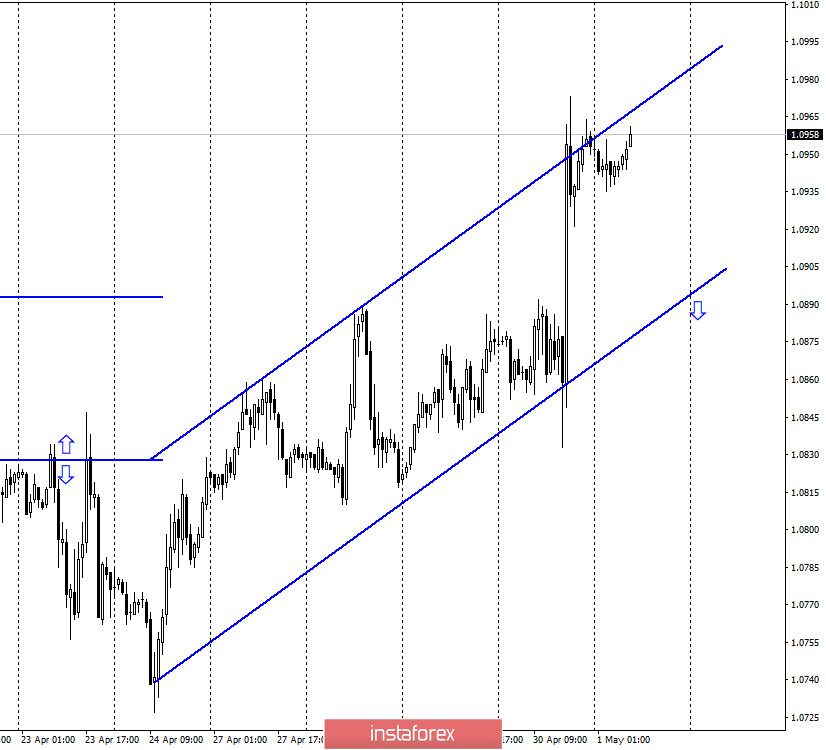

EUR/USD – 1H.

Hello, traders! On April 30, the EUR/USD pair performed a reversal in favor of the European currency on the hourly chart and started a strong growth, as a result of which it reached the upper line of the upward trend corridor. A large number of various types of economic information over the past day led to strong growth in both the euro and the pound. Thus, I believe that the reasons do not lie in the meeting of the European Central Bank, which only expanded the program of buying bonds and lending to banks, and lowered rates on them, leaving the key rates unchanged. In this case, only the euro could be expected to rise or fall. However, the pound also rose on April 30. Thus, the reasons for the fall of the dollar should be found only in America. There is some reason to assume that the US currency has collapsed across the entire spectrum of the market due to the expansion of the Fed's small and medium-sized business lending program, which is just getting ready to launch. Now the number of companies that will be able to get a preferential loan will become much larger. But from my point of view, this is not the reason.

EUR/USD – 4H.

On the 4-hour chart, the quotes of the EUR/USD pair made a consolidation above the corrective level of 23.6% (1.0840), as well as above the downward trend line. During yesterday's session, they also performed a rebound from the Fibo level of 23.6% and an increase in the corrective level of 38.2% (1.0964). It is still difficult to say what was the trigger for such a strong growth of the euro currency. It may be a combination of factors, or it may be the actions of major market players that cannot be analyzed or predicted. The rebound of the pair from the level of 38.2% work in favor of the US dollar and start falling in the direction of the corrective level of 23.6%. The consolidation of the rate above the level of 1.0964 will increase the likelihood of further growth towards the next level of Fibo 50.0% (1.1065). No indicator has any pending divergences today.

EUR/USD – Daily.

On the daily chart, the EUR/USD pair performed a reversal in favor of the European currency and increased to the corrective level of 38.2% (1.0965). Thus, the growth can be continued towards the next corrective level of 50.0% (1.1068), if a close above 1.0965 is made.

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair continues to trade near the bottom line of the "narrowing triangle". The rebound of quotes from this line still allows us to expect an increase in quotes in the long term in the direction of the level of 1.1600 (the upper line of the "triangle"). Closing the pair under the "triangle" will work in favor of the US currency and, possibly, a new long fall.

