The Australian dollar slightly rose after the results of the Reserve Bank of Australia's May meeting were announced. Although the regulator voiced a pessimistic forecast regarding the growth prospects of the global and national economy, traders focused on other, more optimistic theses. As a result, the AUD/USD pair continues to remain in the middle of the 64th figure after an unsuccessful assault on the 65 price level. The sluggish siege of the 0.6500 mark may continue for several days, until the US nonfarms data is released. The pressure of the US currency has now decreased, and the aussie switched to waiting mode – to break the "round" resistance level, a fairly powerful informational reason is needed.

Following Monday's results, it became clear that dollar bulls are unable to develop a large-scale rally against the background of a verbal conflict between Washington and Beijing. Let me remind you that yesterday US Secretary of State Mike Pompeo said that there is a "huge" amount of evidence that the source of the coronavirus is the Wuhan Institute of Virology. Today, there was a reaction from Beijing: China's central television called the words of an American high-ranking official "crazy" and "full of the purest lies." According to the Chinese, the United States began to "dump the blame on China" and "suppress the PRC at a time when their own anti-epidemic measures are a complete mess."

Such an "exchange of courtesies" caused a short-term surge in anti-risk sentiment in the market, but the momentum faded almost immediately - traders won back this fundamental factor yesterday, while China's response rhetoric was very predictable. In general, as long as the conflict between the countries is verbal in nature (and has not moved, for example, to the economic plane), it will have a background effect on the foreign exchange market. The first wave of accusations received a wide resonance in society, so traders reacted to it with an increased demand for defensive assets. But, figuratively speaking, "the flame did not ignite from the spark", so dollar bulls could not develop their success - including in the AUD/USD pair. Following a short-term growth, the dollar index shows a downward trend today, reflecting a decline in overall interest in the greenback. Such a disposition made it possible for the aussie to not only hold on to the gained positions, but even climb a few dozen points higher, which against the background of the general flat looks like a good result.

But back to the results of today's RBA meeting. The May meeting turned out to be a "passing". But two facts should be noted here: firstly, the regulator left the interest rate unchanged (the expected result was 100% expected), and secondly, it decided to reduce the frequency and volume of bond purchases (but this was unexpected). Also, the Australian central bank noted an improvement in the bond market. All these factors played in favor of the Australian dollar, although the pessimistic rhetoric of the accompanying statement did not allow the AUD/USD bulls to develop an upward attack.

The RBA stated that the global economy is experiencing a severe recession, while the Australian economy is "at a difficult stage of its development." Further prospects remain uncertain given the decline in key macroeconomic indicators. In particular, the central bank predicted an increase in unemployment to 10 percent, a significant decline in production in the first half of this year and a significant slowdown in inflation. According to some estimates, inflation will be below the target two percent level over the course of "several years". Summarizing the results of the May meeting, the RBA emphasized that the interest rate would not be increased until the key inflation indicators and the level of employment reached their target levels.

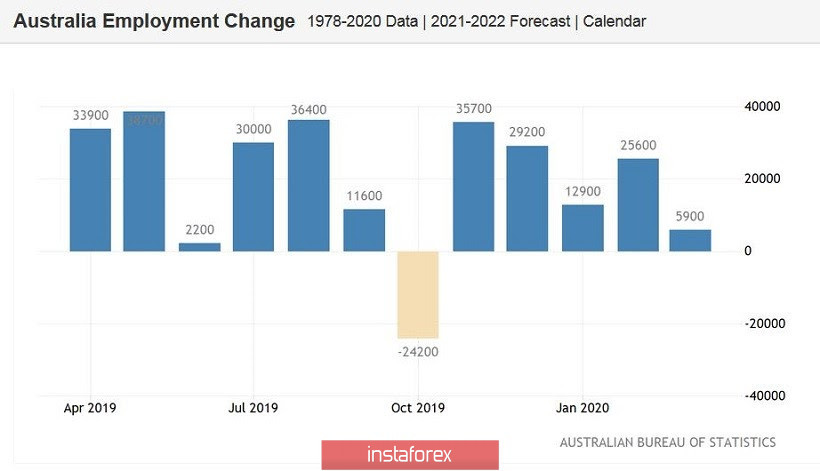

The rhetoric of regulator members quenched the upward momentum of AUD/USD, but failed to help the bears. The fact is that the latest data on the growth of Australian inflation came out in the green zone, surprising the market participants. In annual terms, the general consumer price index crossed the 2 percent mark and reached 2.2%. In quarterly terms, the indicator decreased, but, again, it turned out to be better than expected (decline to 0.3% with a forecast of 0.1%). Moreover, core inflation showed a positive trend, rising both in monthly and annual terms. In addition, the latest Australian labor market data also came out better than expected - instead of rising unemployment to 5.4%, the rate rose to 5.2%; Instead of a decline in the number of employees to -30 thousand, the indicator has grown to almost 6 thousand. But there is one caveat: these figures reflect only the first two weeks of March, while strict quarantine was introduced in the country in the second half of the month before last.

Thus, the Reserve Bank of Australia stated that it had maintained a wait-and-see position and even reduced the volume of bond purchases, while key macro indicators showed a not so strong decline relative to preliminary forecasts. The US dollar remains vulnerable - the latest surge in anti-risk sentiment was short-lived. The combination of these fundamental factors indicates the preservation of the bullish potential of AUD/USD. In the medium term, the pair can be considered long positions with the target of 0.6540 (the upper line of the Bollinger Bands indicator on the daily chart).