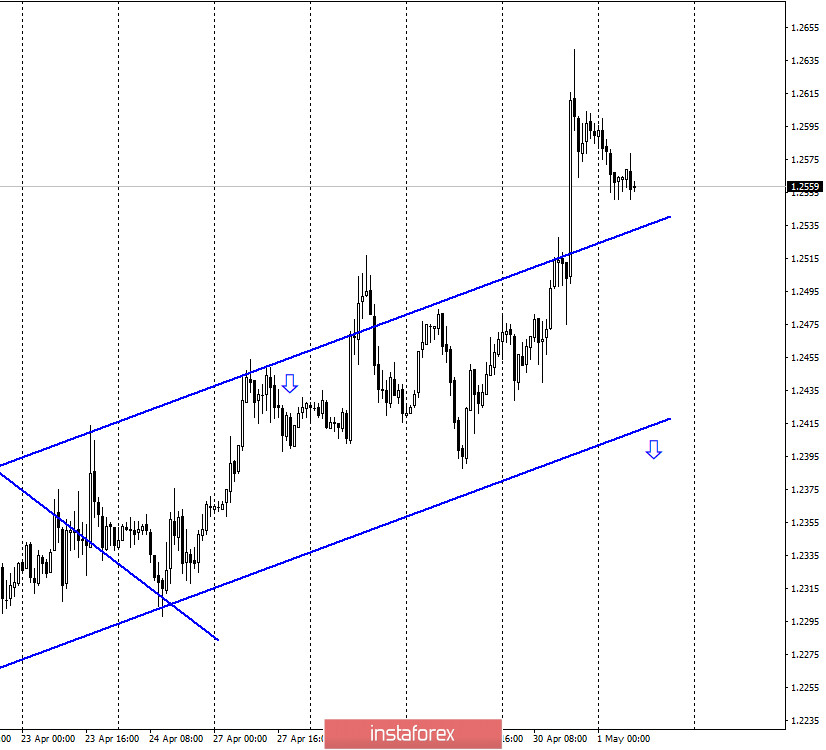

GBP/USD – 1H.

Hello, traders! According to the hourly chart, the GBP/USD pair resumed the growth and even gained a foothold over the upward trend corridor, which shows the strengthening of the "bullish" mood among traders. At the moment, however, the pair's quotes performed a reversal in favor of the US currency and began falling. The fault is the level of 1.2467, after which the pending orders for sale and closing of current purchases were triggered. This level is the peak of April 14. Opposite trend orders and Take Profit orders are often placed near previous peaks and lows. Thus, the further growth of the British is not obvious now. The quotes need to close above the level of 1.2467 in order for the growth to continue in the direction of the corrective level of 76.4% (1.2777). The background for the pound/dollar pair was interesting yesterday, but there were not many economic reports and reports from America. I believe that the Fed's actions to expand the program of lending to small and medium-sized businesses or reports on applications for unemployment benefits could not have caused such a strong fall in the dollar.

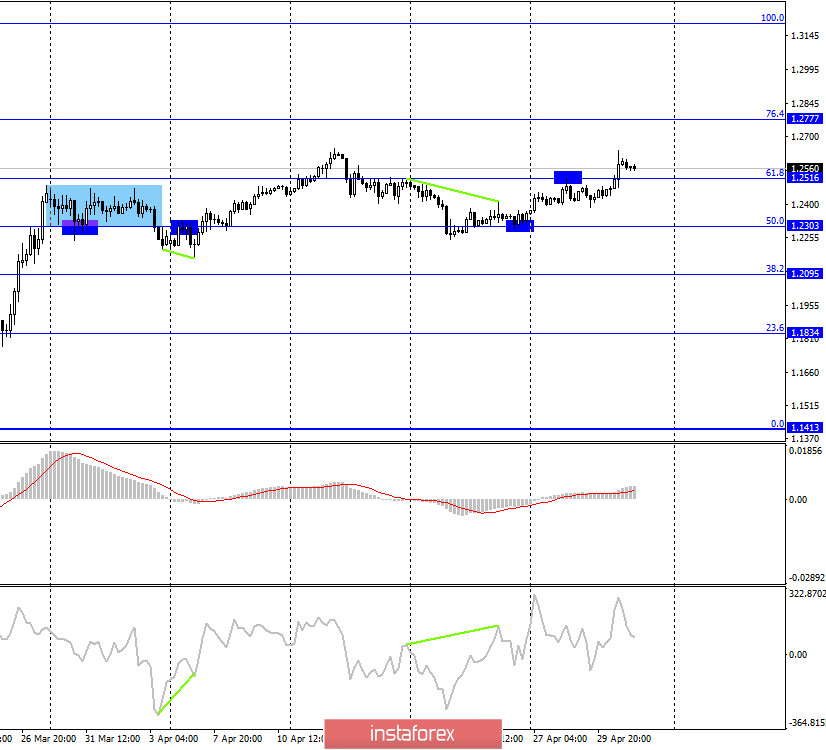

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair made a consolidation above the corrective level of 61.8% (1.2516). Thus, the chances of the pair's growth in the direction of the corrective level of 76.4% (1.2777) have significantly increased. However, as I said above, it is necessary to close the quotes above the peak level of 1.2467. Only in this case, the growth will continue. But fixing the pair's quotes under the corrective level of 61.8% will allow traders to count on a reversal in favor of the US dollar and the beginning of a fall in the direction of the Fibo level of 50.0% (1.2303). Today, the divergence is not observed in any indicator.

