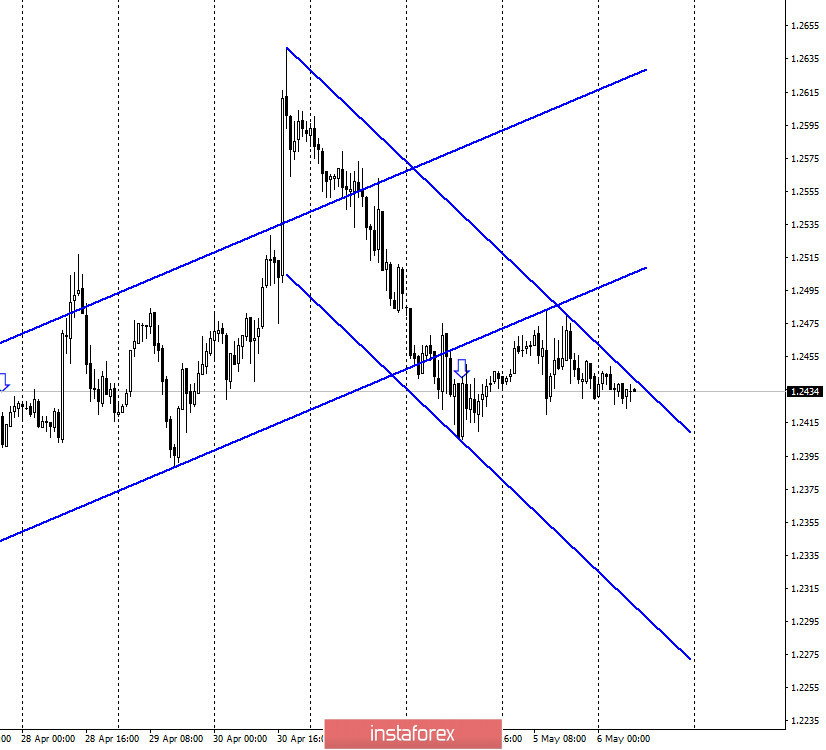

GBP/USD – 1H.

Hello, traders! According to the hourly chart, the GBP/USD pair was trading with a slight upward bias during Monday. Maybe it was a rollback. If so, the price drop may be resumed now. As for the euro currency, I have built a downward trend corridor, which formally supports the "bearish" mood of traders. Nevertheless, the "bearish" mood itself is undeniable. The corridor does not have at least three points that can be considered support points. Meanwhile, in the UK, the information economic background is empty. But there is news about the epidemic, which continues to gain momentum in Britain, while it is slowing down in many European countries. According to the latest official statistics, there are 196,000 cases of infection and more than 32,000 deaths in the UK. Thus, Britain surpassed Italy and Spain on this sad indicator. The authorities are not going to weaken the quarantine yet, as there are no grounds for this. Although there are still claims that the peak of the pandemic has passed the same way as in many EU countries.

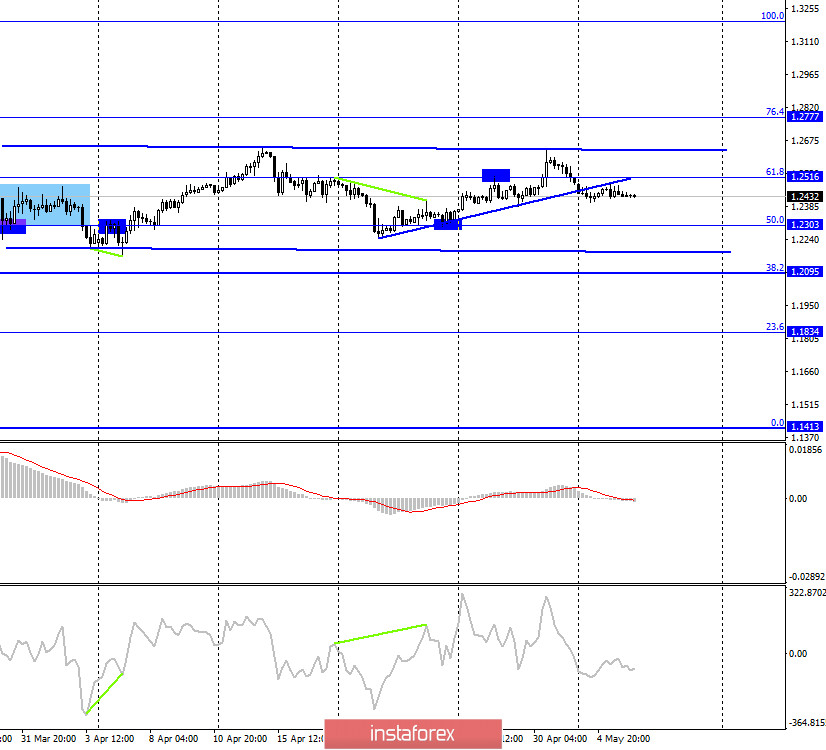

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair made a consolidation under the ascending trend line, so the fall in the English currency quotes can be continued in the direction of the corrective level of 50.0% (1.2303). On this chart, I also built a side corridor that clearly shows the maximum prospects for the fall of the British pound in the near future - this is approximately the level of 1.2190. From it, the rebound can be performed with a reversal in favor of the British and the resumption of growth in quotes. Today, the divergence is not observed in any indicator. Fixing the pair's exchange rate above the Fibo level of 61.8% (1.2516) will work in favor of the US currency and the resumption of the growth. However, it also now has limited prospects due to the corridor of 1.2626.

