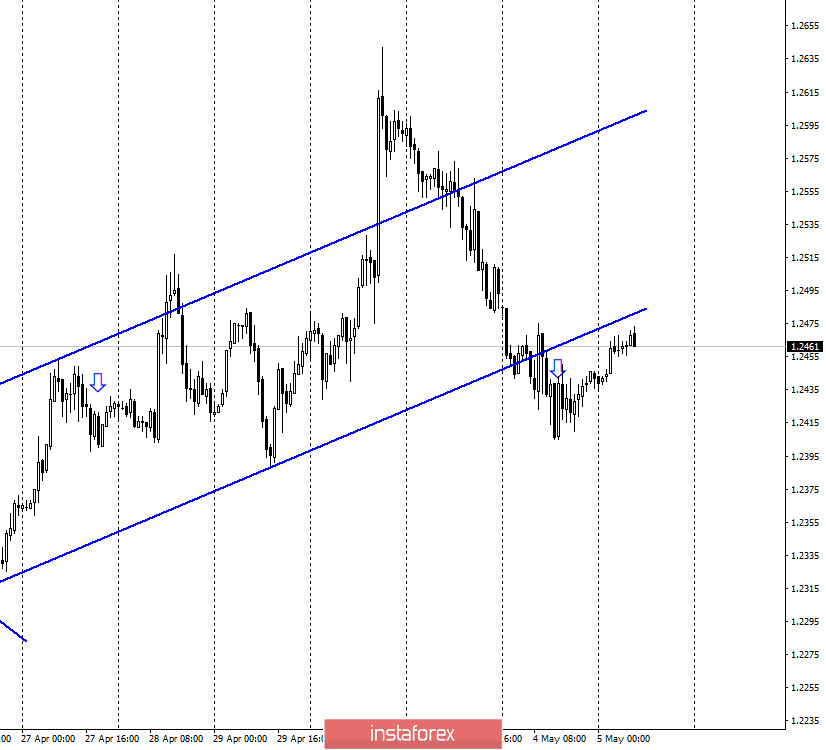

GBP/USD – 1H.

Hello, traders! According to the hourly chart, the GBP/USD pair performed a reversal in favor of the British dollar and began the growth after fixing under the upward trend corridor. However, the overall mood of traders has already changed to "bearish" due to the pair's exit from the corridor. So I expect a further fall. Especially since the 4-hour chart also had an important close under the trend line, which also allows you to count on a further drop in quotes. From the latest news concerning the UK, there is nothing special to highlight. Traders are frankly waiting for the meeting of the Bank of England, the results of which will be summed up this week on Thursday. In addition, the main information background flows from the United States, from the White House. It concerns mainly now the escalation of the trade conflict between China and the United States. More precisely, now the introduction of duties may be nothing more than a tool to pressure China because of its guilt in the spread of coronavirus across the planet. While official measures have not been taken yet, Washington is collecting evidence of China's guilt.

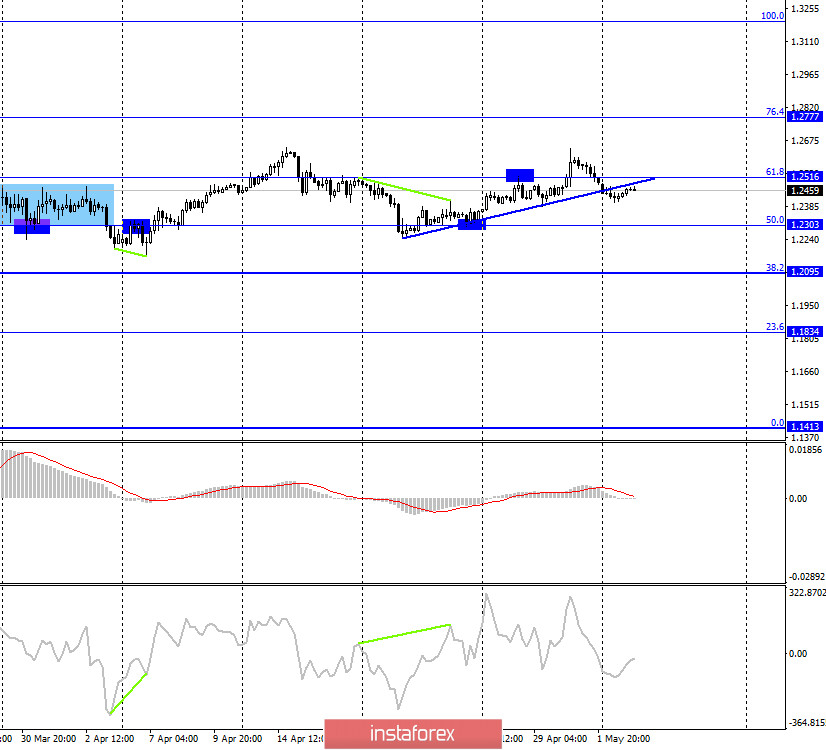

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair performed a consolidation under the ascending trend line, so the fall in the British dollar's quotes can be continued in the direction of the corrective level of 50.0% (1.2303). Today, the divergence is not observed in any indicator. Fixing the pair's exchange rate above the Fibo level of 61.8% (1.2516) will work in favor of the US currency and resume the growth in the direction of the corrective level of 76.4% (1.2777).