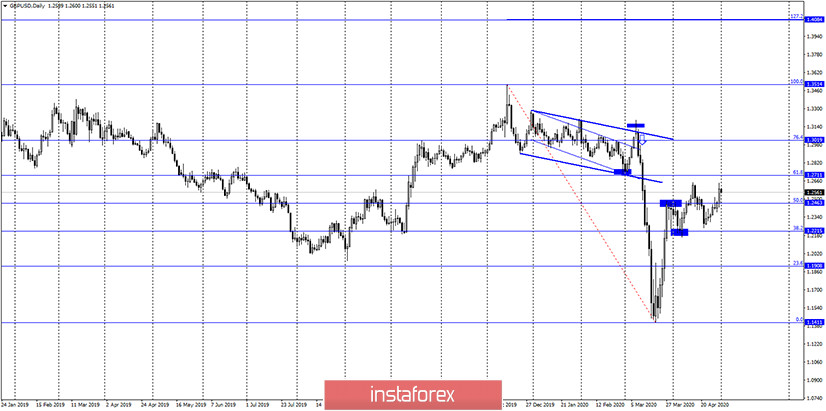

GBP/USD – Daily.

On the daily chart, the pair's quotes secured above the corrective level of 50.0% (1.2463). However, the picture on this chart is almost identical to the 4-hour chart.

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed a false breakdown of the lower trend line. Thus, until the pair's quotes are fixed under this line, there is a high probability of growth in the direction of the top two trend lines, but in the long term.

Overview of fundamentals:

On Thursday, there was again no report or economic news in the UK. And there were enough of them in America. Most of which were weak. The number of applications for unemployment benefits continues to grow and is already in the tens of millions. Personal income and spending of Americans show record declines.

The economic calendar for the US and the UK:

United Kingdom - index of industrial production (10:30 GMT).

United States - index of business activity in the manufacturing sector (15:45 GMT).

United States - ISM manufacturing index (16:00 GMT).

Today, May 1, the UK news calendar contains only the PMI index. Similar indices will be released today in America. These economic reports are not strong, I do not expect the high activity of traders during the day.

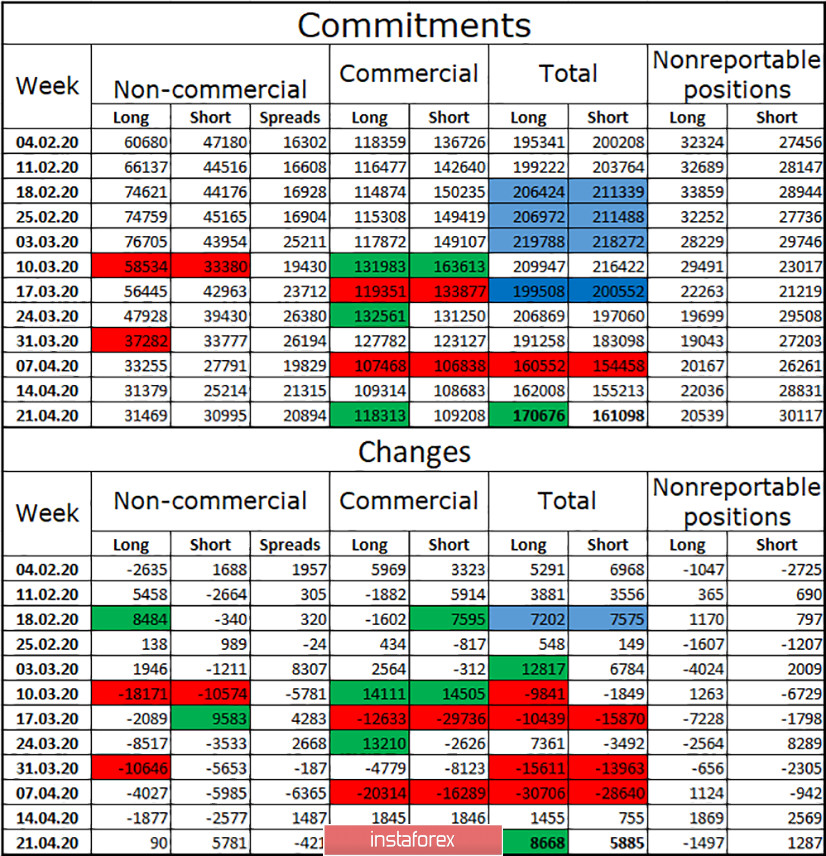

COT (Commitments of Traders) report:

The latest COT report showed an overall increase in the number of long and short contracts. This means that interest in the British among major market players is beginning to grow slowly. However, overall trading volumes remain fairly low. During the reporting week, the total number of longs increased by 8,668 contracts, and shorts - by 5,885. The overall advantage also remains for long positions and it is also minimal - 170,000 against 161,000. For a group of speculators, equality is almost complete - 31,000 short and long. However, I would like to note that since the report for March 31, when the number of long and short contracts in the hands of the "Non-commercial" group has almost leveled off, all trades in the British currency are mostly held between the level of 1.2303 and 1.2516, that is, in a side corridor. Only by the end of this week, bull traders began to show their interest in the growth of the British dollar, but it can end very quickly.

Forecast for GBP/USD and recommendations to traders:

I recommend selling the pound today with a target of 1.2303 if the close is made under the corrective level of 61.8% on the 4-hour chart. New purchases of the pound are recommended after closing above 1.2467 with a target of 1.2777.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.