We are preparing to sell the USD/CAD pair.

Good day, dear traders!

In this article, we will look at a pair of North American dollars, where the main focus will be on the technical picture and the search for points to enter the market.

As you already know, yesterday's results of the two-day meeting of the US Federal Reserve System (FRS) did not come as a surprise and coincided with the forecasts of analysts and market participants. The refinancing rate remained in the range of 0.00%-0.25%. The speech by Fed Chairman Jerome Powell also hardly surprised investors. The head of the Federal Reserve focused on the topic of coronavirus, or rather, the impact of the negative consequences of COVID-19 on the world's leading economy and its recovery from the current crisis. For more information about the results of the two-day meeting of the Open Market Committee (FOMC) and the speech of the head of the Federal Reserve, see today's euro/dollar review.

As for the USD/CAD currency pair, before proceeding to the analysis of price charts, I will indicate the most important and significant events that will come from the US and Canada before the end of the week's trading. So, today at 13:30 (London time), Canada will release data on GDP, as well as the producer price index. No reports are expected from the Maple Leaf country on Friday.

Also today at 13:30 (London time), the United States will publish a whole block of macroeconomic statistics: personal income and spending of Americans, the basic price index of personal consumption expenditures, as well as the purchasing managers' index of Chicago. Tomorrow, the US will also receive information on business activity in the manufacturing sector and the Institute for Supply Management (ISM) manufacturing index.

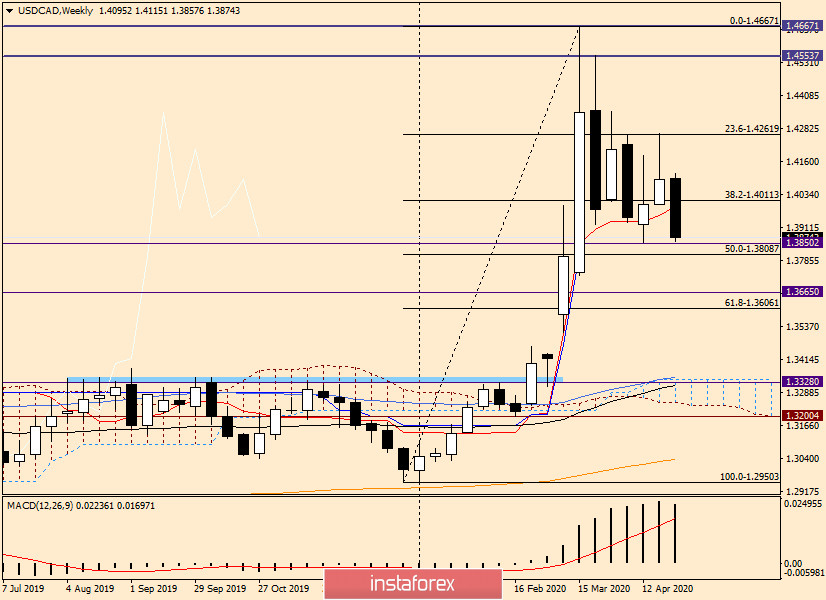

Weekly

As expected, the previous weekly candle with a long upper shadow indicated difficulties for the bulls in the pair with a further rise in the rate and provoked a decline, which we are seeing at the time of writing. Given the soft tone of the head of the Fed and the technical picture, I would venture to assume that before the end of the week's trading, it is unlikely that there will be any drastic changes. Most likely, the weekly session will end with the strengthening of the Canadian dollar against its namesake from the United States.

At the moment of writing, the pair is preparing to test an important support level of 1.3850 for a breakout. In case of success and completion of weekly trading under this level, the road will open to the area of 1.3665, where the broken resistance level of sellers passes.

If the week closes above the important psychological level of 1.4000 and the Tenkan line of the Ichimoku indicator, and the candle forms a long lower shadow, next week we can expect the rate to rise to the area of 1.4260, where the maximum values of the previous weekly trading were shown.

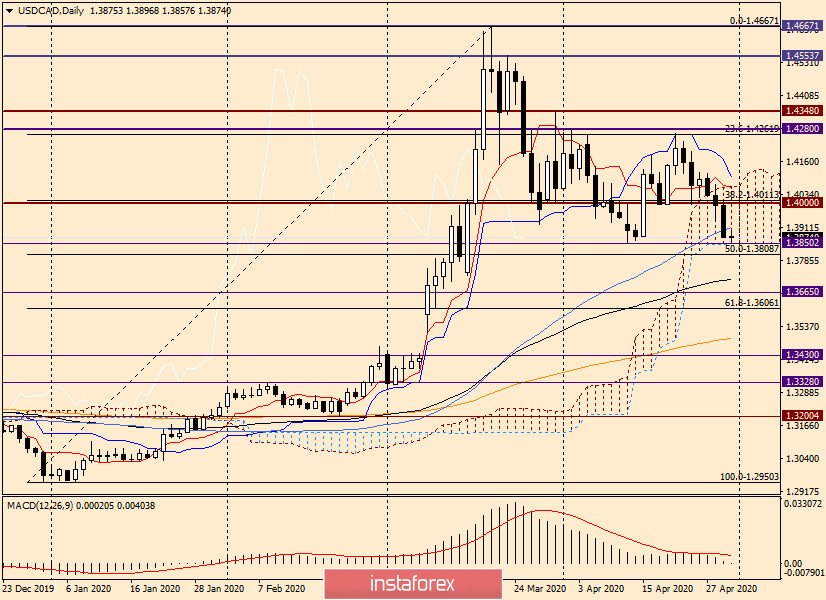

Daily

On this chart, we see that after the breakdown of the Tenkan line, the pair entered the limits of the Ichimoku indicator cloud and is now trading near its lower border. If the trading ends with the price coming down out of the cloud, the bearish sentiment for USD/CAD will increase, after which the road will open to the area of 1.3715. It is at this level that the 89 exponential moving average is located, which can provide significant support and send the course to correction.

Since there is no need to talk about a bullish scenario in the current situation, we are preparing to sell the USD/CAD pair after short-term price rises to the area of 1.3985-1.4000. If this correction does not occur, you can try earlier sales after rising to the price zone of 1.3930-1.3970.

Good luck!