If everything is clear with the Fed, the regulator will definitely begin to understand interest rates next year – either at the beginning of it or already closer to the middle. On the other hand, it seems that the European Central Bank has not decided on this yet.

The minutes of the last ECB meeting published on Thursday did not turn out to be a breakthrough and did not contain any surprises. Nevertheless, we believe that it clearly demonstrates the bank's desire not to rush to radical actions, namely to raise interest rates after the end of the incentive program under the PEPP. We can even say that the increase in inflation, according to the latest data, is noticeably higher than the acceptable level of 2.0% up to 4.1%, although it is quite worrying, but not so much yet.

It can be said that the ECB will still try to keep its monetary rate stimulating even after the end of asset repurchase, which means that the Euro currency will be at a loss amid a clear divergence of monetary policies between it and the Fed. An increase in the yield of treasuries will definitely stimulate demand for the US dollar, and a decrease in its supply in the financial system will stimulate an increase in its value.

Therefore, we believe that while such sentiments exist in the European regulator, the EUR/USD pair will continue to decline with local upward pullbacks, which will be used by traders to resume sales.

Yesterday was a holiday in America, so the local market was closed. Today, trading will be limited to a short day due to the continuation of the Thanksgiving celebration. The absence of American investors has significantly reduced activity in the markets.

Today, the yield of the benchmark 10-year Treasuries is currently falling strongly by 6.03%, that is, to 1.545%.

What is happening in the wake of the growth of new fears related to the coronavirus pandemic?

WHO announced the need to convene a special meeting to discuss the impact of new COVID-19 mutations. We believe that it was this news that caused a wave of demand for protective assets, which include treasuries. On this wave, demand for safe-haven currencies sharply increased during the Asia-Pacific trading session. The yen and the franc are adding 0.68% and 0.51% to the US dollar, respectively. In turn, futures on European and American major stock indexes are declining by an average of 2%.

We expect that negative sentiment will prevail in the markets today, which will be reflected in the fall of stock indices following the Asian ones in the local strengthening of the US dollar against European currencies, as well as commodities, but its weakening against the franc and yen.

Forecast of the day:

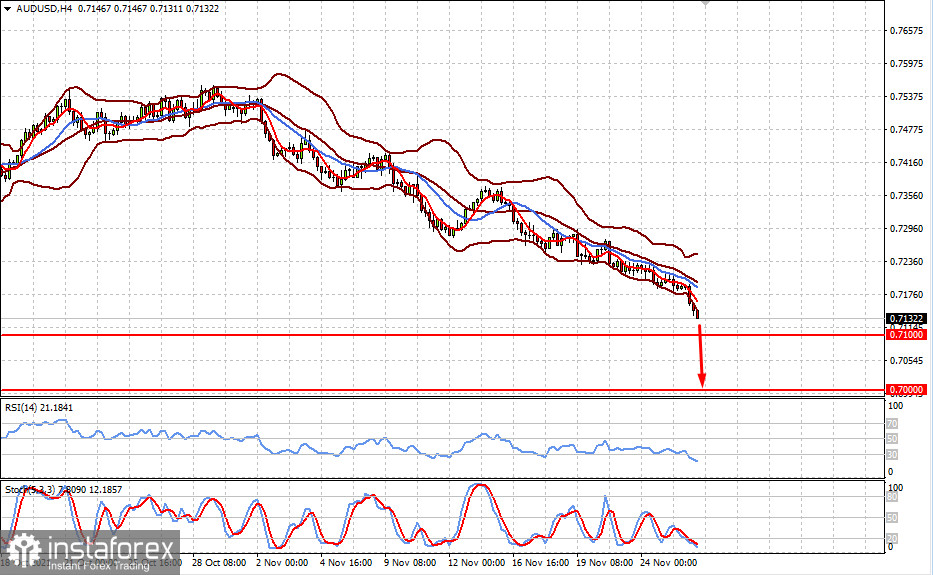

The AUD/USD pair continues to decline amid bad news and the general withdrawal of investors from risky assets. We expect its decline to continue to the level of 0.7100, and then to 0.7000.

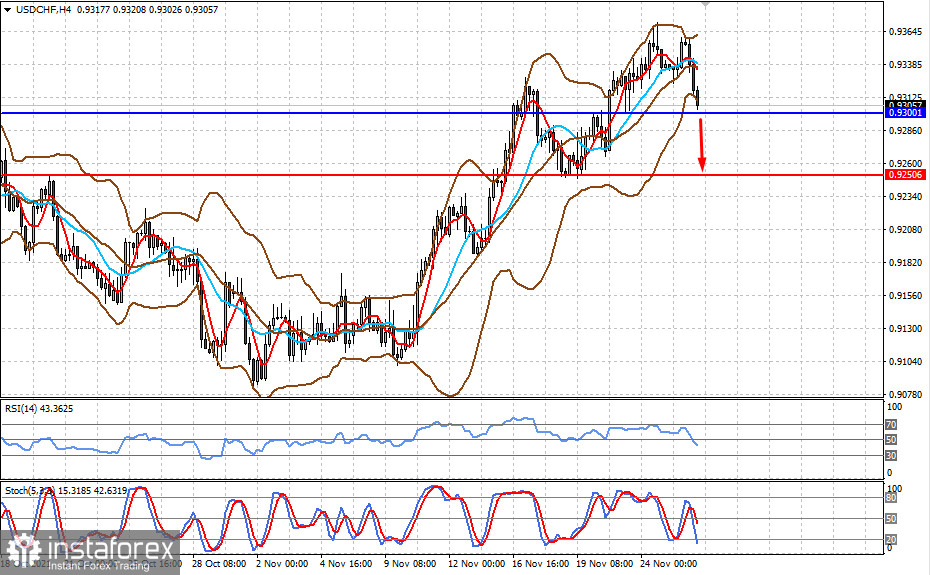

The USD/CHF pair is trading above the strong support level of 0.9300, the breakdown of which will lead to its fall to the level of 0.9250.