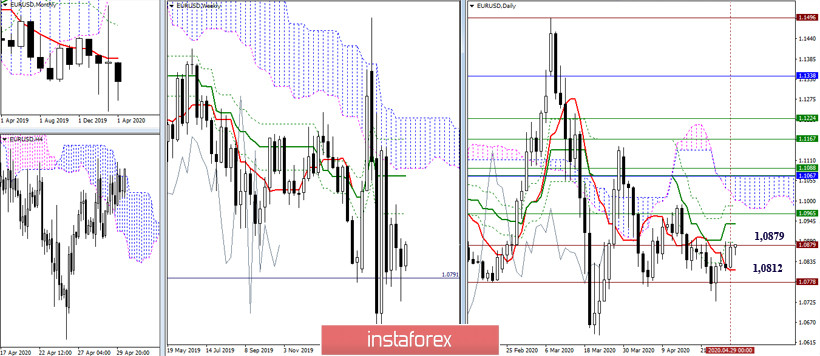

EUR / USD

The situation has not developed over the past day. The pair remained pinned between the daily short-term trend (1.0812) and the resistance of 1.0879-87 (historical level + daily Fibo Kijun). All other landmarks also retained their location. For players to increase, in the event of a breakthrough of the existing barrier (1.0879-87), the direction will open to the next scattered cluster of levels 1.0937-65-87 (weekly Fibo Kijun + final levels of the day dead cross). For players to decline, the loss of the daily short-term (1.0812) will allow us to start testing support 1.0778-27 again (historical level + minimum extremum).

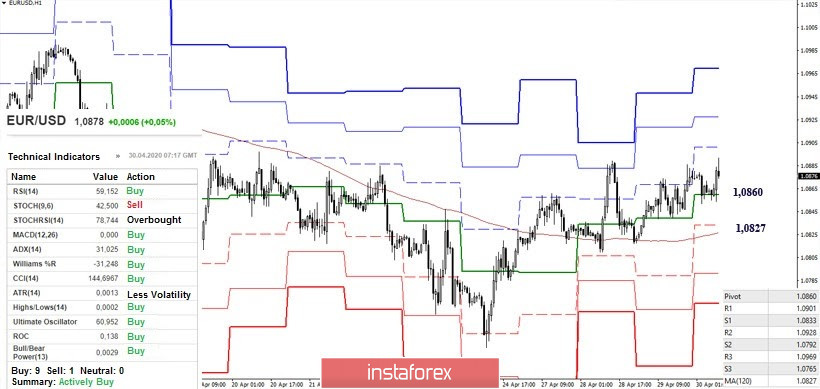

The players to increase in the lower halves retain their advantage; they actively use the support of the central pivot level of the day. Today, the level protects bullish interests at 1.0860. However, it has not been possible to go beyond the correction zone for a long time. The restoration of the upward trend will open the way to the landmarks of the classic Pivot levels at 1.0901 - 1.0928 - 1.0969. Another failure of the bulls and breaking through the support of 1.0860 may inspire the opponent, as it leaves no hope for the development of a downward correction. The next bearish reference points will be 1.0827 (weekly long-term trend) and 1.0792 - 1.0765 (classic pivot levels).

GBP / USD

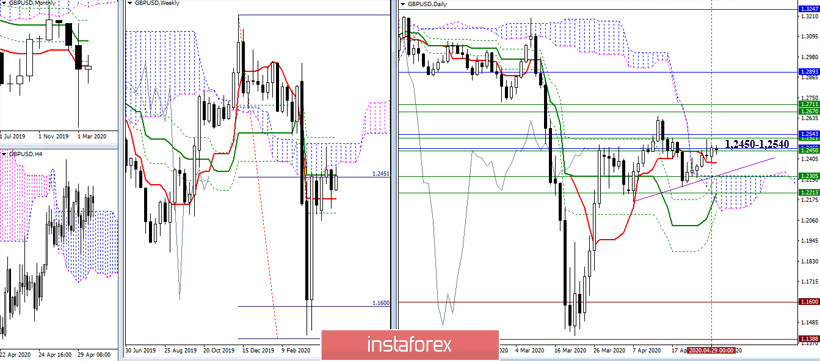

The fight against the resistance zone (1.2450-1.2540) continues since no effective changes in the situation have been observed so far, the conclusions and expectations remain the same. The following resistances are located at 1.2670 - 1.2711 (the upper boundary of the weekly cloud + the final boundary of the weekly dead cross). The nearest support is located at 1.2382 (daily Tenkan) and 1.2305 (weekly Tenkan + daily Senkou Span B and Fibo Kijun).

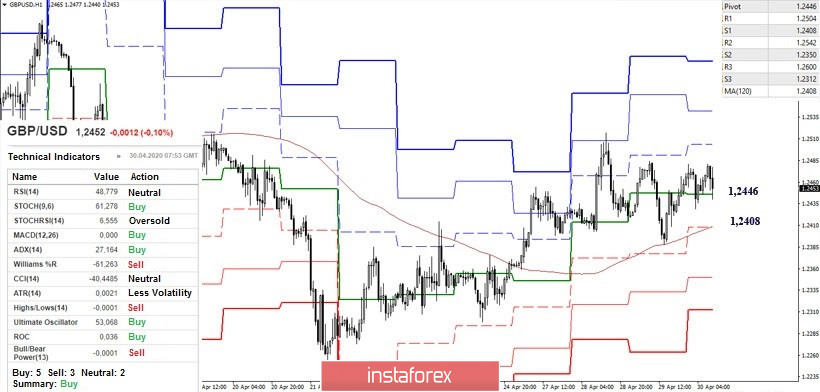

Yesterday, the weekly long-term trend helped maintain the main advantage for the bulls. Today, it is assisted by the central Pivot level of the day (1.2446). The main interest of players to increase is now focused on the restoration of the upward trend (1.2517) and breaking through the resistance zone of the upper halves 1.2450 - 1.2540. The bearish ambitions in this situation still rest against the central pivot level (1.2446) and the weekly long-term trend (1.2408). A reliable consolidation below will change the current balance of power in the lower halves and may have far-reaching plans to further strengthen the bearish sentiment.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)