The last month of spring is a time of lush flowering of greenery and, surprisingly, it sounds, the traditional heyday of the US currency. The greenback, justifying its "green" name, blossoms like a flower in the financial field. However, there are many obstacles that analysts pay attention to.

A significant obstacle to the growth of the "American" currency may be another round of escalation of US-Chinese relations. It can be recalled that this bad situation was noted last weekend. American authorities accused the Chinese leadership of intentionally concealing the enormous scale of the pandemic and demanded retaliation. This gave a new impulse to the long-term trade conflict between the United States and China, threatening the peaceful interaction of both countries. As a result, a surge in anti-risk sentiment was recorded in the market, which provided significant support to the dollar.

A significant obstacle to the growth of the dollar can be another round of escalation of US-China relations. The market does not expect miracles from the next portion of macro statistics from the USA. March indicators, reflecting the extremely negative impact of the COVID-19 pandemic, have already disappointed investors. It can be recalled that the number of people employed in the non-agricultural sector decreased by 700 thousand in March 2020, although the forecast assumed a decrease of about 100 thousand. According to analysts, the situation in the US labor market is very alarming. April non-pharma will show the peak of unemployment in the USA, which will reach 16%. Experts do not rule out the elimination of 21 million jobs and a decline in the number of employees by 210 thousand. Earlier, it was about 30 million unemployed, which is about 18% of the working population of America.

However, there is good news for the dollar. Experts believe that the dollar will be able to recover from recent losses this month. At the end of last week, the dollar suddenly plummeted ending April. The short-term loss of USD positions was caused by an unexpected decision by the US regulator. It can be recalled earlier that the Federal Reserve announced the expansion of the lending program for small and medium-sized businesses, for the support of which considerable funds were thrown.

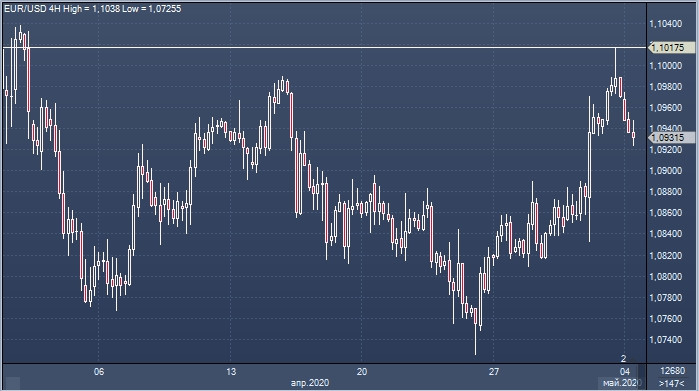

At the beginning of this week, the US currency, rising in the wake of anti-risk sentiment, managed to strengthen its position. On Monday, May 4, the EUR/USD pair went from a monthly maximum of 1.1017 to around 1.0931. On Tuesday morning, May 5, the EUR/USD pair was even lower, trading near the levels of 1.0911-1.0912. Subsequently, the pair rose a little, but it is still far from the conquered highs.

Many experts speak out in favor of the May rise in the dollar. Deutsche Bank currency strategists emphasize that the dollar clearly demonstrates a growth trend in May. The Bank believes that this is a traditional phenomenon that cannot be prevented even by force majeure. According to Deutsche Bank, the upward trend of the dollar in 2020 is multiply amplified against the backdrop of coronavirus infection. Analysts conclude that May's "acceleration" of the USD and its potentially positive dynamics give hope to the market, despite the devastating consequences of COVID-19.