Let's be honest, as the coronavirus epidemic recedes into the background, not just the importance of macroeconomic statistics is growing, but the importance of American statistics is also growing. And it has at least some weight. European statistics are persistently ignored. Of course, we can say that only pan-European statistics are relevant, and data for individual countries are not so important. But after all, pan-European statistics consist of just the data for individual countries. Moreover, the weight of countries such as Germany and France, as well as Italy and Spain, is such that, in fact, these four countries are the entire euro zone. Nevertheless, yesterday's events developed strictly in accordance with the published US macroeconomic data.

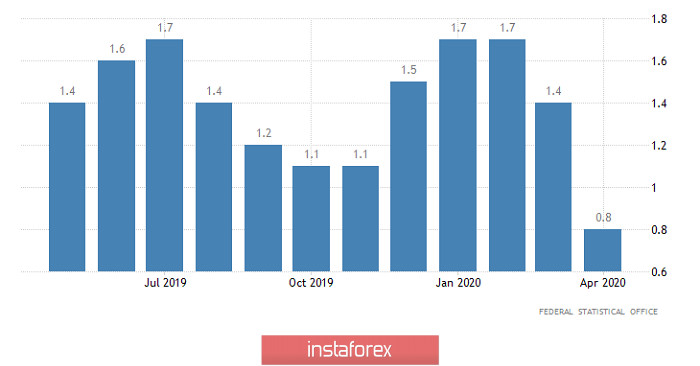

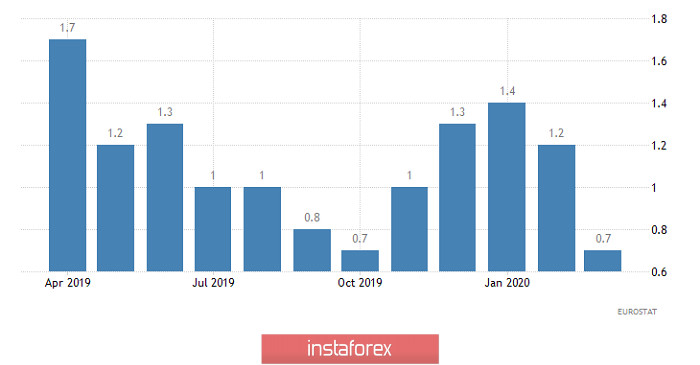

At the same time, European statistics are clearly one of the few which are pleasing. For example, retail sales in Spain, which showed a growth of 1.8% in February, showed a decline of as much as 14.1% in March. And this is on an annualized basis. At the same time, restrictive measures, with the closure of shops and restaurants, as well as entertainment centers, were introduced only in the middle of the month. Consequently, the April data will show an even deeper decline. At the same time, we should not console ourselves with hopes that the situation in other countries is something very different. Moreover, in addition to the catastrophic decline in retail sales, and indeed all consumer activity, the threat of deflation has sharply increased. For example, in Italy, the pace of decline in producer prices accelerated from -2.7% to -3.6%. Preliminary data on inflation in Germany showed a decrease from 1.4% to 0.8%. So, reasons for optimism are somehow not observed in a good way. Nevertheless, the single European currency, although modestly, was growing. Meanwhile, interesting processes of capital flow are observed within Europe itself. And this is not a global flow of capital from around the world to the United States, but a purely intra-European process. So, the yield on 5-year Italian bonds rose from 0.80% to 1.36%. The yield on 10-year bonds grew from 1.48% to 1.78%. At the same time, the yield on 10-year German bonds fell from -0.34% to -0.48%. but a purely intra-European process. So, the yield on 5-year Italian bonds rose from 0.80% to 1.36%. The yield on 10-year bonds grew from 1.48% to 1.78%. At the same time, the yield on 10-year German bonds fell from -0.34% to -0.48%. but a purely intra-European process. So, the yield on 5-year Italian bonds rose from 0.80% to 1.36%. The yield on 10-year bonds grew from 1.48% to 1.78%. At the same time, the yield on 10-year German bonds fell from -0.34% to -0.48%.

