The attention of market participants will be focused on the speech of the head of the ECB.

Hello, dear colleagues!

As expected, the Federal Reserve System (FRS) of the United States at the end of its two-day meeting left interest rates in the range of 0.00%-0.25%. This decision was unanimously voted by all ten members of the Open Market Committee (FOMC).

Also, the forecast was confirmed that the rates will remain at their current minimum values until the US economy survives all the hardships and negative consequences of COVID-19. In addition, the Fed confirmed its intention to buy treasury bonds in unlimited amounts and provide large-scale repos. The Federal Reserve's leaders are particularly concerned about the healthcare sector, which is experiencing a crisis situation due to the coronavirus epidemic.

Even more pessimistic was the press conference of Fed Chairman Jerome Powell, which was expected to focus on the negative effects of COVID-19 on the United States economy. In particular, Jerome Powell acknowledged a significant drop in household spending, a decline in retail trade, and a large-scale decline in economic activity in the second quarter.

At the same time, the head of the Federal Reserve noted that the markets were positively affected and helped by unprecedented asset purchases. Powell promised that his department will continue to use all necessary and possible measures to restore the economy.

Since almost all banks are currently out of business, lowering rates cannot support economic activity to the extent that we would like. Jerome Powell also promised to continue aggressive support for credit markets.

In general, the situation with the ongoing epidemic of a new type of coronavirus did not suggest even hints at the "hawkish" rhetoric of the Fed Chairman, and therefore his speech should not have supported the US dollar. That's exactly what happened.

Today will also be filled with important and significant events for the market. At 12:45 (London time), the European Central Bank (ECB) will announce its decision on interest rates, and at 13:30 (London time), a press conference will be held by the President of the European Central Bank, Christine Lagarde. Also at 13:30 (London time), a large block of macroeconomic statistics will begin to arrive from the US, but the main attention of market participants seems to be focused on the speech of the head of the ECB.

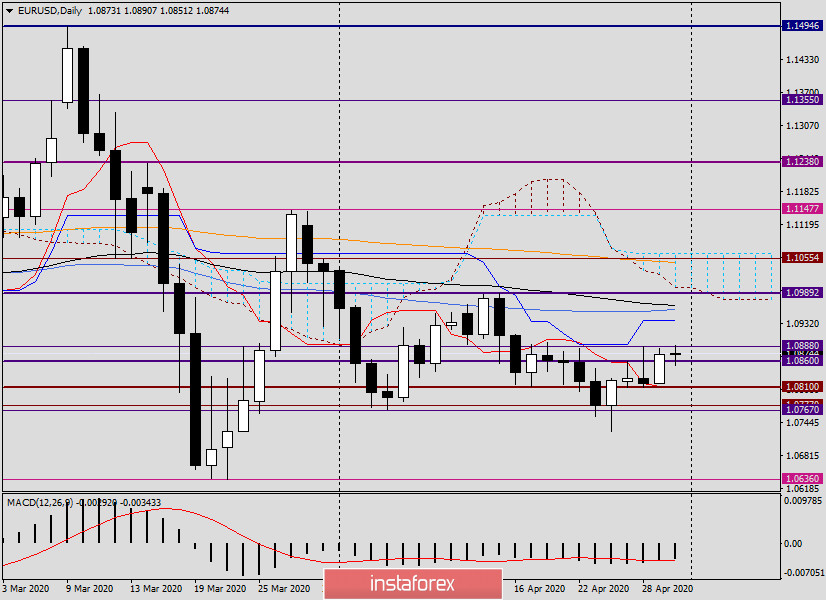

Daily

Yesterday's trading confirmed the assumptions made the day before about the likely growth of the main currency pair of the Forex market, and the main trading idea to buy the euro/dollar on a decline in the area of 1.0840 was generally correct.

After reaching the lows at 1.0818, the pair turned on the rise and ended the session on April 29 at 1.0873.

Thus, the strong resistance level of 1.0860 was passed, but whether the euro bulls will be able to gain a foothold above this mark will depend on the speech and rhetoric of the ECB head.

At the time of writing, the euro/dollar pair has already re-tested the next resistance of sellers, which is at 1.0888 for a breakdown. Judging by the bullish mood of the pair, this level is likely to be broken. If this happens, the next target for buyers of the single currency will be 1.0936, where the Kijun line of the Ichimoku indicator runs. More distant benchmarks for possible growth will be 1.0957 and 1.0966, where the 50 simple and 89 exponential moving averages are located, respectively.

An alternative bearish scenario will become possible if the strong and significant support breaks at 1.0810 and the daily trading closes below the level of 1.0800.

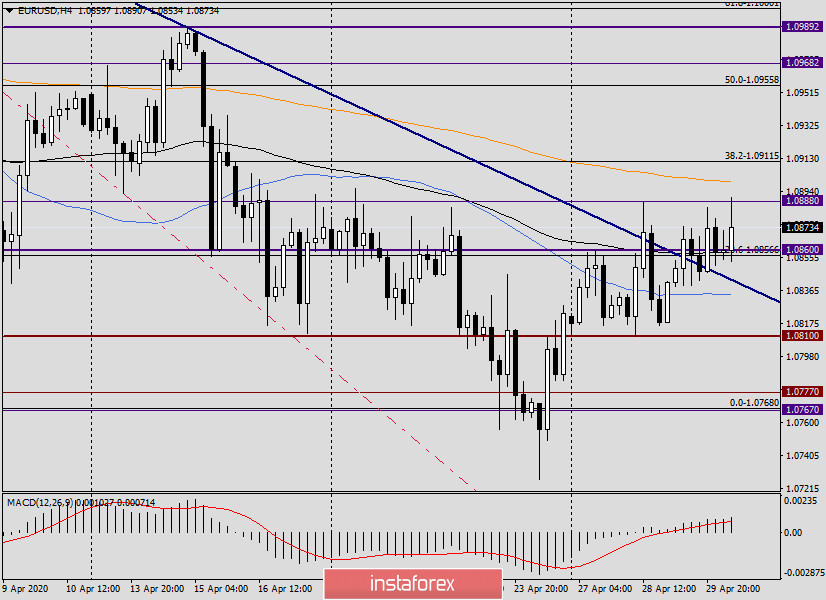

H4

In this timeframe, we see that the 200 exponential is located directly above another important level of 1.0900, so the further prospects for an upward movement will depend on the pair's ability to overcome the 200 EMA.

At the end of this review, the euro/dollar shows intentions to continue rising. The pair is trading with an increase near 1.0880, but since there is also resistance from sellers, I do not rule out a corrective pullback to the area of 1.0870-1.0850, which can be used to open long positions. Perhaps this is the main trading recommendation for EUR/USD, but do not forget about the speech of Christine Lagarde, which will certainly not be sustained in "hawkish" tones and is unlikely to be optimistic. Although it is quite possible that due to the lifting of a number of restrictions in the Eurozone and the gradual return to normal life, the ECB President will calm the markets and give hope for early recovery of economic activity in the region. However, everything will depend on the reaction of market participants.

Good luck with trading!