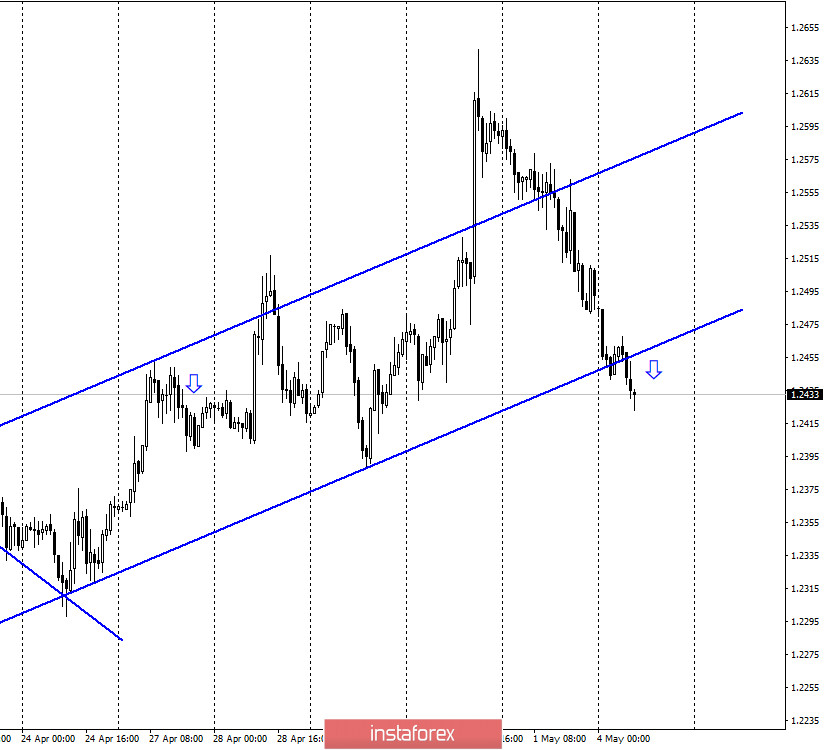

GBP/USD – 1H.

Hello, traders! According to the hourly chart, the GBP/USD pair continued to fall for most of Friday and all of Monday. Thus, at the moment, the pair's quotes have reached the lower border of the upward trend corridor and made an attempt to gain a foothold under it. On the one hand, the attempt looks successful, on the other - the pair immediately began the growth process, and therefore it is not too clear whether traders are ready to continue selling the British pound after an impressive fall. There is even less news from the UK than from Europe and the US. Coronavirus in Britain is not slowing down, so there is no talk of lifting some of the quarantine restrictions now. The British government is expected to discuss the possibility of easing the quarantine this week, but this decision is unlikely to take effect before the end of May. Britain remains the country with one of the highest death rates from the epidemic in the world.

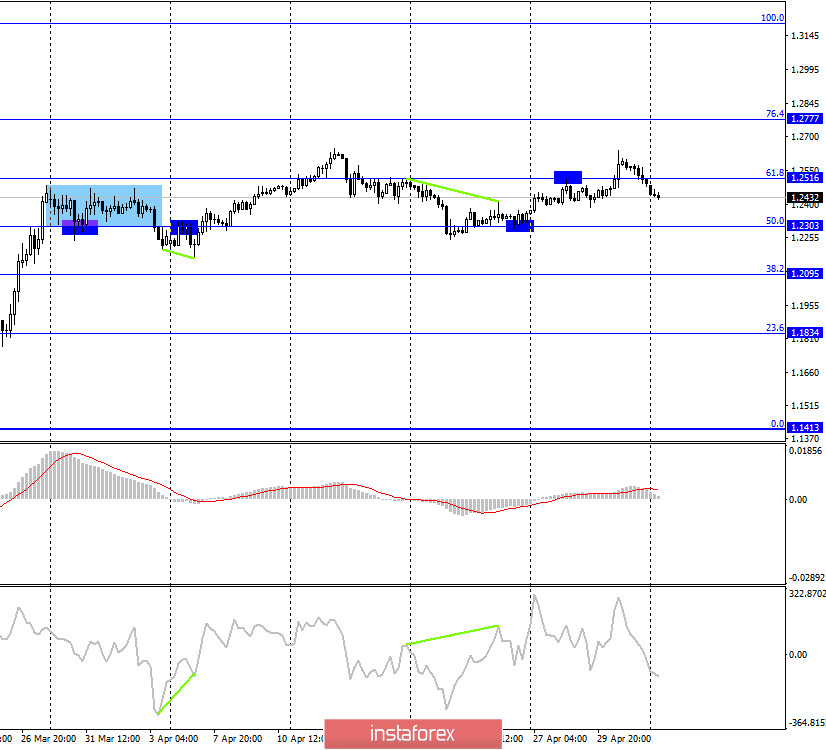

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair also performed a reversal in favor of the US currency and anchored under the corrective level of 61.8% (1.2516), which allows traders to count on the continuation of the fall in quotes in the direction of the next Fibo level of 50.0% (1.2303). Fixing the pair's exchange rate above the Fibo level of 61.8% will work in favor of the British currency and resume the growth process in the direction of the corrective level of 76.4% (1.2777). No indicator has any pending divergences today.