Inflation (Germany):

But American statistics have led to a steady weakening of the dollar. Moreover, both in relation to the single European currency, and the pound. It is all about the first estimate of the United States GDP for the first quarter, which showed a 4.8% decline in the economy. And everyone immediately began to discuss this news vigorously. They say, how is it, such a wild decline, although restrictive measures were introduced only in the middle of March, that is, at the very end of the quarter. However, the trick is that the recession in the American economy has not yet begun. The fact is that this is quarterly data. That is, comparing quarter to quarter. The economic growth rate slowed from 2.3% to 0.3% on an annual basis. So there is no decline yet. More precisely, it already exists, but statistics will fix it only in the second quarter. Nevertheless, the growth slowdown is quite substantial and clearly indicates that the recession in the economy will be quite deep. In addition, there is a catastrophic decline in activity in the real estate market, which is quite predictable. If the growth rate of pending home sales transactions was 9.3% in February, then they began to decline by 16.3% by the end of March. Let me remind you that this is only March. According to the results of April, the result will be even worse. Well, the meeting of the Federal Committee for Open Market Operations went completely unnoticed. There is nothing surprising either. The Federal Reserve proceeds from the assumption that an emergency reduction in the refinancing rate, which has passed in two stages, is currently quite sufficient. Given the time lags, it is too early to judge the adequacy of these measures. The results will be clear later. The recession in the economy itself cannot be stopped by these measures but they are called upon to facilitate a speedy exit from the recession. So, the Federal Reserve can take any measures only a couple of months after the end of the coronavirus epidemic. Until then, the American regulator will be calm.

GDP growth rate (United States):

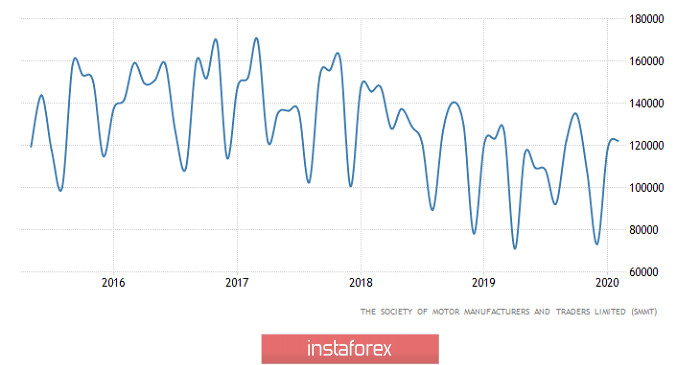

Today is an incredibly busy day, and even Great Britain will publish something there. However, the data, of course, is average, but nonetheless. We are talking about car sales, which fell by 0.8% in February. So, according to the results of March, the rate of decline should be 52.0%. In other words, the car market in the United Kingdom should be halved. This is in annual terms, therefore, there are no reasons for optimism.

Car Sales (UK):

Everything will be much more interesting in the euro area, where the focus of the meeting is the board of the European Central Bank. The fact is that in the conditions of a sharp increase in the risks of deflation, and today's preliminary data on inflation may show a decline from 0.7% to 0.0%, the European Central Bank may well think about the possibility of further lowering interest rates. Today, of course, no such decisions will be made. However, Christine Lagarde may hint at a similar development. Moreover, apparently, the economic situation in Europe is even worse than in the United States. In particular, a preliminary estimate of GDP for the first quarter, and just in annual terms, rather than quarterly, can show that the economy's growth of 1.0% was replaced by a decline of 3.0%. Not only is the decline quite significant, but the picture is clearly worse than on the other side of the Atlantic. In addition, the unemployment rate should rise from 7.3% to 7.9%. So in the end, if we looked at the nightmare that the American statistics showed us for several weeks in a row, we now have an opportunity to compare all this with how things are in Europe, while the Old World looks somehow weak.

