EUR/USD

Analysis:

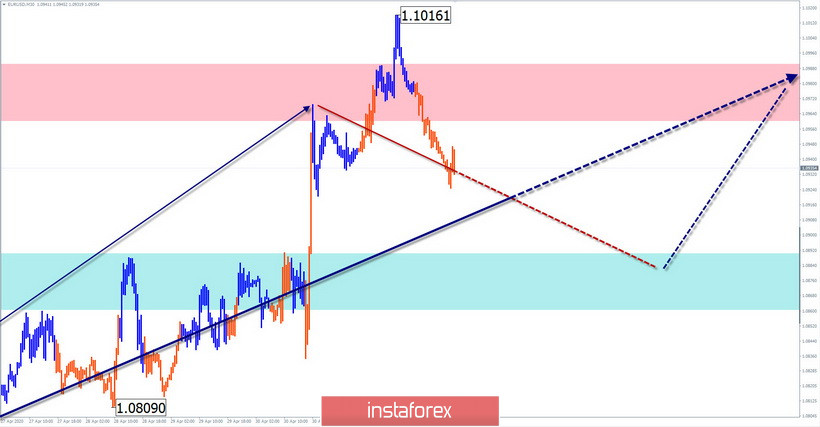

On the chart of the European currency, the direction of the price trend is set by the upward wave from March 20. Since April 24, the wave develops the final part (C). The price has reached an intermediate resistance and forms a correction since the end of last week.

Forecast:

Today, the general flat mood of the price movement is expected. In the first half of the day, a decline to the support border is possible. By the end of the day, you can expect a reversal and the beginning of a price increase.

Potential reversal zones

Resistance:

- 1.0960/1.0990

Support:

- 1.0890/1.0860

Recommendations:

Today, the euro market may sell a reduced lot during sessions. In the area of the support zone, it is recommended to complete sales transactions and look for signals to buy the instrument.

AUD/USD

Analysis:

The upward movement of the major Australian currency since March 19 replaced the previous downward trend, which lasted for more than 2 years. The wave develops in an impulse type. Since the middle of last month, the price has formed a flat correction, which has entered the final phase.

Forecast:

In the coming day, the movement of the price of the Australian dollar is expected in the corridor between the nearest counter zones. A decline is possible in the upcoming session. By the end of the day, a reversal and the beginning of price growth is expected.

Potential reversal zones

Resistance:

- 0.6400/0.6430

Support:

- 0.6340/0.6310

Recommendations:

Until the correction is fully completed and the reversal signals appear on the pair's market, sales are relevant. It is more reasonable to reduce the lot.

Explanation: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of arrows shows the formed structure, and the dotted ones show the expected movements.

Note: The wave algorithm does not take into account the duration of the tool movements in time!