Overview of fundamentals:

On April 30, there was a sufficient amount of news from both the European Union and America. In Europe, it turned out that GDP fell in the first quarter by 3.3% y/y, unemployment rose to 7.4%, and inflation fell to 0.4%. The ECB left rates unchanged. In America, it became known about a record drop in income and spending of Americans and new 3.8 million applications for unemployment benefits.

News calendar for the United States and the European Union:

USA - index of business activity in the manufacturing sector (15:45 GMT).

USA - ISM manufacturing index (16:00 GMT).

On May 1, the US economic calendar contains two relatively important reports on business activity in the manufacturing sector, which is likely to repeat the fate of European indices. No news is expected in Europe today.

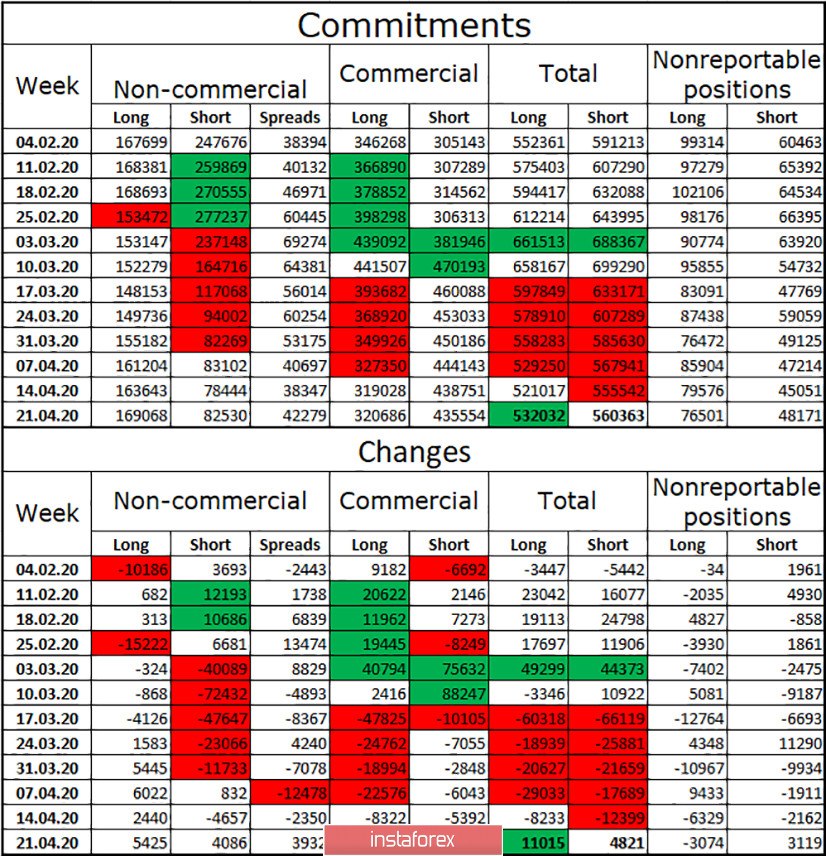

COT (Commitments of Traders) report:

The latest COT report showed that during the reporting week, major players in the currency market again increased contracts. According to this report, the total number of long contracts increased by 11,000, and a short - by 5,000, and the overall advantage remains in favor of short - 560,000 against 532,000 contracts. The advantage is not too strong. Over the past three months, every COT report has shown the advantage of bear traders. However, during this time, the euro not only fell but also showed growth. Thus, the overall trend remains "bearish", that is, in the long term, I would expect a further fall in quotes. However, there is still a graphic picture, which may show a signal to buy. Speculators continue to believe in the euro currency since they have twice as many long contracts in their hands as short ones. And at the end of the week, their faith came true. Probably, in the new COT report, which will be released today, we will see the growth of long, although it will not take into account trading on Thursday (it comes out with a three-day delay).

Forecast for EUR/USD and recommendations for traders:

At this time, I recommend selling the euro currency with the goal of 1.0638, only if the closing is performed under the ascending corridor on the hourly chart with the goal of 1.0638. I recommend buying the pair again when closing quotes above the level of 38.2% on the 4-hour chart with the goal of 1.1065.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.