To open long positions on EURUSD, you need:

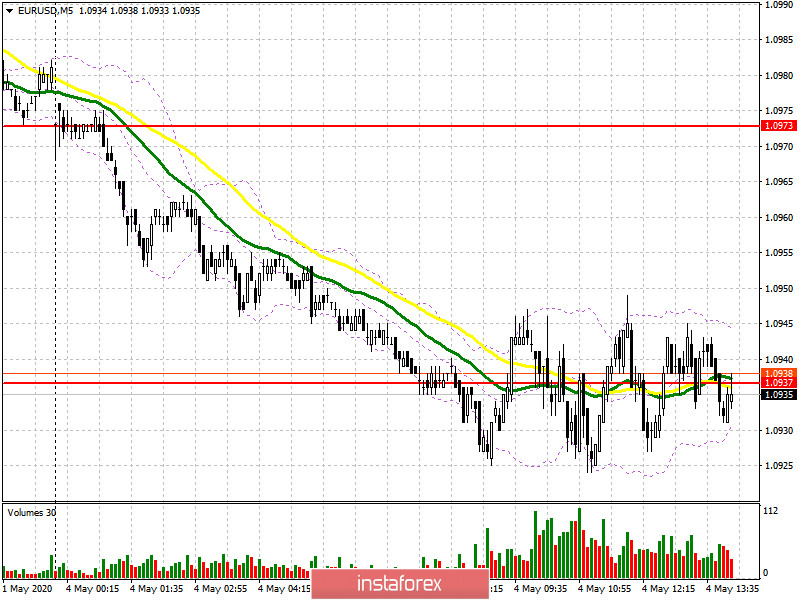

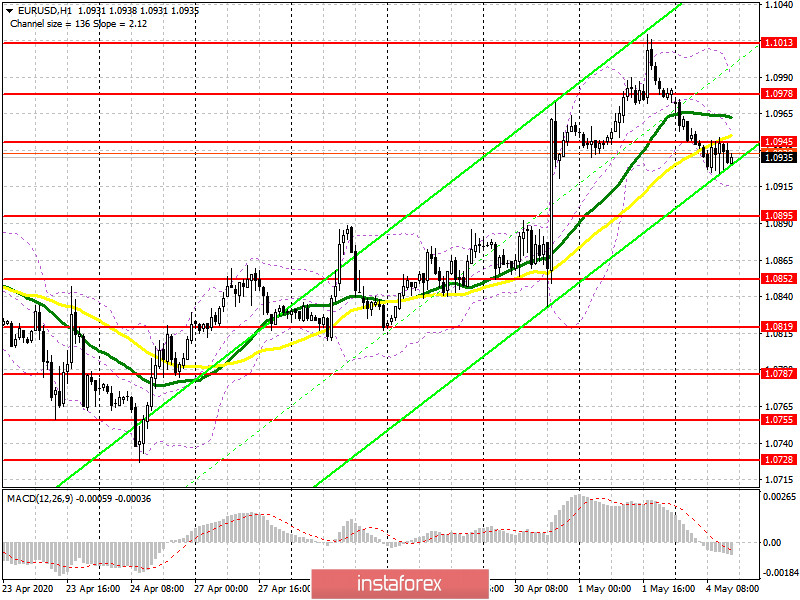

In my morning forecast, I paid attention to the support level of 1.0937 and the probability of forming a false breakout, which would allow us to build a larger upward correction in the pair. However, after several unsuccessful attempts, which are visible on the 5-minute chart, and weak data on manufacturing activity in the Eurozone, it was not possible to return to the maximum of 1.0973. Now if we look at the hourly chart, by the beginning of North American trading, a new resistance of 1.0945 has already formed, which the bulls need to focus on. Only a break and consolidation above this level will allow you to get to a larger maximum of 1.0978 and then get to a larger resistance of 1.1013, where I recommend fixing the profits. If the pressure on EUR/USD continues, it is best to postpone long positions until the test of the minimum of 1.0895 or buy immediately for a rebound from the support of 1.0852 in the expectation of correction of 25-30 points within the day.

To open short positions on EURUSD, you need:

Sellers continue to be active in the area of a new resistance of 1.0945, and while trading is below this level, the pressure on EUR/USD will remain, which will lead to an update of a new low of 1.0895, where I recommend fixing the profits. However, it will be possible to talk about a break in the upward trend in the euro from April 24 only after testing the minimum of 1.0852. If the bulls manage to get above the resistance of 1.0945, I recommend that you postpone short positions until the test of a larger level of 1.0978, again provided that a false breakout is formed there or sell EUR/USD immediately to rebound from the maximum of 1.1013. However, given the fact that no important fundamental statistics are scheduled for release in the second half of the day, trading may remain around the morning range of 1.0945.

Signals of indicators:

Moving averages

Trading is already below the 30 and 50 daily moving averages, but they have not yet crossed each other, which keeps the market on the side of buyers and does not exclude their active attempt to return in the second half of the day.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

A break in the lower border of the indicator around 1.0915 may lead to a larger sale of the European currency. The growth of the euro will be limited by the upper level of the indicator in the area of 1.0990, from where you can open short positions immediately on the rebound.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20