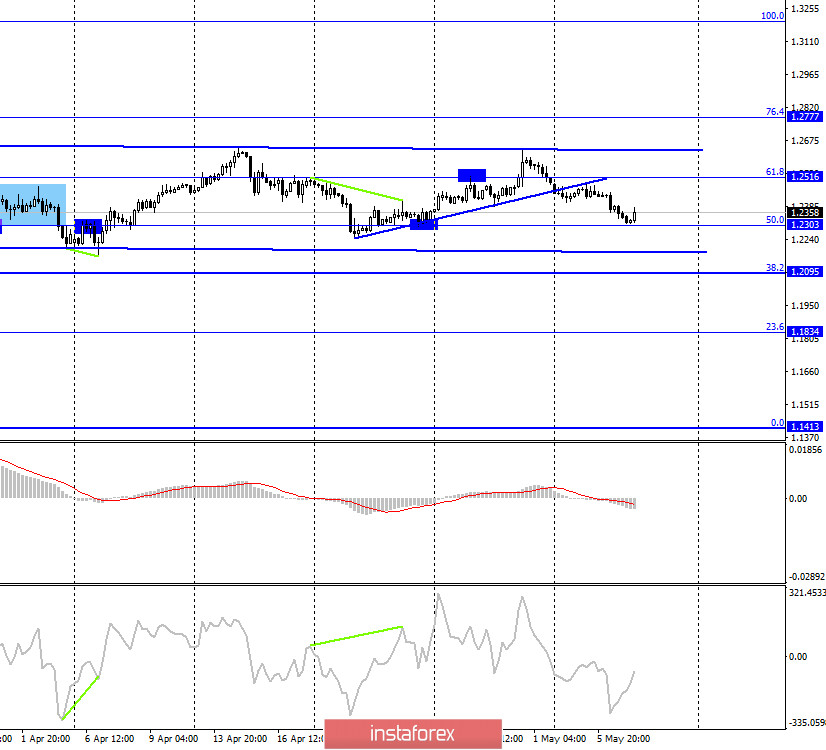

GBP/USD – 1H.

Hello, traders! According to the hourly chart, the GBP/USD pair continued falling on Wednesday, while being strictly inside the downward trend corridor. Only this morning, the pair's quotes performed a reversal in favor of the British dollar and began the growth in the direction of the upper line of the corridor. Closing the pair's exchange rate above this line will work in favor of the British currency once again and allow traders to count on the continued growth of quotes. A meeting of the Bank of England is scheduled for today, summing up its results. And the first data is already known. The Central Bank's key rate remained unchanged at 0.1%, while the planned volume of asset repurchases also remained unchanged at 645 billion. A little later, the minutes of the Bank of England meeting will be released and a press conference will be held with its President, Andrew Bailey, who will clearly tell traders something interesting. The morning growth of the British pound is associated with this event. At the same time, the UK officially ranked first in Europe and second in the world in terms of the number of deaths from coronavirus. However, rumors suggest that the British government is considering easing the quarantine in May.

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair made a consolidation under the ascending trend line and fell to the corrective level of 50.0% (1.2303), which was only a few points short. Thus, there was no formal rebound, which means there was no buy signal. However, the EUR/USD pair continues to move strictly inside the trend side of the corridor. Rebound from its lower border may also work in favor of the British and the beginning of growth in quotes. But at the moment, there is no such signal either. No indicator has any pending divergences on May 7 either. As a result, we have a situation in which the growth of the pair is possible, but there are no buy signals yet. The only hope is for closing above the trend corridor on the hourly chart, which can be considered as a signal.

GBP/USD – Daily.

On the daily chart, the pair's quotes performed a reversal in favor of the US currency and anchored under the corrective level of 50.0% (1.2463), which allows us to count on a fall in the direction of the Fibo level of 38.2% (1.2215). However, this is in the long term. On the two lower charts, growth is possible today.

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed a false break of the lower trend line. Thus, before the pair's quotes are fixed under this line, there is a high probability of growth in the direction of the two upper trend lines, but in the long term.

Overview of fundamentals:

On Wednesday, the UK released PMI for the construction sector with a value of 8.2. In America, we change ADP non-farm employment. Overall, statistics from America were more important and weaker, but the US currency was still growing.