GBP/USD – Daily.

On the daily chart, the pair's quotes returned to the corrective level of 50.0% (1.2463). The pair's rebound from this level will allow us to expect a reversal in favor of the British dollar and the resumption of the growth process in the direction of the corrective level of 61.8% (1.2711).

GBP/USD-Weekly.

On the weekly chart, the pound/dollar pair performed a false breakdown of the lower trend line. Thus, until the pair's quotes are fixed under this line, there is a high probability of growth in the direction of the top two trend lines, but in the long term.

Overview of fundamentals:

On Friday, there was again very little news and reports in the UK. Thus, the influence of the information background was practically absent. The index of business activity in the UK manufacturing sector fell as expected, and the same picture was observed in America.

News calendar for the US and UK:

Today, May 4, the UK and US news calendars do not contain any important information. Thus, there will be no background information on Monday.

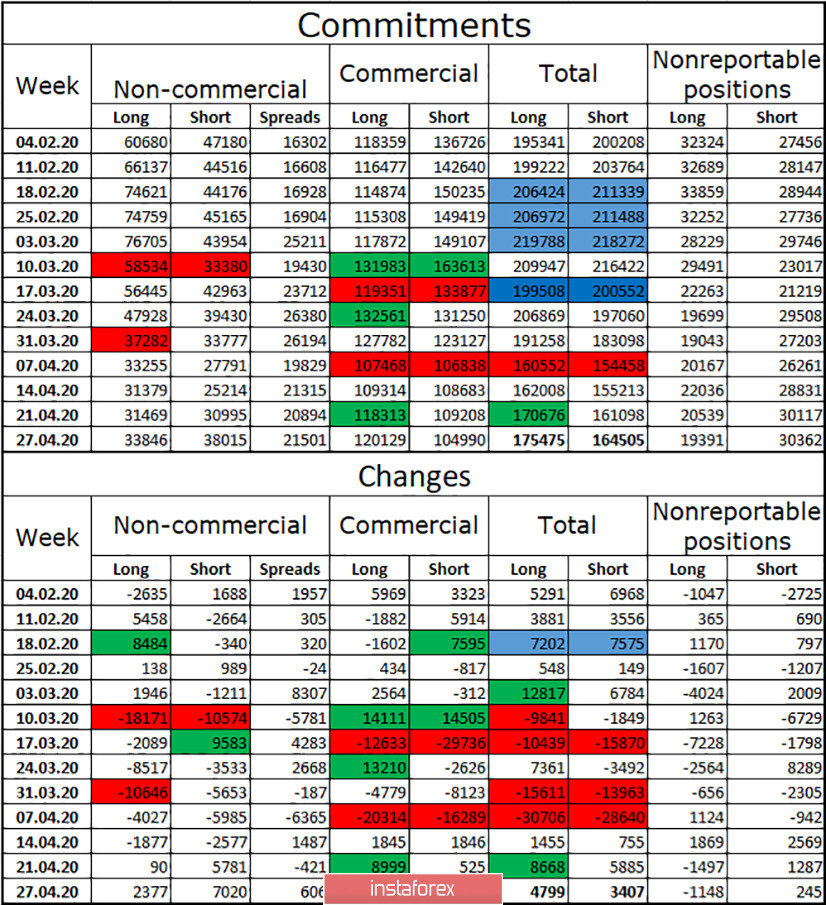

COT (Commitments of Traders) report:

The latest COT report shows that interest in the pound among major market players is starting to increase. The total number of long and short contracts increased during the reporting week. Professional players (speculators) increased both purchases and sales, with contracts for sale (+7020). Hedgers, on the contrary, got rid of short positions. Based on this, we draw the following conclusions. The Briton is regaining its appeal in the eyes of major players, but it still remains much lower than that of the euro currency. Speculators are beginning to look in the direction of selling the British, but the total number of contracts remains in favor of long (175 thousand against 164 thousand). Due to low interest among major players in the GBP/USD pair, the trend has been almost absent in recent weeks. For example, during the reporting week, it is impossible to say that the pair was rising or falling. However, in the last two weeks, the "Non-commercial" group has been increasing sales of the pound. Thus, I believe that there is more chance of a new downward trend.

Forecast for GBP/USD and recommendations to traders:

I recommend selling the pound today with a target of 1.2303, as the close was made under the corrective level of 61.8% on the 4-hour chart. New purchases of the pound are recommended after closing above 1.2516 with a target of 1.2777.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.