Hello everyone!

The EUR/USD pair rallied for the past five trading days, the growth of which amounted to 1.46%. The week was not the best for the US dollar, as the instrument weakened against all its major competitors, and suffered the most losses in tandem with the single European currency.

The article will analyze the technical picture of the EUR/USD pair, outline the main macroeconomic reports that may affect its price dynamics, and discuss the COVID-19, which continues to affect the mood of market participants.

Continental Europe is preparing to lift its strict restrictive measures to gradually return to normal life. Construction companies and industrial enterprises in Italy are resuming work today, despite the fact that the country was the most affected by the coronavirus pandemic. Yesterday, 174 people died, which is the lowest recorded daily mortality rate in Italy since the introduction of quarantine.

Prime Minister Boris Johnson, who previously contracted the coronavirus, is also considering lifting a number of restrictions in the UK. However, many virologists fear a re-outbreak of the pandemic, so it's quite early to relax and completely cancel all quarantine activities.

The US, meanwhile, continues to blame China for misinforming and hiding the real extent and consequences of COVID-19. Following US President Donald Trump, US Secretary of State Mike Pompeo spoke in a similar vein.

A lot of macroeconomic statistics will be published this week, the main event of which will be data on the US labor market, which will come out on May 8 at 13:30 (London time). Data on retail sales, the PMI index and other reports will come from the eurozone.

The report on production orders in the US will come out today at 15:00 (London time).

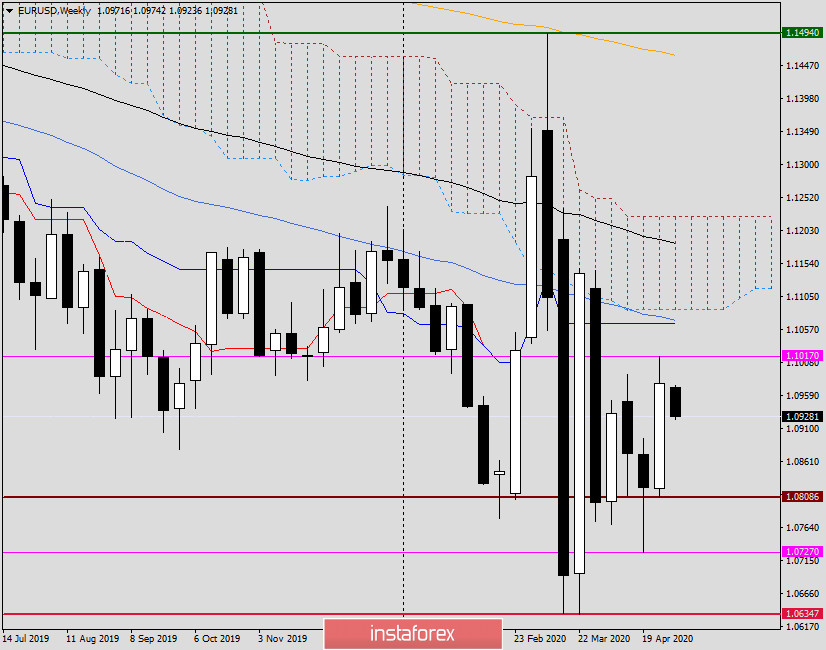

Weekly

As noted above, the EUR/USD pair rallied last week and closed at 1.0977. In addition, the pair tested the important technical and psychological level of 1.1000, setting maximum values at 1.1017. Continuation of the rally, as well as an update of the previous highs, will set the next targets for EUR/USD in the price area of 1.1065-1.1087, from which the Kijun line of the Ichimoku indicator, 50 SMA and the lower border of the Ichimoku cloud are located.

A break of the 1.0808 support down, from which last week's lows are located, will indicate a bearish scenario, but judging by the technical picture, the quotes have every chance to continue rising, but much will depend on Friday's US labor market reports, which are the most important data that will put an end to trading on May 4-8.

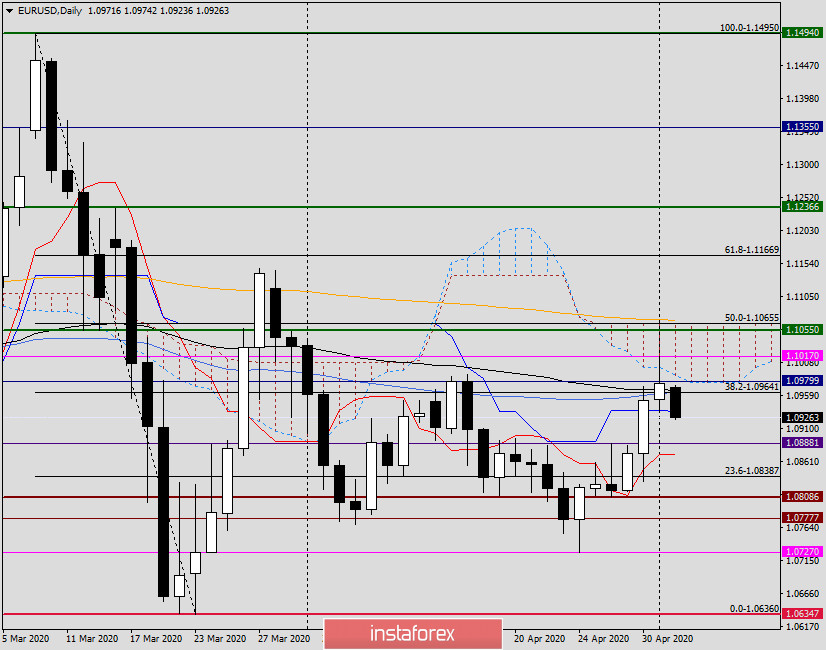

Daily

Trading on May 1 ended above 50 SMA and 89 EMA in the daily chart, as well as in the 38.2 level of the Fibonacci grid, which is stretched to a decline of 1.1495-1.0636. However, such cannot be considered a true breakdown of both movings and 38.2 Fibo, since one candle closed above is not enough for such judgment.

At the end of this article, the pair is trading slightly down, correcting the previous growth.

Conclusion and trading recommendations for the EUR / USD pair:

Considering the previous weekly growth, closing price and the already tested break of the symbolic level of 1.1000, bullish mood will continue in the EUR/USD pair. If such assumption turns out to be true, the main trading idea for EUR/USD is to consider purchases after declines in the area of 1.0920-1.0880.

Sales will be relevant if the corresponding candle signals appear on the daily, 4-hour and (or) hourly time frames, in the area of 1.0960-1.1000. The long upper shadow of Friday's candle does not exclude a downward scenario. Perhaps, after today's trading ends, clearer signals will be observed, and the trading ideas will be adjusted.

Good luck!