The economic calendar for the US and the UK:

UK - a decision on the main interest rate of the Bank of England (08:00 GMT).

UK - planned volume of asset purchases by the Bank of England (08:00 GMT).

UK - Bank of England monetary policy report (08:00 GMT).

UK - Bank of England Governor Andrew Bailey will deliver a speech (13:30 GMT).

US - number of primary and secondary applications for unemployment benefits (14:30 GMT).

Today, on May 7, the UK has already released data on changes in the monetary policy of the Bank of England. Actually, there were no changes. Thus, traders need to wait for the report on monetary policy and the speech of the President of the Bank of England.

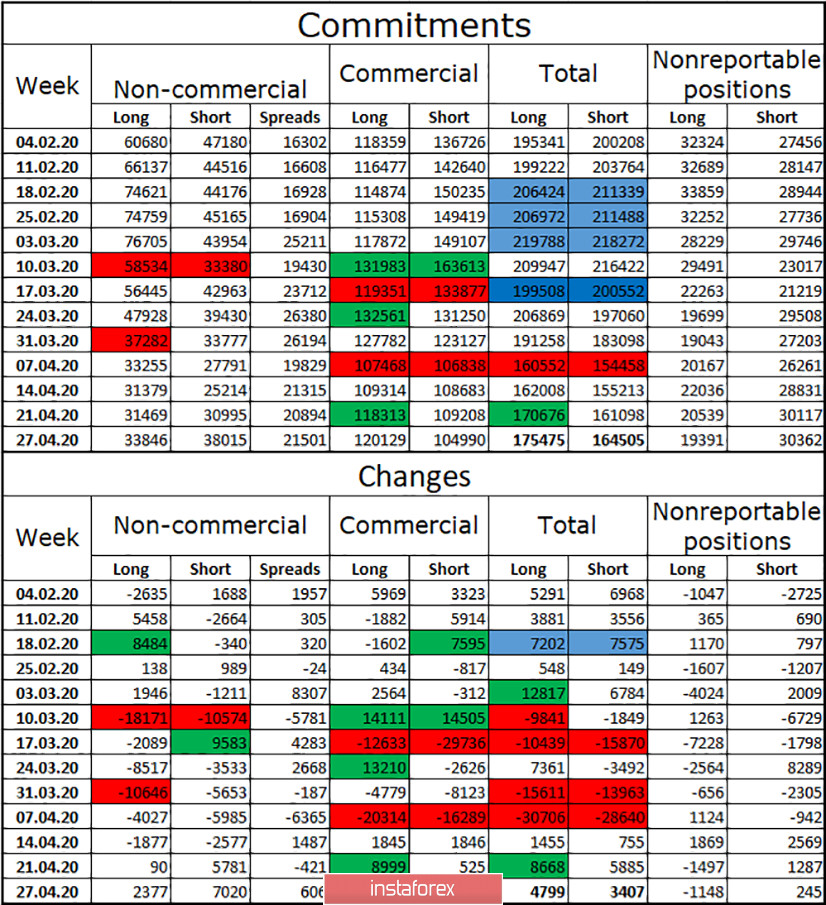

COT (Commitments of Traders) report:

The latest COT report showed that interest in the pound among major market players is starting to grow. The total number of long and short contracts increased during the reporting week. Professional players (speculators) increased both purchases and sales, with contracts for sale (+7020). Hedgers, on the contrary, got rid of short positions. Based on this, we draw the following conclusions. The pound is regaining its appeal in the eyes of major players, but it still remains much lower than that of the euro currency. Speculators are beginning to look in the direction of selling the British, but the total number of contracts remains in favor of long (175,000 against 164,000). Due to low interest among major players in the GBP/USD pair, the trend has been almost absent in recent weeks. In the past two weeks, the "Non-commercial" group has been increasing sales of the pound. Thus, I believe that there is more chance of a new downward trend.

Forecast for GBP/USD and recommendations to traders:

I recommend buying the pound today with targets of 1.2516 and 1.2635 if the hourly chart shows a close above the trend corridor. I do not recommend selling the pound yet, as there are no signals for this now.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.