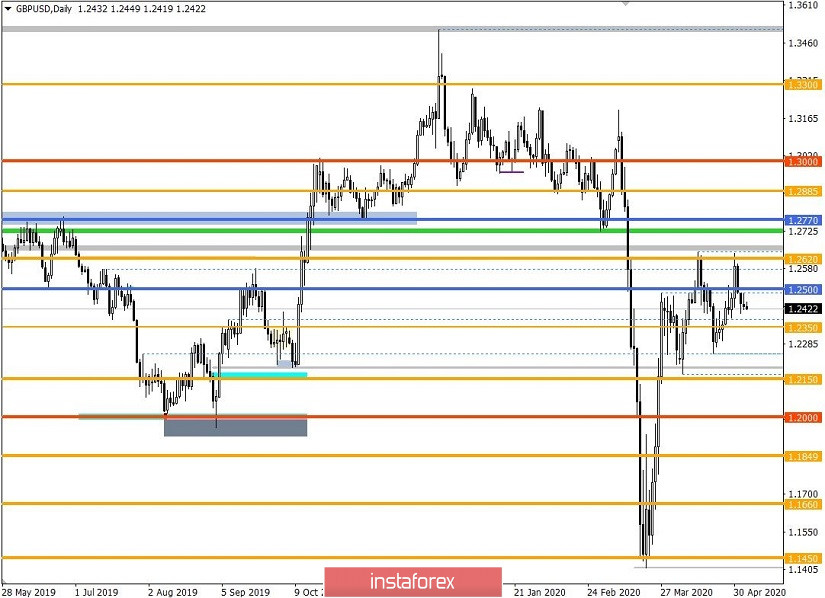

From the point of view of a comprehensive analysis, we see another price return below the level of 1.2500, and now let's talk about the details. The previous days turned out to be impulsive, the upward spiral set still from the point of variable support 1.2246 [April 21] lasted up to the level of 1.2641, that is, we almost touched the local maximum on April 14, but there was a rebound due to the regularity, and it was very strong in speed similar to the initial move.

As it turns out, the upward movement set by the market in mid-March is still relevant, but the graphic model "Head and Shoulders", which was pinned a lot of expectations on that week, was a failure. In all this, I admire the range level of 1.2620, where the interaction of trading forces has an impressive scale, if such surgical precision is performed, with increased speed.

It turns out that there is still a chance for the resumption of downward interest on the basis of this level [1.2620], but at the same time, if the level still falls under the pressure of buyers, then you understand that 100% production of the movement 10.03.20-20.03.20 will not take long.

Analyzing the details on May 4 and 5, you can see that there was an inertial downward move at first that led the quote to 1.2404, but then a stagnation arose, where the quote concentrated on the range of 1.2400 / 1.2480.

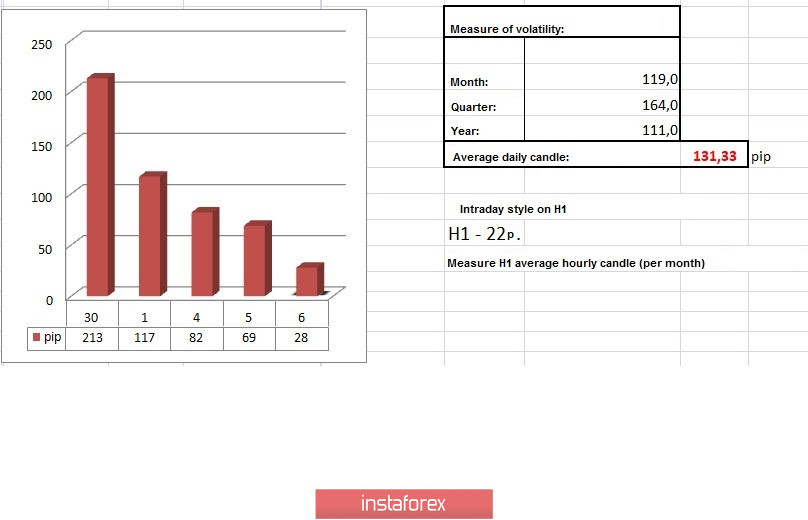

In terms of volatility, the lowest indicator for three weeks is 69 points, which is 47% lower than the average daily indicator. Analyzing the collected data on daily activity, we see a gradual normalization of the overall dynamics, which will definitely go to improve the emotional mood of market participants.

Details of volatility: Monday - 165 points; Tuesday - 245 points; Wednesday - 172 points; Thursday - 358 points; Friday - 359 points; Monday - 144 points; Tuesday - 271 points; Wednesday - 676 points; Thursday - 354 points; Friday - 522 points; Monday - 267 points; Tuesday - 296 points; Wednesday - 333 points; Thursday - 452 points; Friday - 352 points; Monday - 148 points; Tuesday - 227 points; Wednesday - 108 points; Thursday - 126 points; Friday - 198 points; Monday - 116 points; Tuesday - 217 points; Wednesday - 131 points; Thursday - 122 points; Friday - 42 points; Monday - 87 points; Tuesday - 146 points; Wednesday - 193 points; Thursday - 119 points; Friday - 114 points; Monday - 86 points; Tuesday - 198 points; Wednesday - 111 points; Thursday - 106 points; Friday - 78 points; Monday - 94 points; Tuesday - 113 points; Wednesday - 96 points; Thursday - 213 points; Friday - 117 points; Monday - 82 points; Tuesday - 69 points. The average daily indicator relative to the dynamics of volatility is 86 points [see volatility table at the end of the article].

