To open long positions on EURUSD, you need:

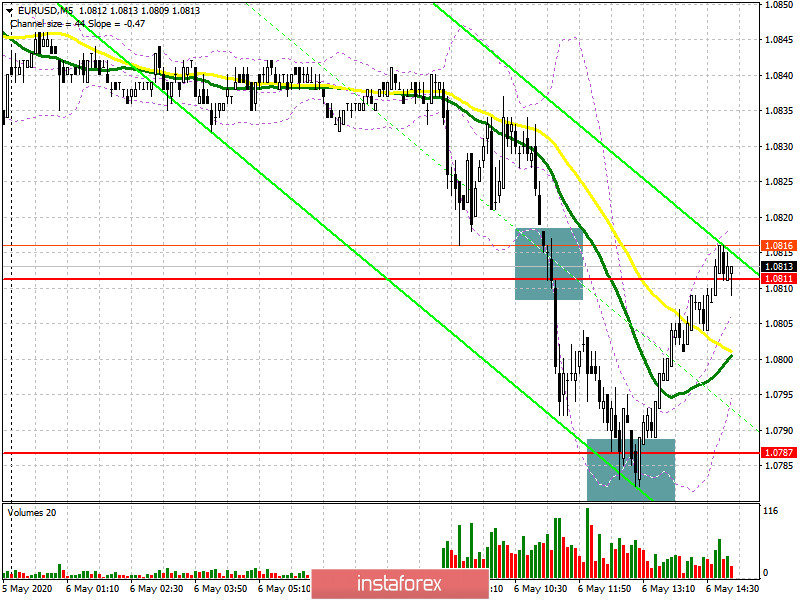

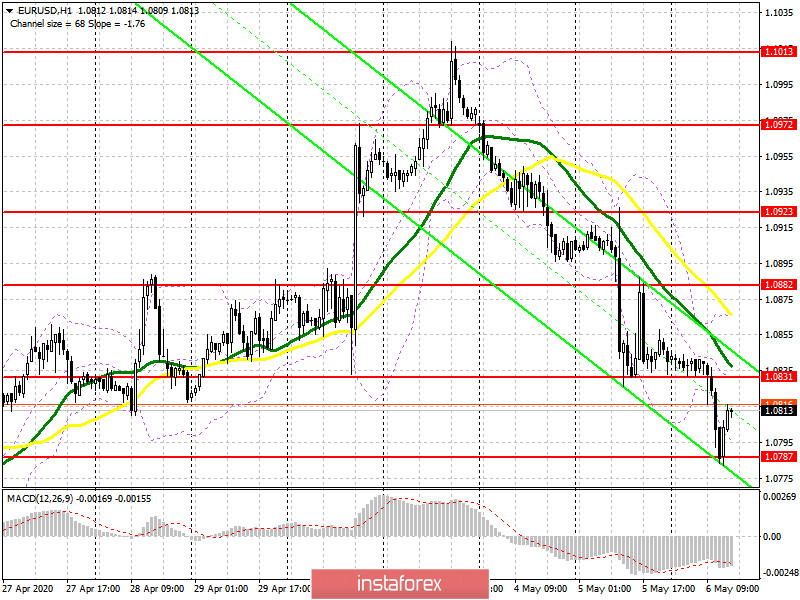

In the morning forecast, I recommended selling the euro below the level of 1.0811, which led to an update of the next support in the area of 1.0787, where I advised opening long positions immediately on the rebound. If you look at the 5-minute chart, you can see how the breakout of 1.0811 led to a major sale of the euro, and the formation of a false breakout at 1.0787 allowed the bulls to take their 30 points from the market after its correction. Weak fundamental data can be considered the main reason for the sale of the euro within the day. The morning reports indicated that the sphere of Eurozone servants continued to decline, as did the overall composite PMI index. While trading is above the support of 1.0787, the bulls will seek to update the resistance of 1.0831, just above which the moving average passes, so I recommend thinking about fixing profits there. It is not quite correct to consider new long ones from a minimum of 1.0787. If the EUR/USD declines further, it is best to buy the pair from the new weekly low of 1.0755 or even lower, for a rebound from the support of 1.0755. Only a consolidation above the resistance of 1.0831 will return the market to bullish momentum, which can last until the test of the maximum of 1.0882.

To open short positions on EURUSD, you need:

Sellers fully control the market and now aim to return the pair to the minimum of the day in the area of 1.0787. Only a repeated test of this level will lead to a new wave of selling EUR/USD with access to new areas of 1.0755 and 1.0728, where I recommend fixing the profits. However, a more pleasant gift for the bears will be an upward correction to the resistance area of 1.0831, which may occur after the release of data from ADP on the number of people employed in the private sector. Only the formation of a false breakout at this level will signal the opening of new short positions in the euro with the goal of breaking 1.0787 and further in the scenario above. If there is no activity on the part of sellers in the area of 1.0831, it is best to abandon short positions until the test of a larger maximum of 1.0882, where you can sell for a rebound in the expectation of correction of 30-35 points within the day.

Indicator signals:

Moving averages

Trading is below the 30 and 50 daily moving averages, which indicates a continuation of the bear market.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In the case of an upward correction, the average border of the indicator in the area of 1.0831 will act as a resistance, and you can sell immediately on a rebound from the upper border in the area of 1.0865.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20