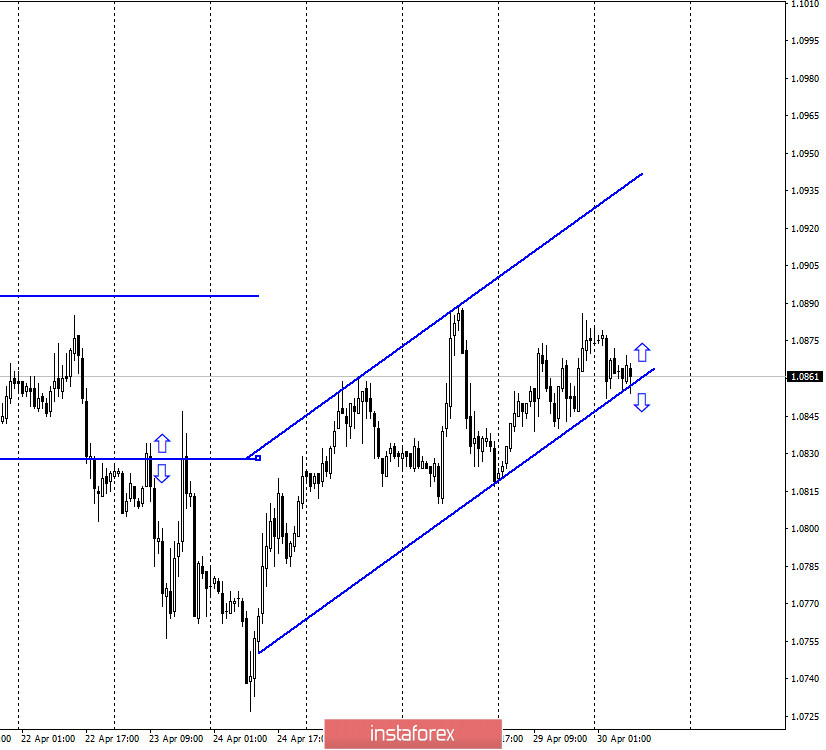

EUR/USD – 1H.

Hello, traders! The euro/dollar pair continued to grow on the hourly chart on April 29. Thus, I was even able to build an upward trend corridor, which now more eloquently shows the mood of traders - "bullish." At the same time, the pair's quotes are currently trading near the lower line of this corridor, so there is a probability that there will be a close under it, which will allow traders to count on the pair's reversal in favor of the US currency and some fall. Yesterday was full of various economic events. However, none of them had a proper impact on the course of the euro/dollar pair. If there are no complaints about the Fed meeting and its results, since there were no changes in the QE program or rates, and Jerome Powell himself took a wait-and-see position, then why did traders ignore the report on GDP in America? However, in recent weeks and even months, this often happens when traders do not notice important reports and news. Thus, the dollar has not experienced the slightest bit of pressure.

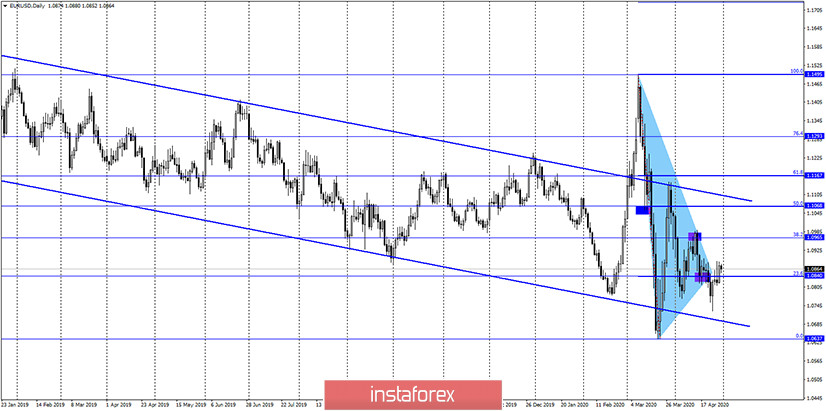

EUR/USD – 4H.

On the 4-hour chart, the quotes of the euro/dollar pair made a consolidation above the corrective level of 23.6% (1.0840), as well as above the downward trend line. Thus, we received two signals to buy at once. However, I would like to note that both of these closures are weak and questionable. The pair didn't seem to notice both barriers and went through them. This means that the strength of the signals decreases. On the hourly chart, by the way, the pair may already in the next few hours perform a consolidation under the ascending corridor, which will be a signal to sell. On the 4-hour chart, fixing the pair's exchange rate under the Fibo level of 23.6% will work in favor of the US currency and begin to fall in the direction of the corrective level of 0.0% (1.0638). Emerging divergences are not observed on April 30.

EUR/USD – Daily.