Inflation (Europe):

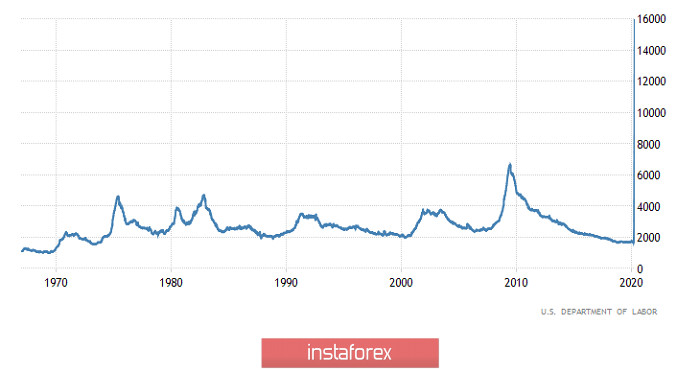

However, this does not cancel the next series of heartbreaking drama about the hard everyday life of American workers who lose their jobs at an incredible rate. Yes, the number of initial applications for unemployment benefits should be 3,680 thousand. That is, it has been declining for the fourth consecutive week which is generally not surprising, since 26,453 thousand people were unemployed in the previous five weeks. Sooner or later, there will simply be no one to replenish the army of the unemployed, but normal is approximately 200 thousand calls per week. So the growth rate of unemployment is still prohibitive. However, the worst thing is that, having lost their jobs, people simply cannot find a new one, and the number of repeated applications for unemployment benefits could be as much as 18,900 thousand. This is another record with a negative sign. So unemployment is not just growing at a catastrophic rate, but also takes on a long-term character. This means that the way out of the crisis will drag on for a long time. In addition, as practice shows, American statistics also indicate what will happen in other parts of the world in the future including in Europe. Therefore, the picture is really kind of gloomy.

Repeated Jobless Claims (United States):

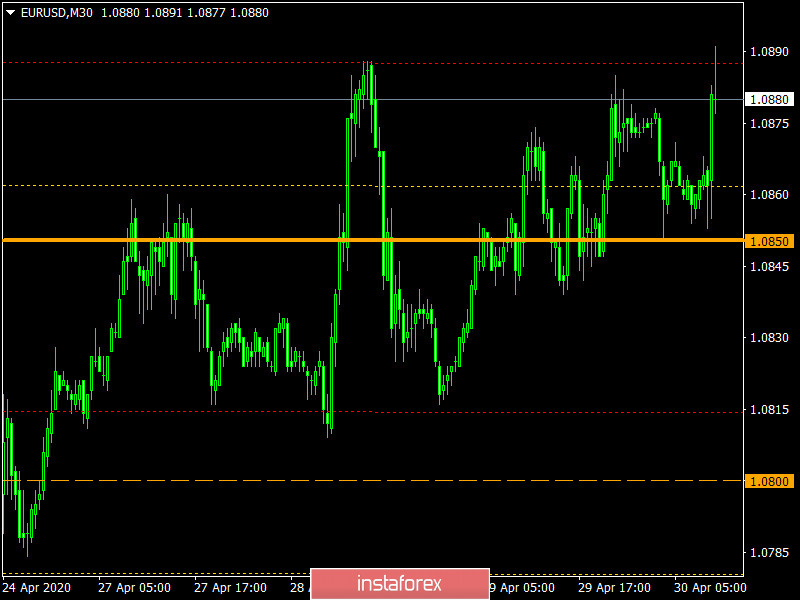

The euro/dollar currency pair turned into a variable fluctuation within the limits of 1.0815 // 1.0850 // 1.0885 after a short technical correction from the value of 1.0727. It can be assumed that the price movement in the specified frames of 1.0815 // 1.0850 // 1.0885 will still be preserved, but the breakdown method remains the main tactic.

The pound/dollar currency pair in the phase of corrective movement reached the level of 1.2500, where it felt resistance and as a result formed a variable range of 1.2400 / 1.2500. It can be assumed that the range of 1.2400 / 1.2500 will still remain on the market, the best tactic will be to break through the established boundaries.