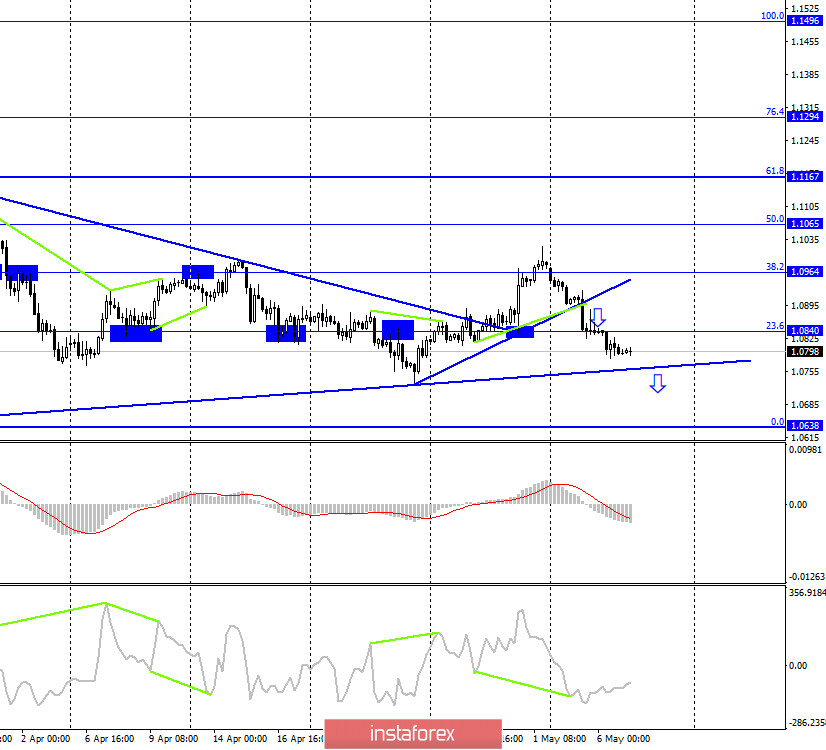

EUR/USD – 1H.

Hello, traders! The EUR/USD pair continued to fall on the hourly chart on May 6. The downward trend line, which I called "formal" yesterday and does not provide real support to bear traders, suddenly turned out to be quite strong. At least, the pair's quotes have never even come close to it. Thus, the "bearish" mood in the market remains. I still can't say that the movement of the euro/dollar pair now depends on the information background. Because the news is equally negative from the United States and the European Union. For example, yesterday the economic forecast from the European Commission was released, according to which the EU economy will decline by more than 7% in 2020. Some countries, like Italy, Spain and Greece, will lose more than 9% of GDP. At the same time, the German court ruled that the ECB, which just conducts programs to stimulate the European economy by buying bonds through the central banks of each country, must explain the legality of direct and disproportionate debt repurchase within three months. According to the legislation of the European Union, such actions may be illegal. As a result, the Bundesbank may withdraw from this program and sell back bonds worth more than 500 billion euros.

EUR/USD – 4H.

On the 4-hour chart, the quotes of the EUR/USD pair made a consolidation under the ascending trend line and under the corrective level of 23.6% (1.0840). Thus, the fall of quotes can be continued in the direction of another upward trend line, which is longer. The pair's rebound from this line will work in favor of the European currency and the beginning of growth in the direction of the Fibo level of 38.2% (1.0964). Closing quotes below the trend line will increase the probability of a further fall in the direction of the next corrective level of 0.0% (1.0638). Today, the divergence is not observed in any indicator.

EUR/USD – Daily.

On the daily chart, the EUR/USD pair made a consolidation under the corrective level of 23.6% (1.0840). Thus, the process of falling quotes can be continued in the direction of the next corrective level of 0.0% (1.0637). Despite the fact that the euro/dollar pair twice went beyond the downward trend corridor, now it is trading inside it, so the mood of traders is still "bearish".

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair continues to trade near the bottom line of the "narrowing triangle". The rebound of quotes from this line still allows us to count on the growth of quotes in the long term in the direction of the level of 1.1600 (the upper line of the "triangle"). Closing the pair under the "triangle" will work in favor of the US currency and a new, possibly long fall.

