To be honest, yesterday was a good illustration of the fact that in an extreme situation, and what is happening now in the world can not be called anything else, the market mostly ignores minor and insignificant macroeconomic data, even if under ordinary conditions, they seemed somehow incredibly important.

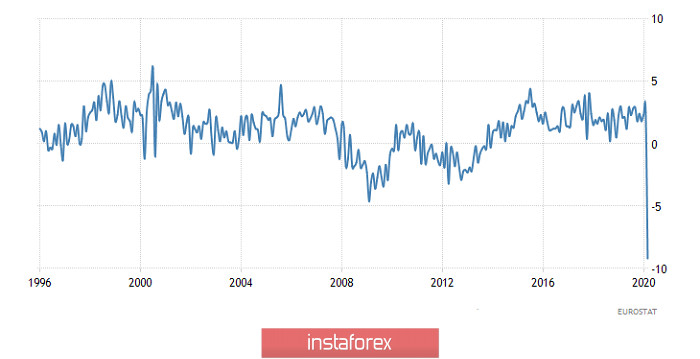

It may seem that at first glance, the single European currency began to decline actively at the time of publishing the final data on business activity indices. However, the data did not differ much from the preliminary assessment, and they turned out to be slightly better. Thus, the index of business activity in the service sector collapsed from 26.4 to 12.0, while a fall to 11.4 was predicted. The composite business activity index collapsed from 29.7 to 13.6. A preliminary assessment showed a collapse of up to 13.2. So, the data in the bottom line is slightly better than predicted, although the overall scale of the reduction is so impressive that the discrepancies between plan and fact are purely symbolic. However, it is worth paying attention to the fact that data on retail sales were published exactly one hour after the business activity indexes. And after their release, the single European currency literally froze in place. That is, the whole movement can be safely attributed precisely to the preparation of the publication of precisely these data, which turned out to be simply terrifying. Indeed, at the end of March, the retail sales decline rate was 9.2%, which turned out to be significantly worse than forecasts that predicted a decrease of 8.4%. And this is only for March. But restrictive measures in connection with the epidemic of coronavirus, in fact, were introduced only in mid-March. That is, for an incomplete month in Europe, the deepest decline in at least the last quarter century has been recorded. And this is a serious reason for the weakening of the single European currency. Moreover, it now becomes obvious that the recession will be even more frightening by the end of April.

Retail Sales (Europe):

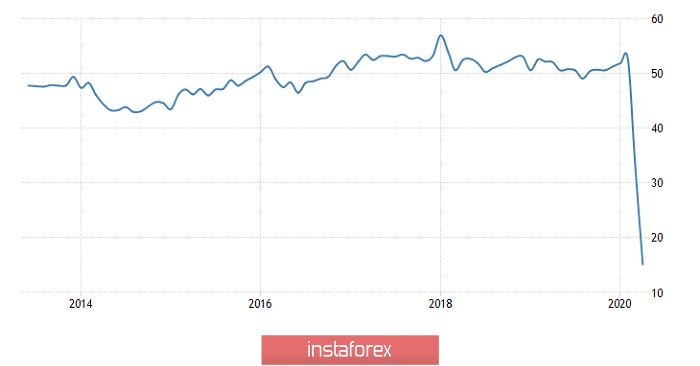

The pound was declining amid only the publication of an index of business activity in the construction sector. Although not even on the decline, but on the collapse from 39.3 to 8.2. Moreover, the preliminary estimate showed a decline to 20.0. The reality turned out to be significantly worse than the forecasts. And in any case, we are talking about the lowest value of the index in the entire history of observations even if the final value coincided with the preliminary estimate. However, the main driving force was not this, but expectations of the outcome of the Bank of England Board meeting, which took place this morning. So we'll talk about it later.

Construction sector business activity index (UK):

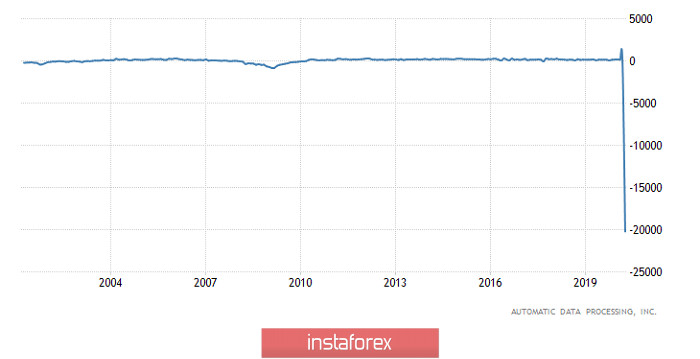

Moreover, in fact, the market ignored ADP employment data, which also turned out to be the worst in the history of publication of this indicator. Employment decreased by 20,236 thousand. This, by the way, is slightly better than the forecast of 20,800 thousand. But also the previous data was reviewed for the worse, and in March, employment decreased not by 27 thousand, but by 149 thousand. However, let's be honest, these data didn't tell us anything new. Rather, on the contrary, they are even slightly embellished, since, based on the data on applications for unemployment benefits, which will be published today, the reality is much worse. Thus, there was no market reaction in particular.