Looking at the trading chart in General terms [daily period], we see an upward spiral lasting six weeks, of which the quote has a closed cycle of fluctuations for five weeks. At the same time, the global downward trend remains unchanged.

The news background of the past day had a business activity index (PMI) in the United States services sector in April, where it recorded a decline from 39.8 to 26.7. Market reaction to statistics was literally absent.

In terms of the general information background, we have colossally high numbers of COVID-19 virus infected in the world, and in particular, Britain came out on top in Europe in the number of deaths.

Lifting quarantine measures is discussed by the heads of state, but everyone understands that one must be extremely careful in actions, since you can catch the second wave of infection, which should not be allowed.

Regarding the Brexit process, we see a literally paralyzed negotiation process due to the virus. Video conferences do not give the desired result, and time remains less and less, and if there is no deal before the end of the year and the transition period is not extended, the basic rules of the WTO will automatically come into force, which neither the UK nor the EU likes.

In turn, the two-week negotiations between the United States and Great Britain regarding bilateral free trade began yesterday, which, according to statements, should pass in an accelerated mode.

"We will negotiate expeditiously and allocate the resources necessary for rapid progress. A free trade agreement will contribute to the long-term health of our economies, which is vital because we are recovering from the problems associated with COVID-19," a joint statement by US Trade Representative Robert Lighthizer and British Foreign Secretary Elizabeth Truss.

Today, in terms of the economic calendar, we have an index of business activity in the construction sector in Britain in April, where they expect a decline from 39.3 to 22.0. In the afternoon, they will publish the ADP report on employment in the United States for April, where it is projected to expect a change for the better 27,000,000 ---> 20,050,000. It is worth considering that this is preliminary data before the Friday publication of the Department of Labor.

Further development

Analyzing the current trading chart, we see price fluctuations all in the same frame of 1.2400 / 1.2480, where activity is reduced. In fact, the quote has a conditionally tighter point of variable support, as a period earlier, that is, there is a similarity with the fluctuation on April 28-29. It turns out that there were no fundamental changes, which means that if the price goes below the level of 1.2400, the price will easily return to the mirror level of 1.2350, and there will be a discussion of downward development again.

It can be assumed that price fluctuations within the range of 1.2400 / 1.2480 will still remain for some time, where the method of breakdown of established boundaries will be considered the best trading tactic.

Based on the above information, we derive trading recommendations:

- Buy positions have already been considered from the level of 1.2480, towards 1.2500

- Sell positions are considered lower than 1.2400, towards 1.2350.

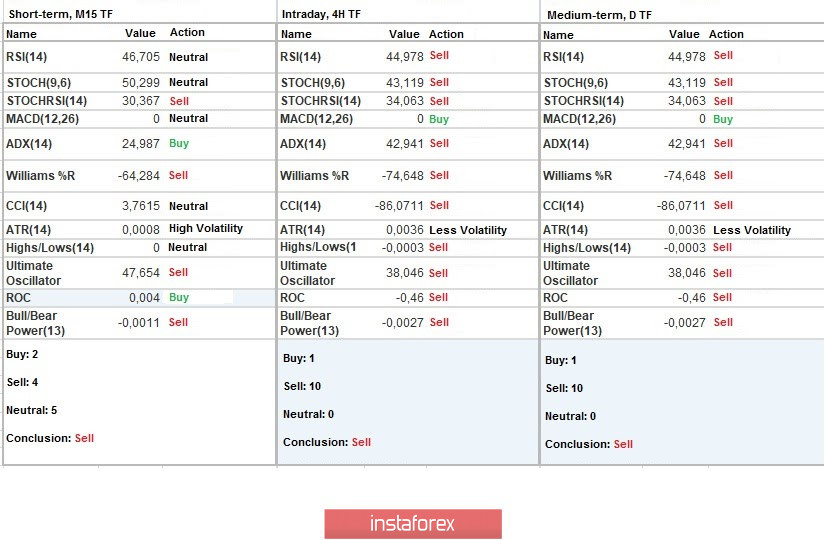

Indicator analysis

Analyzing a different sector of time frames (TF), we see that relative to all time intervals, there is a sell signal due to the available recovery.

Volatility per week / Measurement of volatility: Month; Quarter; Year

Measurement of volatility reflects the average daily fluctuation, calculated for Month / Quarter / Year.

(May 6 was built taking into account the publication time of the article)

The current time volatility is 28 points, which is considered an extremely low indicator even for the start of trading. It can be assumed that the existing slowdown, as well as the weakness of the past day will play into the hands of speculators, eventually having local acceleration.

Key levels

Resistance Zones: 1.2500; 1.2620; 1.2725 *; 1.2770 **; 1.2885 *; 1.3000; 1.3170 **; 1.3300 **; 1.3600; 1.3850; 1.4000 ***; 1.4350 **.

Support areas: 1.2350 **; 1.2250; 1.2150 **; 1.2000 *** (1.1957); 1.1850; 1.1660; 1.1450 (1.1411); 1.1300; 1,1000; 1,0800; 1,0500; 1,0000.

* Periodic level

** Range Level

*** Psychological level

**** The article is built on the principle of conducting a transaction, with daily adjustment