The lack of latest news from D. Trump on the topic of robbing China, for example, raising customs duties or calls to simply not pay interest on deposits in American treasuries or something else, somewhat reassured investors and contributed to a slight weakening of the US currency in the currency market.

The absence of new threatening statements from the American President or his Secretary of state, M. Pompeo, as well as the Minister of Finance or personal adviser, somewhat reduced the tension in the markets. At the same time, the recovery of quotes of crude oil and other commodity assets, pending the growth of demand as economic activity in the world recovered, began to support the exchange rates of commodity currencies.

On this wave, the Australian, New Zealand and Canadian dollars, as well as the Norwegian krone, recovered most of their losses on Monday evening and continued to grow steadily in the Asian trading session on Tuesday. Moreover, crude oil prices significantly increase before the opening of trading in Europe, confidently above the mark of $ 20 per barrel.

In the previous review, we pointed out that if D. Trump's threats against China are not followed by any serious actions, and the experience of his presidency indicates that this may be the case, then the markets will begin to recover again, switching all their attention to assessing the prospects for creating a drug against COVID-19, restoring economic activity primarily in China, Europe and the United States.

This scenario will lead to the resumption of the weakening of the US dollar, but it should not be expected to decline steadily, since it is not yet clear when COVID-19 will be finally defeated or, in any case, its influence will be significantly reduced, and the global economic recovery will begin to gather pace. A lot will depend on what form the period of recovery from the crisis will take - "V"-shaped, "U" or "L". So far, the markets are hoping that it will be a "V" shape, characterized by a strong recovery after the same strong decline. It would be the best option. The U-shaped recovery will be prolonged, but it will end with an increase in economic activity, but the development of the situation in the "L" scenario threatens with a long and prolonged crisis.

We are still considering option "V", but if D. Trump continues to promote the topic of "guilt" of the PRC for the emergence and spread of the coronavirus pandemic, and there is a high probability, then the post-coronavirus economic picture will look like "L", which will be characterized weak economic activity and a noticeable drop in demand for risky assets in general, although in particular many companies will receive support.

Regarding the prospects for the dollar, it can be noted that the "V" form will be the most negative. At the same time, "L"will be a positive option for it, in which it will be in demand along with other assets of the company. In this situation, gold and other precious metals will also be in demand.

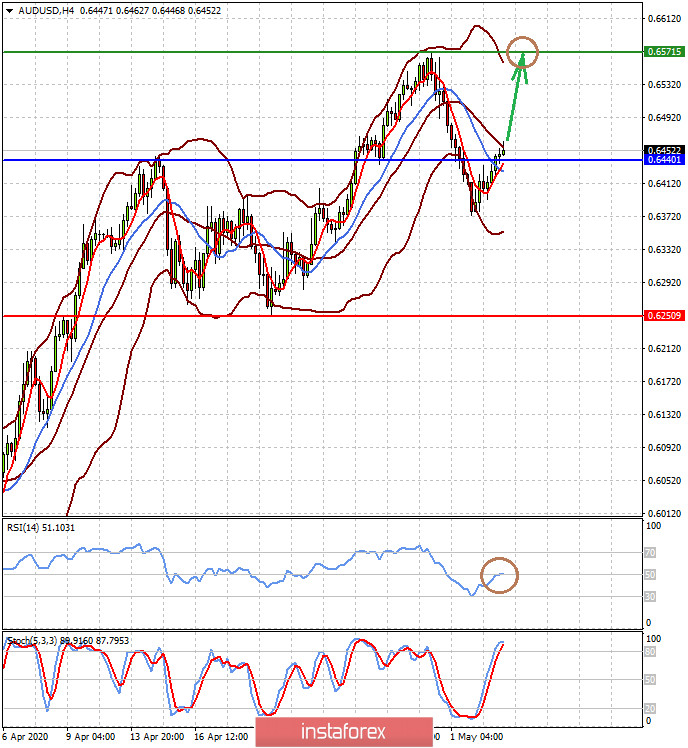

Forecast of the day:

The AUD/USD pair is recovering amid rising commodity and commodity assets. We believe that if it holds above the level of 0.6440, it will continue to rise to 0.6570.