Employment Change from ADP (United States):

Now let's talk about the meeting of the Board of the Bank of England. The reaction to the results of which clearly demonstrates how in the current difficult times the priorities of large investors are changing. An earlier increase in the quantitative easing program would lead to a weakening of the national currency. But now, as soon as the Bank of England announced the expansion of this program by 20 billion pounds, from 625 billion pounds to 645 billion pounds, the market cheered and the pound increased. So investors are greeted by the readiness of the Bank of England to make every effort to save the economy. However, this will obviously not be enough, and soon, one more expansion of the program of quantitative easing should be expected. The fact is that, according to forecasts of the Bank of England, the loss of the banking sector can reach almost 100 billion pounds. So incentive measures will only expand.

Well, the single European currency has shown once again that the significance of business activity indices is currently extremely low. The decrease in the index of business activity in the construction sector from 33.5 to 15.1, which is a historical minimum again was virtually ignored. Rather, we are seeing a slight technical rebound after yesterday's decline or even preparing for today's publication of data on applications for unemployment benefits in the United States.

Construction sector business activity index (Europe):

So, the focus is on applications for unemployment benefits, which should show the further slide of the labor market into the abyss. Yes, the number of initial appeals should be reduced for the fifth week in a row and may amount to only 3,210 thousand. This does not seem serious compared to a record 6,867 thousand. However, do not forget that about 200 thousand initial visits per week are normal. So the Americans continue to lose their jobs all together. But alright, when people just lose their jobs, it becomes scary when they cannot find a new one. And this is precisely what the repeated applications for unemployment benefits reflect, of which as many as 20,450 thousand should be. This is another historic maximum. That is, unemployment is becoming more and more prolonged. In the meantime, the situation on the labor market is not normalizing, It's not worth talking about any economic growth. However, oddly enough, this is what could cause the dollar to grow. Only after the publication of application data last week, did the dollar lose ground. The preceding five weeks had been the exact opposite. So you should not focus on the last week. And the whole point is that investors are well aware that if this is the situation in the United States, then the rest of the world is no better. It's just that the United States is much quicker to publish such statistics. So, the scale of the disaster in other countries so far simply does not have its digital expression. That is, there is a certain uncertainty that also scares the market. Moreover, everyone understands that the restoration of the global economy will sooner or later, but inevitably begin. Moreover, according to many, will initially begin with the United States. So it's better to transfer all the money in advance to where, firstly, there is some understanding of the real state of affairs, and secondly, where the return on these investments will be faster.

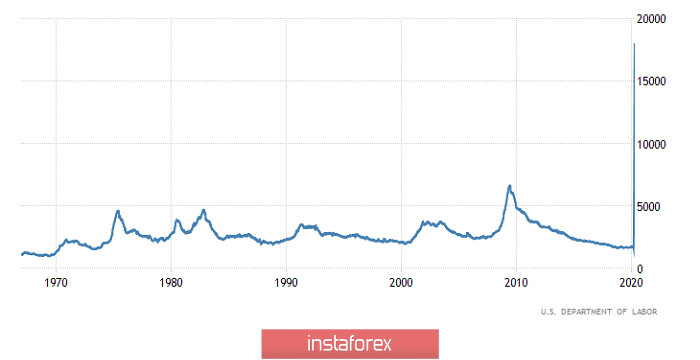

Repeated Unemployment Claims (United States):

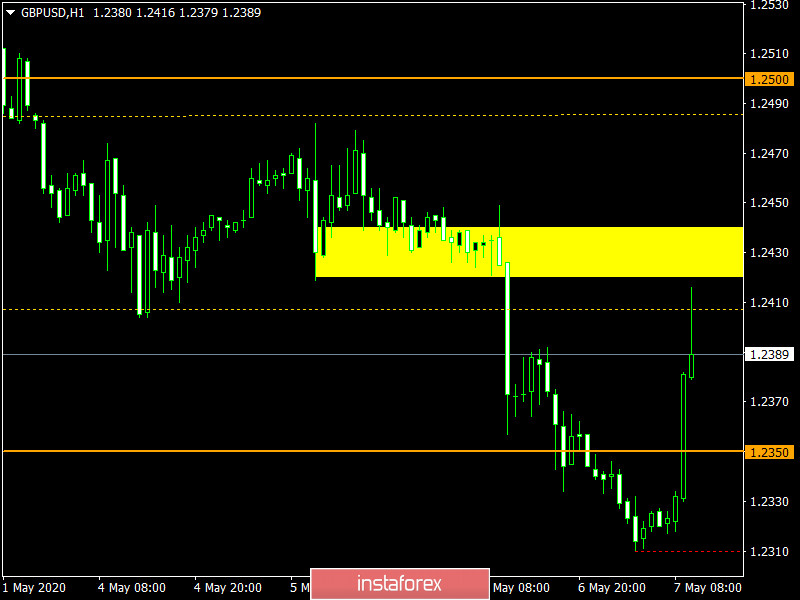

After a three-day decline, the EUR/USD currency pair found a variable support in the area of the support level of 1.0775, where the range of 1.0782/1.0826 was formed. It can be assumed that the fluctuation within the established framework of 1.0782/1.0826 will still persist, where the method of boundary breakdown is considered the best tactic.

In the recovery phase, the GBP/USD currency pair managed to decline to the value of 1.2310, where a slight stagnation of 1.2310/1.2327 was formed and a local upward jump appeared on the background news flow. It can be assumed that the existing fluctuation belongs to the form of short-term ones and it is not worth putting a lot of expectations on it. Thus, the area of 1.2420/1.2440 can already play the role of resistance with the subsequent return of the price to the fulcrum.