Crypto Industry News:

The regulatory framework for digital content planned by the European Union is moving forward. On Wednesday, the European Council, which steers the EU's political agenda, announced its position on Markets in Crypto Assets (MiCA) and the Digital Operational Resilience Act (DORA).

After an agreement that must then be ratified, the European Council and Parliament can now start discussing the initiative before it is finally approved as law.

The MiCA framework is designed to protect investors and consumers from fraud, including guarantees that investors' money is safe in the event of hack. If authorities consider that certain virtual currency exchange platforms pose a risk to investors or users, they may impose more stringent rules on them under MiCA.

The European Central Bank said the new rules would establish comparable cultural standards for payment service providers to guarantee user safety. According to a recent ECB communication, the framework will also contain provisions on corporate governance and risk management, as well as prohibitions on the provision of services such as high-risk payment instruments.

The MiCA European Council document, which is over 400 pages long, suggests that the EU will not soften its stance on asset-backed token issuers. It also says that they should be subject to stricter obligations than the issuers of other crypto assets.

Technical Market Outlook

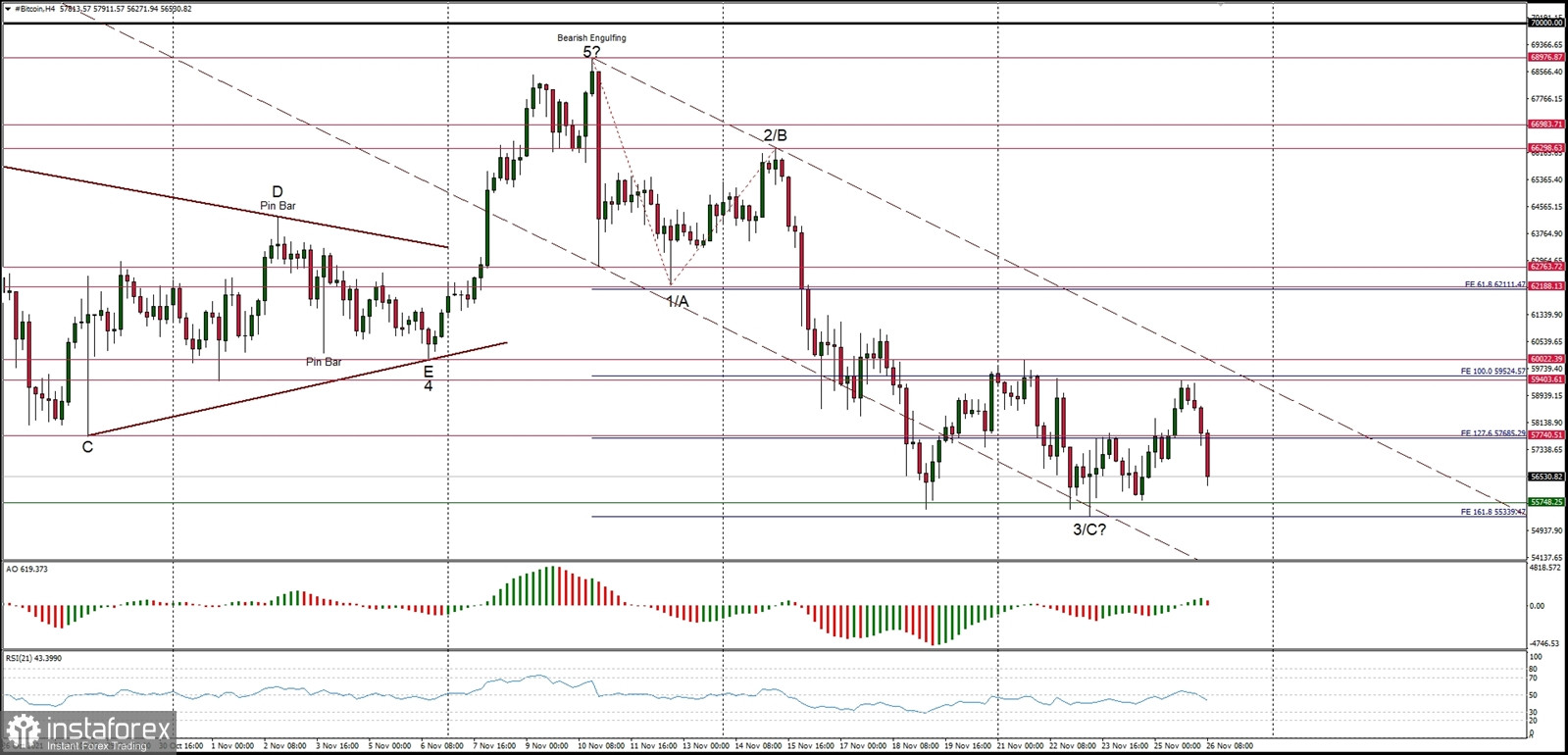

The BTC/USD pair has broken below the recent bottom of the wave 3, which is located at the level of $55,758. The new, marginal lower low was made at the level of $54,888 (at the time of writing the article). The nearest technical resistance is seen at the level of $57,740 and the local technical support at $53,747. The momentum remains weak and negative despite the potential low of the wave 3/C as the bearish pressure intensify. Only a sustained breakout above the level of $62,767 would change the outlook to more bullish.

Weekly Pivot Points:

WR3 - $75,582

WR2 - $70,896

WR1 - $64,654

Weekly Pivot - $60,209

WS1 - $54,112

WS2 - $49,298

WS3 - $43,190

Trading Outlook:

According to the long-term charts the bulls are still in control of the Bitcoin market, so the up trend continues and the next long term target for Bitcoin is seen at the level of $70,000. This scenario is valid as long as the level of $52,943 is clearly broken on the daily time frame chart (daily candle close below $52,000).