One of the focus events of this week is the April US Jobs Report. The overall picture is expected to be appalling as the US Department of Labor is likely to report a loss of 21 million jobs. This happens after a 701 thousand job cut in March when the historic job growth ended. According to experts, the unemployment rate will jump to 16%.

Over the past six weeks, more than 30 million Americans have applied for unemployment benefits in the United States. This is over 18% of the working population of the country. New data is likely to increase pressure on the states. Authorities may be forced to open enterprises, despite the fact that the number of cases of coronavirus infection at some points in the country continues to increase.

According to the latest data, the number of registered cases has increased to more than 1.1 million, including about 65 thousand deaths. Meanwhile, governors in about half of the US states partially opened the economy over the weekend. Georgia and Texas are leading the way.

Market traders will closely monitor progress in European countries, which are taking cautious steps to resume economic activity. From Monday, after a long quarantine, Italian factories and construction sites open. German schools, museums, churches will open their doors. The UK will work out its quarantine strategy in the coming days.

Europe fears a second wave of infection. Given that the ECB expects the eurozone economy to fall in the second quarter by as much as 15%, the authorities will seek to resume economic activity.

Trading problems

If the second wave of the virus is still at the level of fears, then a new round of trade conflict between the US and China seems to be on the way, which spoils the mood of the markets.

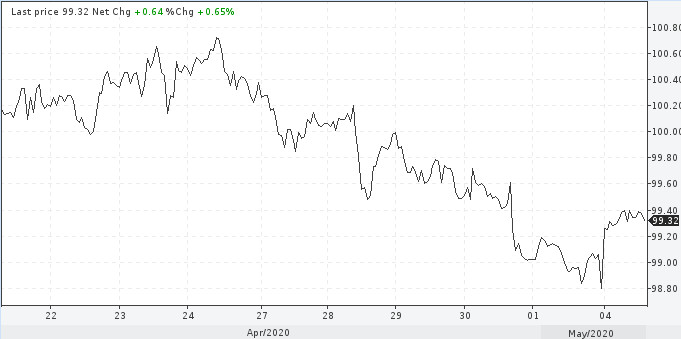

A new week began with a drop in risk appetite. Investors return to safe-haven assets and started to buy dollars. This trend may strengthen in the week.

USD

The US President accuses China of a man-made virus, and Washington is considering raising tariffs on goods from China to be one of the ways to punish for untimely informing the world about the threat of infection.

It is not yet clear how much Donald Trump is willing to risk the failure of his trade deal with Beijing. It is possible that he will move from words to deeds, since the US presidential election is ahead, and his re-election in November is threatened by high mortality from coronavirus and economic damage.

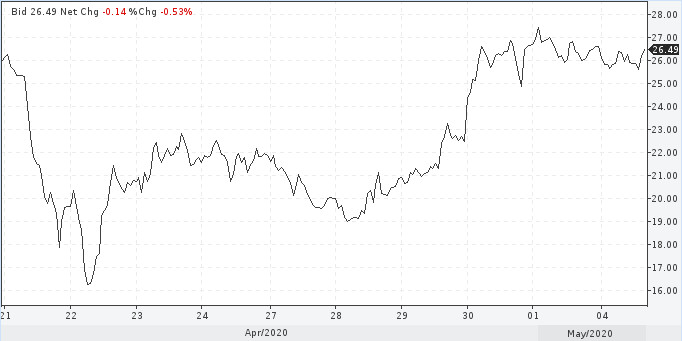

The flaring conflict between the United States and China will negatively affect the price of oil in the long run, which is already barely alive. After a 3-day growth on Monday, quotes again went to negative territory.

This year, the Brent brand has lost almost 60% of its value and reached a 21-year low in April due to the pandemic which destroyed demand. On May 1, the OPEC + deal to reduce production came into force, however, analysts doubt that this will be enough in the current realities. As before, it will no longer be, and what will happen is unknown. So far, only one thing is clear, that is, high volatility in the oil market will continue.

Brent

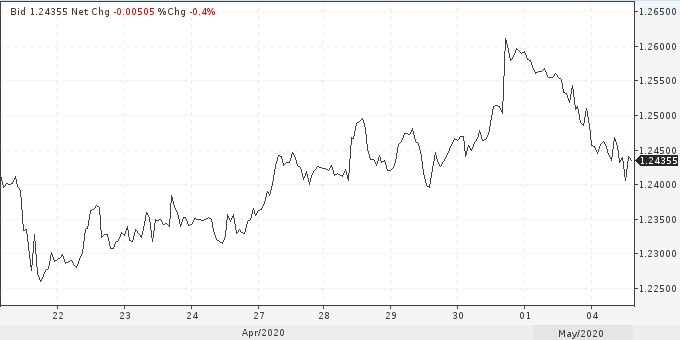

What to expect from the pound after a meeting of the Bank of England

The Bank of England is unlikely to make changes in monetary policy, so traders will focus on the publication of a new economic forecast. In this regard, they will closely monitor the dynamics of the GBP / USD pair. At past auctions, the rate fell to 1.2508, losing about 80 points per day. Today, the pair continues to be under pressure, including amid the growing US dollar. This dynamics may continue until Thursday, when the British regulator holds its next meeting.

Traders do not expect an improvement in the economic situation in the country. Data on activity in the service sector, which accounts for about 80% of national economic growth, will be presented on Tuesday. According to experts, the indicators will display a record drop by analogy with the industrial sector. If the forecast comes true, the Bank of England may go for additional measures of monetary stimulus and the pound will be under even greater pressure.

GBP / USD

The factor of a long-term decline in the GBP / USD pair is still the prospect of an unswayed Brexit. Last week, negotiations between the EU and Britain was again stalled.