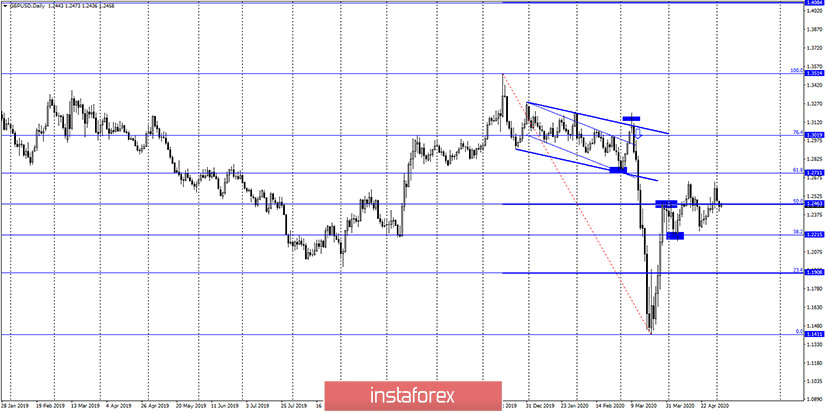

GBP/USD – Daily.

On the daily chart, the pair's quotes performed a reversal in favor of the US currency and secured under the corrective level of 50.0% (1.2463). Thus, three charts at once speak now in favor of continuing the fall of quotes. On the daily chart - in the direction of the Fibo level of 38.2% (1.2215).

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed a false breakdown of the lower trend line. Thus, until the pair's quotes are fixed under this line, there is a high probability of growth in the direction of the top two trend lines, but in the long term.

Overview of fundamentals:

There were no economic reports in the UK or America on Monday. Thus, there was no background information.

News calendar for the US and UK:

United Kingdom - PMI for services (10:30 GMT).

United States - PMI for the services sector (15:45 GMT).

United States - ISM composite index for the non-manufacturing sector (16:00 GMT).

Today, on May 5, the UK and US news calendars contain indices of business activity in the service sectors. All three indices are expected to fall to very low values, especially the British one - to 12.3.

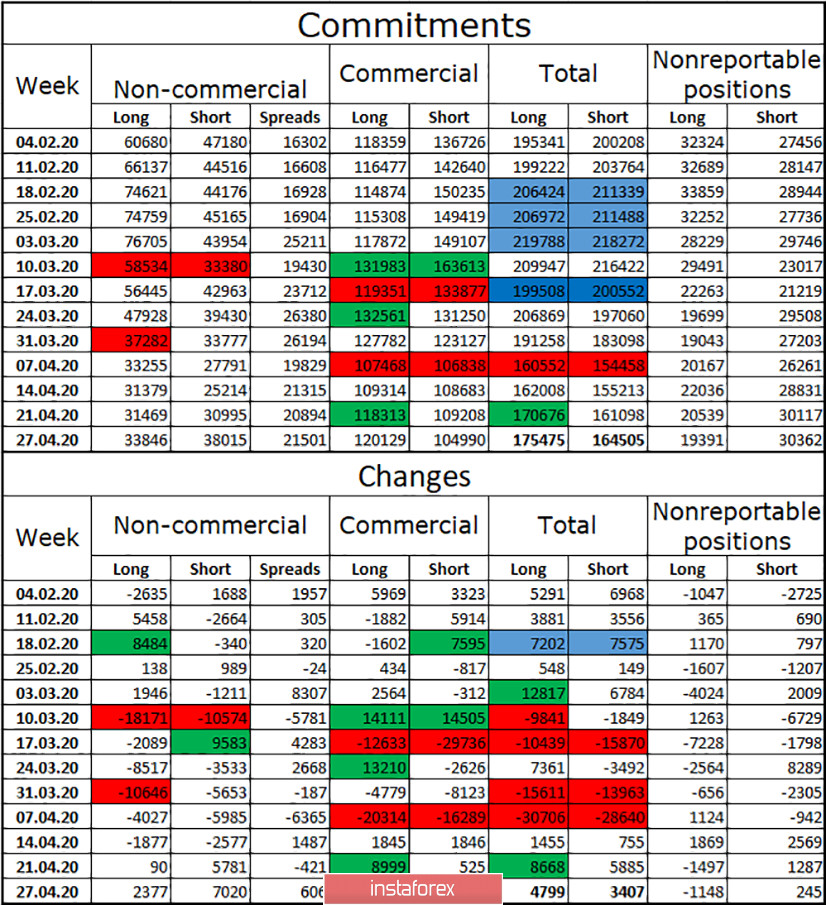

COT (Commitments of Traders) report:

The latest COT report showed that interest in the pound among major market players is starting to grow. The total number of long and short contracts increased during the reporting week. Professional players (speculators) increased both purchases and sales and primarily contracts for sale (+7020). Hedgers, on the contrary, got rid of short positions. Based on this, we draw the following conclusions. The pound is regaining its appeal in the eyes of major players, but it still remains much lower than that of the euro. Speculators are beginning to look in the direction of selling the British, but the total number of contracts remains in favor of long (175,000 against 164,000). Due to low interest among major players in the GBP/USD pair, the trend has been almost absent in recent weeks. In the past two weeks, the "Non-commercial" group has been increasing sales of the pound. Thus, I believe that there is more chance of a new downward trend.

Forecast for GBP/USD and recommendations to traders:

I recommend selling the pound today with a target of 1.2303, as the close was made under the corrective level of 61.8% on the 4-hour chart. New purchases of the pound are recommended after closing above 1.2516 with a target of 1.2777.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.