On the daily chart, the euro/dollar pair performed a reversal in favor of the European currency and fixed above the Fibo level of 23.6% (1.0840). Thus, the growth can be continued towards the next corrective level of 38.2% (1.0965).

EUR/USD – Weekly.

On the weekly chart, the euro/dollar pair continues to trade near the bottom line of the "narrowing triangle". The rebound of quotes from this line still allows us to expect an increase in quotes in the long term in the direction of the level of 1.1600 (the upper line of the "triangle"). Closing the pair under the "triangle" will work in favor of the US currency and, possibly, a new long fall.

Overview of fundamentals:

On April 29, the main and most important news came from America. GDP in the first quarter fell by 4.8%, which was generally in line with traders' expectations. The FOMC meeting was mentioned above, it turned out to be a passing one.

News calendar for the United States and the European Union:

Germany - unemployment rate and change in the number of unemployed (09:55 GMT).

EU - change in GDP for the first quarter (11:00 GMT).

EU unemployment rate (11:00 GMT).

EU- consumer price index (11:00 GMT).

EU - publication of the ECB's decision on the main interest rate (13:45 GMT).

EU - monetary policy report (13:45 GMT).

EU - ECB press conference (14:30 GMT).

US - number of initial applications for unemployment benefits (14:30 GMT).

On April 30, the calendar of economic events in the United States contains only a report on initial applications for unemployment benefits, the total number of which may reach 30 million. And all the main news will come from the European Union. We pay special attention to GDP and the results of the ECB meeting.

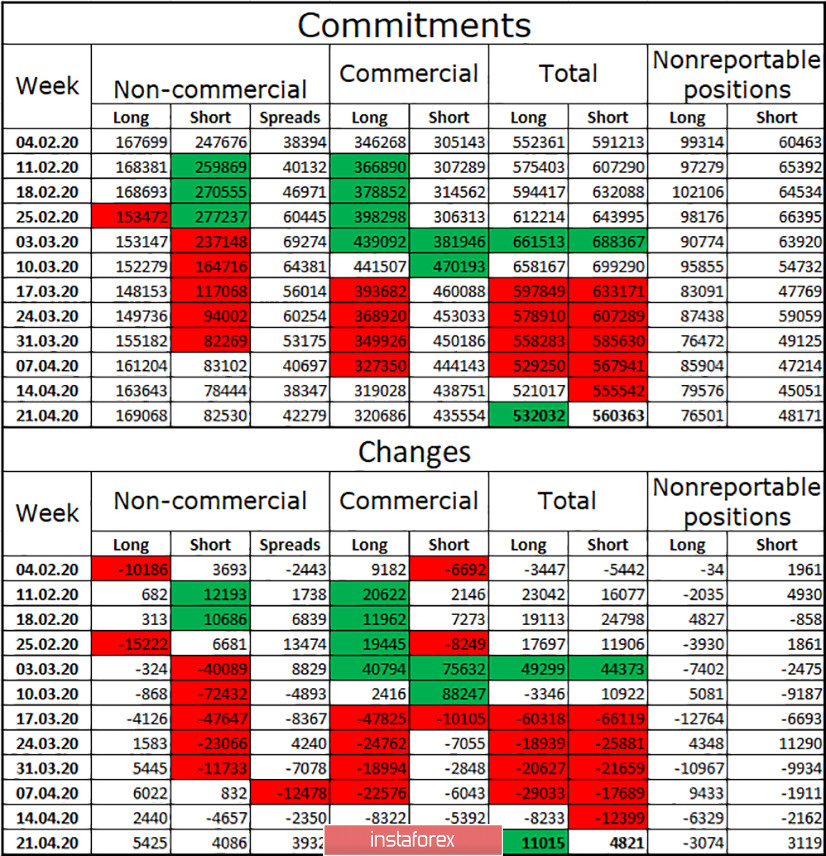

COT (Commitments of Traders) report:

The latest COT report showed that during the reporting week, major players in the currency market again increased contracts. The total number of long contracts increased by 11,000, and short - by 5,000. The overall advantage remains in favor of short - 560,000 against 532,000 contracts. The advantage is not too strong. Over the past three months, every COT report has shown the advantage of bear traders. However, during this time, the euro not only fell, but also grew. Thus, the overall trend remains "bearish", that is, in the long term, I would expect a further fall in quotes. However, there is still a graphic picture, which may show a signal to buy. Speculators continue to believe in the euro currency since they have twice as many long contracts in their hands as short ones.

Forecast for EUR/USD and recommendations for traders:

At this time, I recommend selling the euro with the goal of 1.0638, if there is a close under the level of 1.0840 on the 4-hour chart and a close under the ascending corridor on the hourly chart. You can buy the pair now, although there are no specific buy signals at this time. However, the pair still closed above the trend line and continues to remain inside the trend corridor. The goal is 1.0964.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.