Forecast for May 4:

Analytical review of currency pairs on the scale of H1:

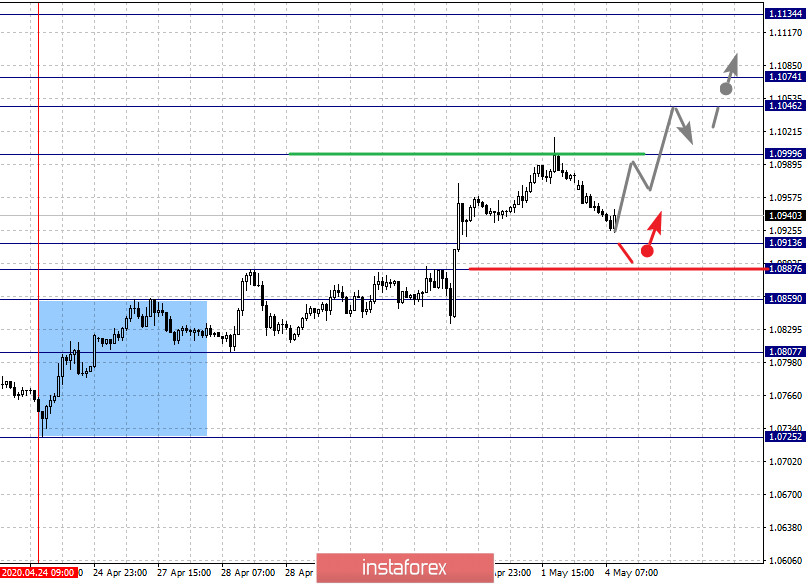

For the euro / dollar pair, the key levels on the H1 scale are: 1.1134, 1.1074, 1.1046, 1.0999, 1.0913, 1.0887, 1.0859 and 1.0807. Here, we continue to monitor the development of the ascending structure of April 24. The continuation of the upward movement is expected after the breakdown of the level of 1.0999. In this case, the target is 1.1046. Price consolidation is in the range of 1.1046 - 1.1074. For the potential value for the top, we consider the level of 1.1134, the movement to which is expected after the breakdown of the level of 1.1076.

A short-term downward movement is possible in the range of 1.0913 1.0887. The breakdown of the last level will lead to an in-depth correction. Here, the target is 1.0859. This level is a key support for the top and its breakdown will lead to the development of a downward structure. In this case, the target is 1.0807. We are waiting for the initial conditions for the downward cycle to this level.

The main trend is the upward cycle of April 24, the correction stage.

Trading recommendations:

Buy: 1.1000 Take profit: 1.1046

Buy: 1.1076 Take profit: 1.1134

Sell: 1.0913 Take profit: 1.0888

Sell: 1.0885 Take profit: 1.0862

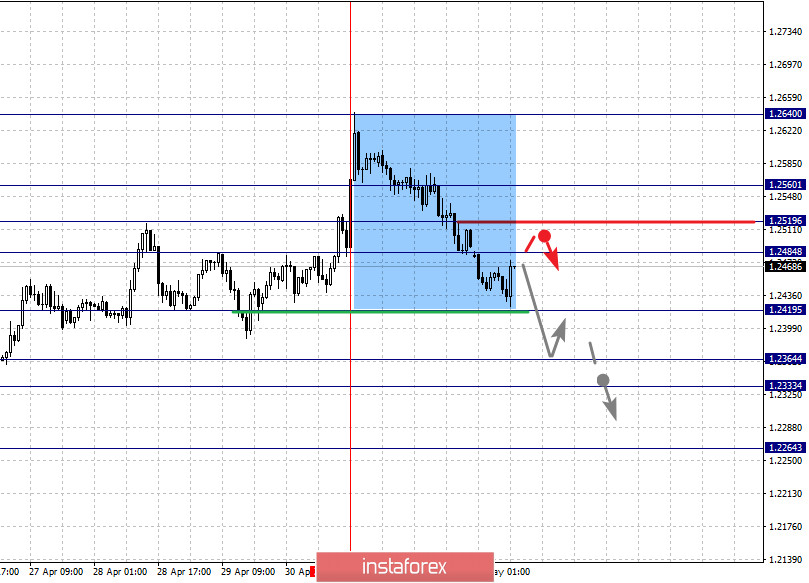

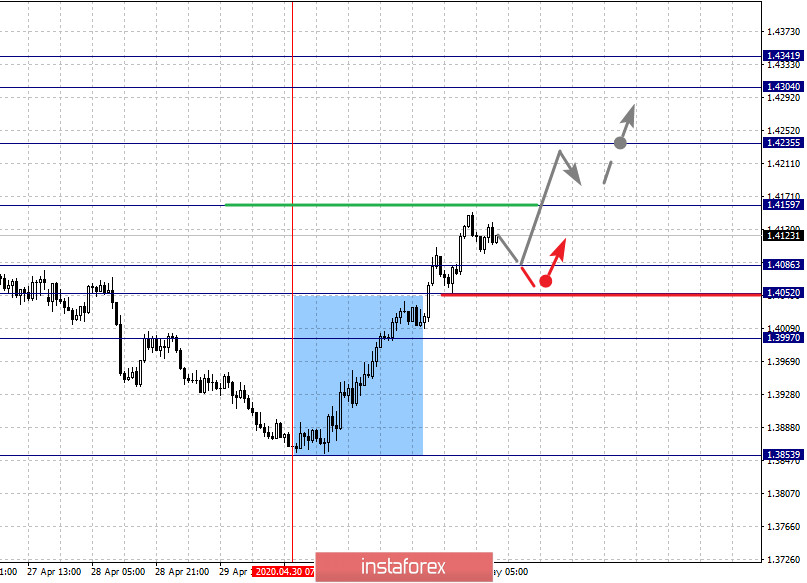

For the pound / dollar pair, the key levels on the H1 scale are: 1.2560, 1.2519, 1.2484, 1.2419, 1.2364, 1.2333 and 1.2264. Here, we are following the formation of the descending structure of April 30. The continuation of the downward movement is expected after the breakdown of the level of 1.2419. In this case, the target is 1.2364. Price consolidation is in the range of 1.2364 - 1.2333. For the potential value for the bottom, we consider the level of 1.2264. Upon reaching which, we expect a downward pullback.

A short-term upward movement is possible in the range of 1.2484 - 1.2519. The breakdown of the last level will lead to an in-depth correction. Here, the target is 1.2560. This level is a key support for the downward structure.

The main trend is the formation of the downward structure of April 30

Trading recommendations:

Buy: 1.2484 Take profit: 1.2517

Buy: 1.2521 Take profit: 1.2560

Sell: 1.2419 Take profit: 1.2366

Sell: 1.2333 Take profit: 1.2270

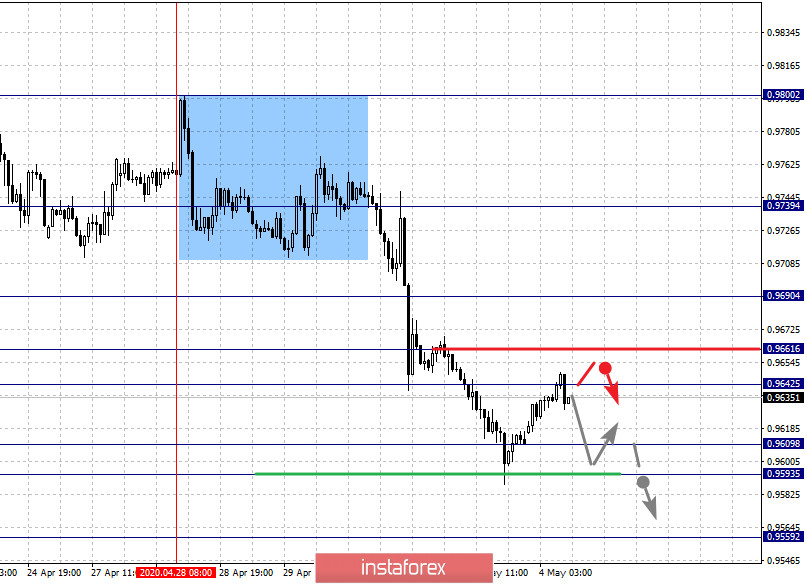

For the dollar / franc pair, the key levels on the H1 scale are: 0.9690, 0.9661, 0.9642, 0.9609, 0.9593 and 0.9559. Here, we are following the development of the descending structure of April 28. Short-term downward movement is expected in the range of 0.9609 - 0.9593. The breakdown of the last level will lead to a pronounced downward movement. Here, the potential target is 0.9559. Upon reaching which, we expect consolidation, as well as an upward pullback.

