EUR/USD – 1H.

Hello, traders! The EUR/USD pair continued to fall on the hourly chart on May 4 and made a consolidation under the upward trend corridor, which changed the current mood of traders to "bearish". However, I would like to pay attention to the 4-hour chart, where the upward trend line remains working, under which the quotes have not yet been fixed. Thus, the pair's growth may still be resumed, and the upward trend corridor may be slightly rebuilt. While the coronavirus is beginning to recede (at least, we want to believe it), and countries are beginning to relax the quarantine, a conflict between America and China is brewing, in which some European countries may also participate. Donald Trump believes that China violated several principles of the World Health Organization, as it did not inform about the scale of the disease at the very beginning of the epidemic, and also hid the facts about the contagion of the new virus and the number of victims on its territory. If China had immediately provided the correct information, the epidemic around the world could have been avoided. Thus, now Washington is considering the possibility of imposing new trade duties on goods from China or imposing other sanctions and restrictions.

EUR/USD – 4H.

On the 4-hour chart, the quotes of the EUR/USD pair fall to the upward trend line. Thus, the rebound of the pair's exchange rate from this line will work in favor of the European currency and the resumption of the growth in the direction of the corrective level of 50.0% (1.1065). Also, a bullish divergence was formed for the CCI indicator, which increases the probability of a rebound from the trend line. At the same time, the closing of the pair's quotes on May 5 under the trend line will allow traders to count on the continuation of the fall of quotes in the direction of the Fibo level of 23.6% (1.0840).

EUR/USD – Daily.

On the daily chart, the EUR/USD pair performed a reversal in favor of the US dollar near the corrective level of 38.2% (1.0965) and began a new process of falling in the direction of the corrective level of 23.6% (1.0840). However, now everything rests on the trend line on the 4-hour chart.

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair continues to trade near the bottom line of the "narrowing triangle". The rebound of quotes from this line still allows us to count on the growth of quotes in the long term in the direction of the level of 1.1600 (the upper line of the "triangle"). Closing the pair under the "triangle" will work in favor of the US currency and, possibly, a new long fall.

Overview of fundamentals:

On May 4, there was very little news in the European Union, and no news in America at all. Business activity in the EU manufacturing sector fell to 33.4, which did not particularly interest traders.

News calendar for the United States and the European Union:

US - PMI for services (15:45 GMT).

US - ISM composite index for the non-manufacturing sector (16:00 GMT).

On May 5, the US economic calendar contains two business activity indices for the service sector, each of which may reach a record low. The first - 27.0, the second - 37.5. No news is expected from the European Union today.

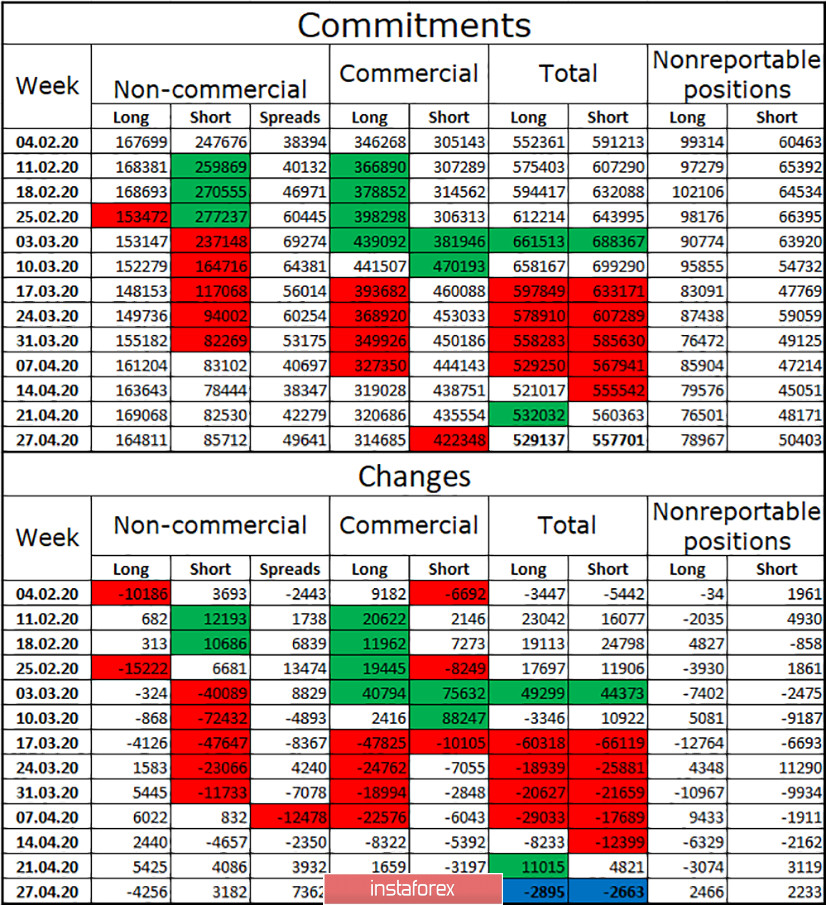

COT (Commitments of Traders) report:

On Friday, a new COT report for the week to April 27 was released. Please note that COT reports are published with a three-day delay. In total, during the reporting week, long contracts lost 2,895, while short contracts lost 2,663. Thus, the losses are almost identical, which means that the general mood remains the same. As for the "Commercial" and "Non-commercial" groups separately, the former got rid of long contracts, and the latter got rid of both long and short. Moreover, hedgers closed 13,200 contracts for sale at once, which is a high value. Speculators also got rid of purchases of the euro currency and increased sales. The euro currency fell after these manipulations, but in the second half of last week, it began to grow, which may indicate a new build-up of long-contracts by speculators. In general, the "Non-commercial" group still has twice as many purchase contracts in its hands, which means a "bullish" mood among professional market players in the long term. However, the total number of contracts remains in favor of short - 557,000 against 529,000.

Forecast for EUR/USD and recommendations for traders:

At this time, I recommend selling the euro currency with the goals of 1.0840 and 1.0770, only if the closing is performed under the ascending trend line on the 4-hour chart. I recommend buying the pair again when the quotes are rebound from the same trend line with the goal of 1.1065.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.