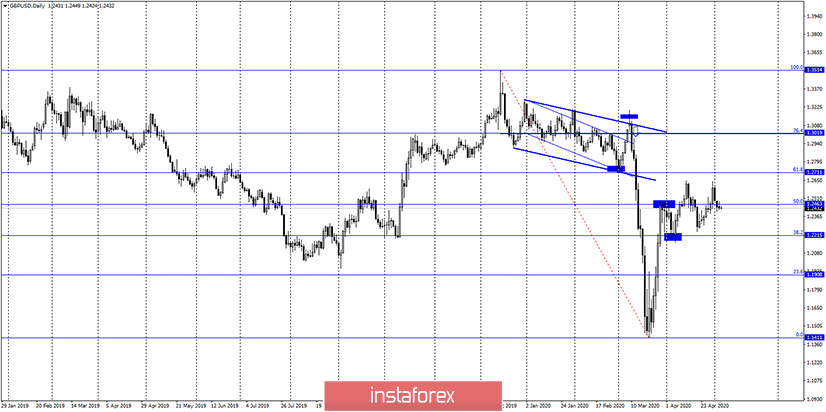

GBP/USD – Daily.

On the daily chart, the pair's quotes performed a reversal in favor of the US currency and secured under the corrective level of 50.0% (1.2463). Thus, three charts at once speak now in favor of continuing the fall of quotes. On the daily chart - in the direction of the Fibo level of 38.2% (1.2215).

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed a false breakdown of the lower trend line. Thus, until the pair's quotes are fixed under this line, there is a high probability of growth in the direction of the top two trend lines, but in the long term.

Overview of fundamentals:

On Tuesday, the UK released the PMI for the services sector with a value of 13.4. In America, data on the business activity was also released, which turned out to be much stronger. Thus, in some ways, the growth of the dollar would be justified, but it was not yesterday.

The economic calendar for the US and the UK:

UK - PMI for the construction sector (10:30 GMT).

US - change in number of employees from ADP (14:15 GMT).

Today, on May 6, the UK will release not too important PMI report for the construction sector, and in the US data on the change in the number of workers in April, which are much more significant. The US currency may be under pressure due to 20 million job losses in April.

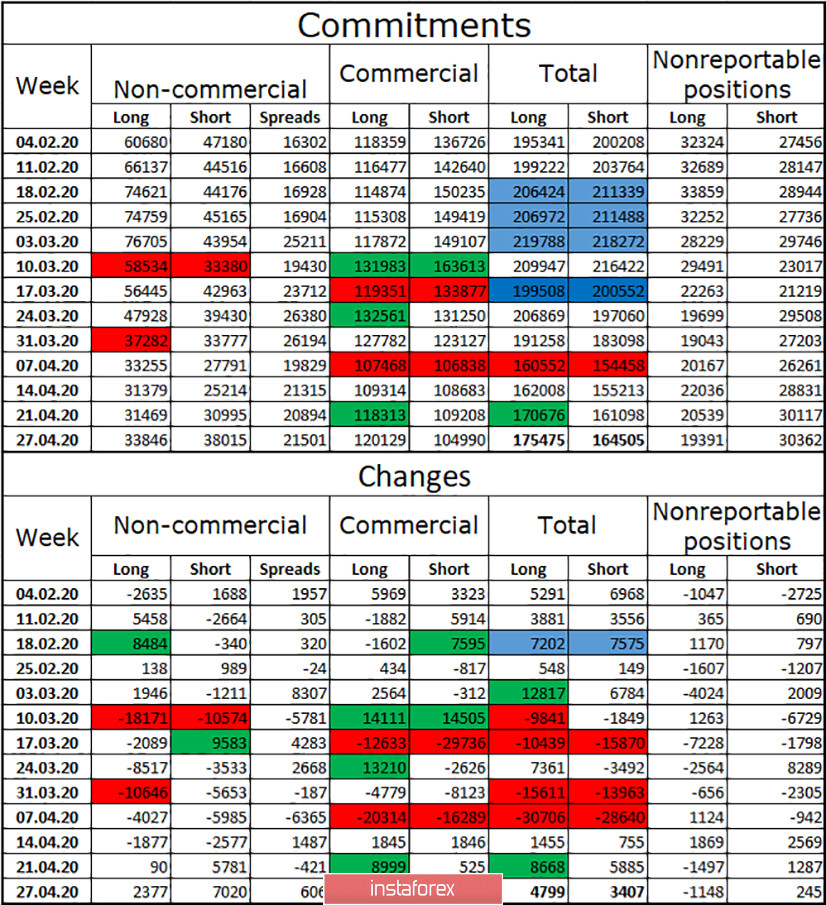

COT (Commitments of Traders) report:

The latest COT report showed that interest in the pound among major market players is starting to grow. The total number of long and short contracts increased during the reporting week. Professional players (speculators) increased both purchases and sales, with first of all contracts for sale (+7020). Hedgers, on the contrary, got rid of short positions. Based on this, we draw the following conclusions. The pound is regaining its appeal in the eyes of major players, but it still remains much lower than that of the euro currency. Speculators are beginning to look in the direction of selling the British, but the total number of contracts remains in favor of long (175,000 against 164,000). Due to low interest among major players in the GBP/USD pair, the trend has been almost absent in recent weeks. In the past two weeks, the "Non-commercial" group has been increasing sales of the pound. Thus, I believe that there is more chance of a new downward trend.

Forecast for GBP/USD and recommendations to traders:

I recommend selling the pound today with targets of 1.2303 and 1.2190, as the closing was performed under the corrective level of 61.8% on the 4-hour chart and under the trend line. New purchases of the pound are not recommended yet, as there are no signals yet.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.