A short-term upward movement is possible in the range of 0.9642 - 0.9661. The breakdown of the last level will lead to an in-depth correction. Here, the target is 0.9690. This level is a key support for the downward structure.

The main trend is the descending structure of April 28

Trading recommendations:

Buy : 0.9642 Take profit: 0.9660

Buy : 0.9663 Take profit: 0.9686

Sell: 0.9609 Take profit: 0.9594

Sell: 0.9590 Take profit: 0.9562

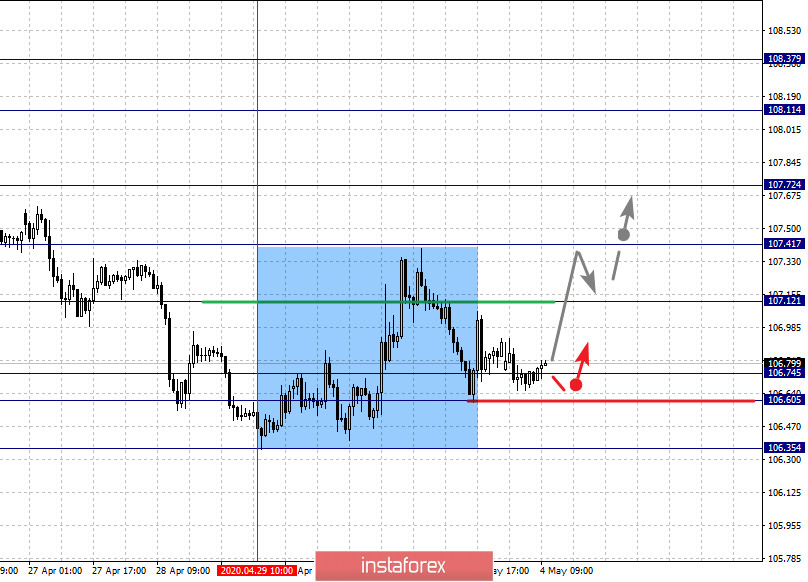

For the dollar / yen pair, the key levels on the scale are : 108.37, 108.11, 107.72, 107.41. 107.12, 106.74, 106.60 and 106.35. Here, we are following the formation of the initial conditions for the upward cycle of April 29. The continuation of the upward movement is expected after the breakdown of the level of 107.12. In this case, the goal is 107.41. The breakdown of which, in turn, will begin the development of the upward cycle on the H1 scale. Here, the first goal is 107.72. Price consolidation is near this level. The breakdown of the level of 107.72 will lead to the development of pronounced movement and here, the goal is 108.11. We consider the level of 108.37 as a potential level for the top.

The range of 106.74 - 106.60 is a key support for the ascending structure and the price passing this range will lead to the formation of a descending structure. In this case, the first potential target is 106.35.

The main trend is the formation of the ascending structure of April 29

Trading recommendations:

Buy: 107.12 Take profit: 107.40

Buy : 107.44 Take profit: 107.70

Sell: 106.60 Take profit: 106.35

Sell: Take profit:

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.4341, 1.4304, 1.4235, 1.4159, 1.4086, 1.4052 and 1.3997. Here, we are following the development of the ascending structure of April 30. The continuation of the upward movement is expected after the breakdown of the level of 1.4159. In this case, the target is 1.4235. Price consolidation is near this level. The breakdown of the level of 1.4235 should be accompanied by a pronounced movement towards a potential target - 1.4341. Upon reaching which, we expect consolidation in the range of 1.4304 - 1.4341, as well as a downward pullback.