Overview of fundamentals:

On May 6, the European Union released reports on business activity in the service sector(12.0), as well as on retail trade(-9.2% y/y and -11.2% m/m). In America, the numbers were no better. The ADP report on changes in the number of employees showed a reduction of 20 million employees. Despite the fact that all reports were weak, the US dollar rose again.

News calendar for the United States and the European Union:

US - number of primary and secondary applications for unemployment benefits (14:30 GMT).

EU - ECB President Christine Lagarde will deliver a speech (16:00 GMT).

On May 7, the US economic events calendar contains a report on applications for unemployment benefits, which displays the same essence as yesterday's ADP report. Christine Lagarde, the President of the European Central Bank, will also speak today.

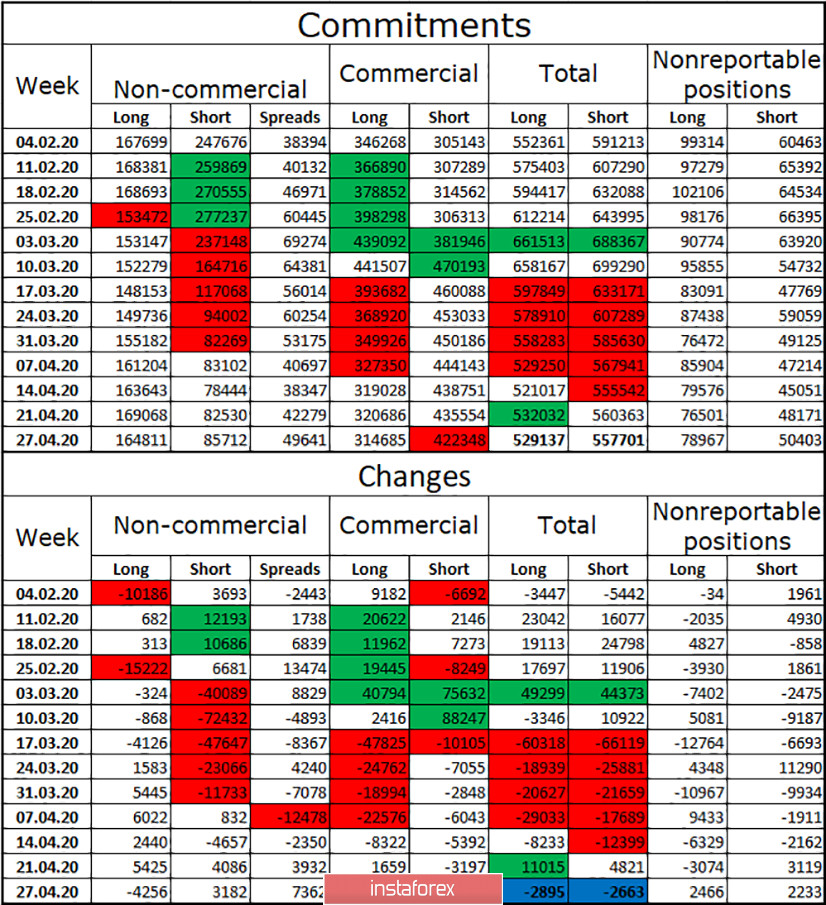

COT (Commitments of Traders) report:

Last Friday, the latest COT report for the week to April 27 was released. In total, during the reporting week, long contracts lost 2,895, while short contracts lost 2,663. Thus, the losses are almost identical, and the general mood remains the same. As for the "Commercial" and "Non-commercial" groups separately, the former got rid of long contracts, and the latter got rid of both long and short. At the same time, hedgers closed 13,200 contracts for sale at once, which is a high value. Speculators also got rid of purchases of the euro currency and increased sales. The euro currency fell after these manipulations, but in the second half of last week, it began to grow, which may indicate a new build-up of long-contracts by speculators. In general, the "Non-commercial" group has twice as many purchase contracts in its hands, which means that the mood among professional market players is bullish in the long term. However, the total number of contracts remains in favor of short - 557,000 against 529,000. During this week, the US currency is growing mainly, so we can assume that speculators continue to get rid of long contracts and increase short.

Forecast for EUR/USD and recommendations to traders:

At this time, I recommend selling the euro currency with the goals of 1.0770 and 1.0638, since the closing was performed under the ascending trend line on the 4-hour chart. I recommend buying the pair if the pair performs a rebound from the upward trend line on the 4-hour chart with the goal of 1.0964.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.