EUR/USD – 1H.

Hello, traders! The EUR/USD pair continued to fall on the hourly chart on May 5. I was able to build a new downward trend line, but since there has not been a single pullback to the top in recent days, this trend line does not support the "bearish" mood of traders. Or at least weak support. Thus, closing the pair's quotes above it will not mean that the mood of traders has changed to "bullish". This will mean that a pullback has started, and already at the peak of this pullback, you can correct the trend line itself. There was no big news again on Tuesday. Moreover, several economic reports did not interest traders too much, and there was nothing else worth noting. Even there was not much news from America, although usually, the information flow from Washington is very strong. However, investigations into China's "guilt" in the coronavirus case are still ongoing, and only when evidence is found will proceedings begin.

EUR/USD – 4H.

On the 4-hour chart, the quotes of the EUR/USD pair secured under the ascending trend line and fell to the corrective level of 23.6% (1.0840). Thus, the fall in quotes can be continued in the direction of 1.0767 - the level of the previous two local lows. If the quotes close below this level, the probability of a further fall with the goal of the Fibo level of 0.0% (1.0638) will increase. No indicator shows any pending divergences on May 6. The last bullish divergence allowed us to count on the growth of the pair, but it was quickly canceled.

EUR/USD – Daily.

On the daily chart, the EUR/USD pair returned to the corrective level of 23.6% (1.0840) and may close below it. Thus, the process of falling quotes can be continued in the direction of the next corrective level of 0.0% (1.0637). The Fibonacci grids on the daily and 4-hour charts are the same. Although the euro/dollar pair twice went beyond the downward trend corridor, it is now trading inside, so the mood of traders is still "bearish".

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair continues to trade near the bottom line of the "narrowing triangle". The rebound of quotes from this line still allows us to count on the growth of quotes in the long term in the direction of the level of 1.1600 (the upper line of the "triangle"). Closing the pair under the "triangle" will work in favor of the US currency and, possibly, a new long fall.

Overview of fundamentals:

On May 5, there was no news in the European Union of economic data, and in the US, the PMI index for the service sector (26.7) and the ISM index for the non-manufacturing sector (41.8) were released. Although the values of both indices are extremely weak, the US dollar continues to grow.

News calendar for the United States and the European Union:

EU - index of business activity in the service sector (10:00 GMT).

EU - change in retail trade volume (11:00 GMT).

EU - economic forecast from the European Commission (11:00 GMT).

US - change in the number of employees from ADP (14:15 GMT).

On May 6, the calendar of economic events in the United States contains a fairly important report on changes in the number of workers in the country. The forecast is minus 20 million. This data can affect the mood of traders. In Europe, several reports will also be released, but they are of lower significance and are unlikely to affect today's trading.

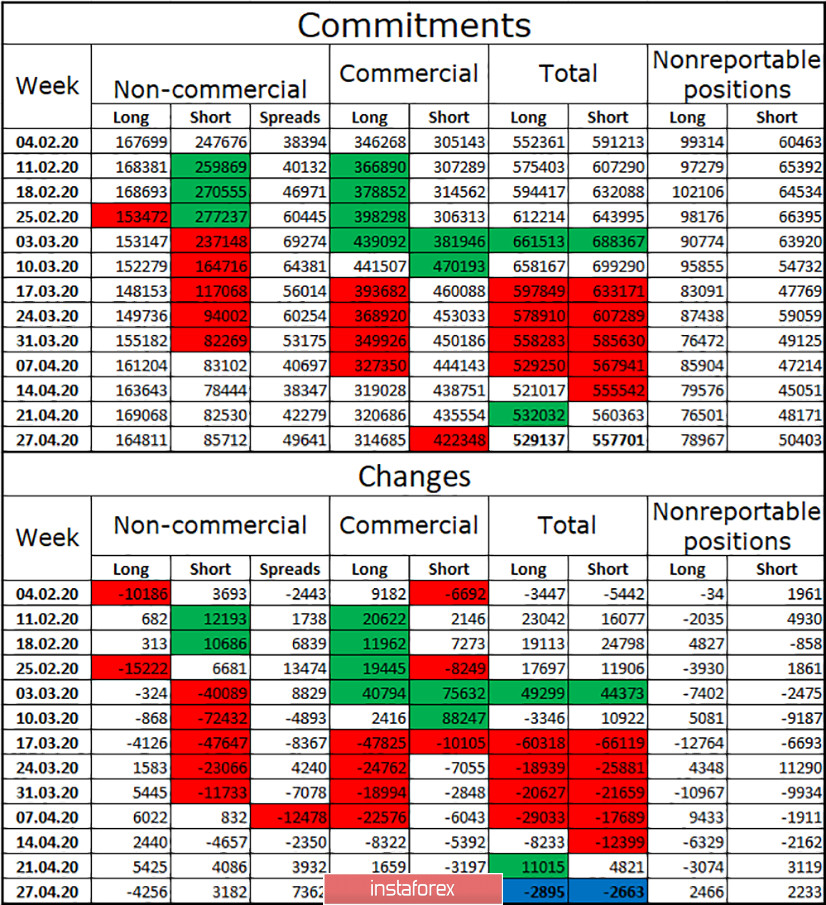

COT (Commitments of Traders) report:

On Friday, a new COT report for the week to April 27 was released. In total, during the reporting week, long contracts lost 2,895, while short contracts lost 2,663. Thus, the losses are almost identical, and the general mood remains the same. As for the "Commercial" and "Non-commercial" groups separately, the first one got rid of long contracts, and the second one got rid of both long and short. Moreover, hedgers closed 13,200 contracts for sale at once, which is a high value. Speculators also got rid of purchases of the euro currency and increased sales. The euro currency fell after these manipulations, but in the second half of last week, it began to grow, which may indicate a new build-up of long-term contracts by speculators. In general, the "Non-commercial" group has twice as many purchase contracts in its hands, which means that the mood among professional market players is bullish in the long term. However, the total number of contracts remains in favor of short - 557,000 against 529,000.

Forecast for EUR/USD and recommendations for traders:

At this time, I recommend selling the euro currency with the goals of 1.0767 and 1.0638, since the closing was performed under the upward trend line on the 4-hour chart. I do not recommend buying the pair yet since there are no sell signals yet.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.