A short-term downward movement is expected in the range of 1.4086 - 1.4052. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.3997. This level is a key support for the top.

The main trend is the upward structure of April 30

Trading recommendations:

Buy: 1.4160 Take profit: 1.4230

Buy : 1.4236 Take profit: 1.4304

Sell: 1.4086 Take profit: 1.4053

Sell: 1.4050 Take profit: 1.4000

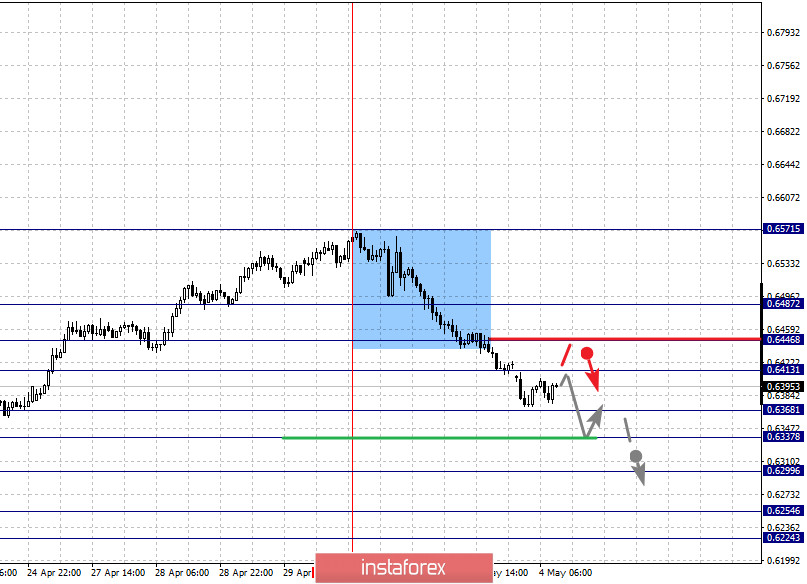

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6487, 0.6446, 0.6413, 0.6368, 0.6337, 0.6299, 0.6254 and 0.6224. Here, we are following the development of the descending structure of April 30. Short-term downward movement is expected in the range of 0.6368 - 0.6337. The breakdown of the last level will lead to a movement to the level of 0.6299. We expect consolidation near this level. The breakdown of the level of 0.6297 should be accompanied by a pronounced downward movement. Here, the target is 0.6254. For the potential value for the bottom, we consider the level of 0.6224. Upon reaching which, we expect consolidation, as well as an upward pullback.

A short-term upward movement is expected in the range of 0.6413 - 0.6446. The breakdown of the last level will lead to an in-depth correction. Here, the potential target is 0.6487. This level is a key support for the bottom.

The main trend is the downward structure of April 30

Trading recommendations:

Buy: 0.6413 Take profit: 0.6444

Buy: 0.6447 Take profit: 0.6485

Sell : 0.6368 Take profit : 0.6338

Sell: 0.6335 Take profit: 0.6300

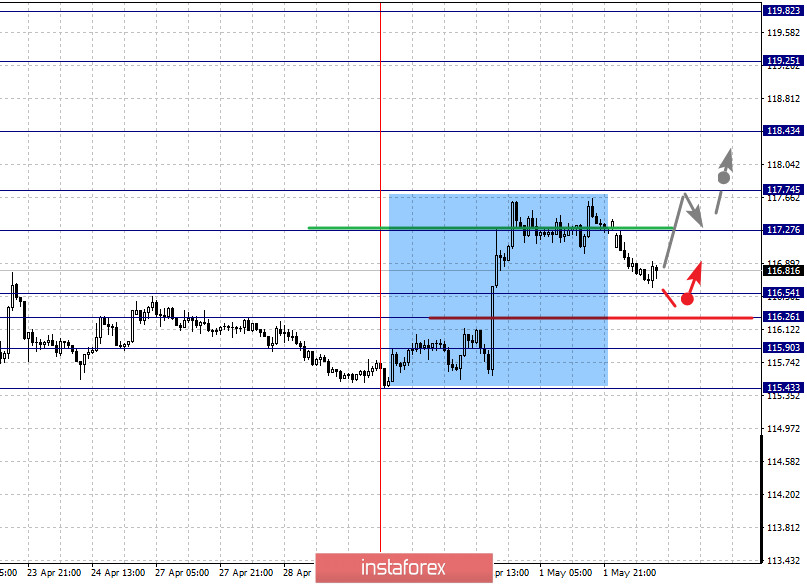

For the euro / yen pair, the key levels on the H1 scale are: 119.82, 119.25, 118.43, 117.74, 117.27, 116.54, 116.26, 115.90 and 115.43. Here, we are following the formation of the initial conditions for the top of April 29. Short-term upward movement is possible in the range of 117.27 - 117.74. The breakdown of the last level will lead to the development of an upward cycle. In this case, the first target is 118.43. Price consolidation is near this level. The pronounced upward movement is expected after the breakdown of the level of 118.45. Here, the target is 119.25. We consider the level of 119.82 as a potential goal, after which we expect a downward pullback.

A short-term downward movement is possible in the range of 116.54 - 116.26. The breakdown of the last level will lead to an in-depth correction. Here, the goal is 115.90. This level is a key support for the upward structure and its breakdown will lead to the development of a downward movement. In this case, the first goal is 115.43.

The main trend is the formation of initial conditions for the top of April 29

Trading recommendations:

Buy: 117.28 Take profit: 117.72

Buy: 117.76 Take profit: 118.40

Sell: 116.54 Take profit: 116.27

Sell: 116.24 Take profit: 115.92

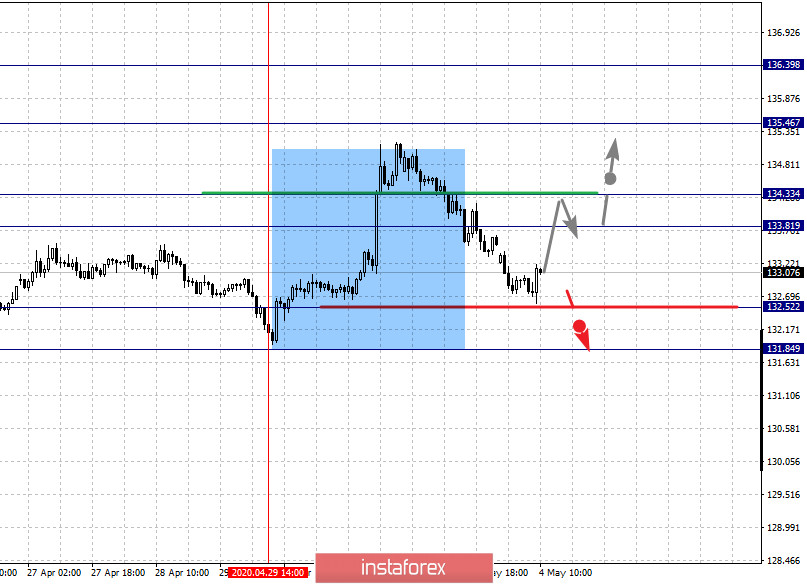

For the pound / yen pair, the key levels on the H1 scale are : 134.33, 133.77, 133.39, 132.52, 132.02, 131.43, 131.05 and 130.32. Here, we are following the formation of the initial conditions for the top of April 29. Short-term upward movement is expected in the range of 117.27 - 117.74. The breakdown of the last level will lead to the development of the cycle. In this case, the target is 118.43. Price consolidation is near this level. The breakdown of the level of 118.45 should be accompanied by a pronounced upward movement. Here, the potential target is 119.25.

A short-term downward movement is possible in the range of 116.54 - 116.26. The breakdown of the last level will lead to an in-depth correction. Here, the goal is 115.90. This level is a key support for the upward structure.

The main trend is the formation of initial conditions for the top of April 29

Trading recommendations:

Buy: 117.28 Take profit: 117.72

Buy: 117.76 Take profit: 118.40

Sell: 116.54 Take profit: 116.27

Sell: 116.24 Take profit: 115.92