Economic calendar (Universal time)

There are few important events in today's economic calendar. In the afternoon, we can only note data on the number of initial applications for unemployment (USA, 12:30).

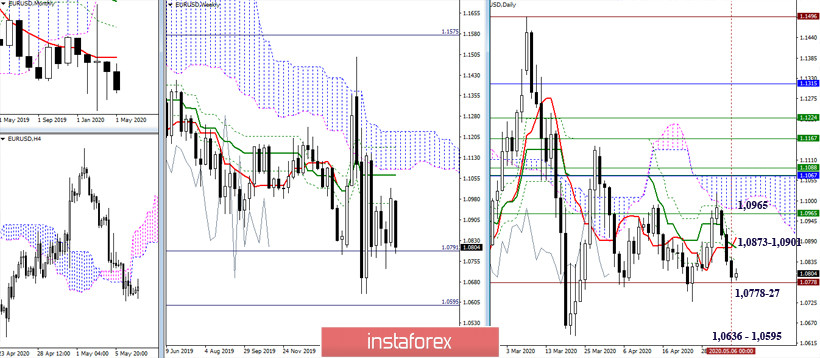

EUR / USD

Yesterday, the pair continued to decline, and so far has descended to the historical support area of 1.0778. The main task of the bears in this situation is to break the level and update the last minimum (1.0727). The implementation of these plans will allow us to talk about the further strengthening of the bears and the emergence of new prospects, such as, for example, restoring the weekly downward trend (1.0636) and 100% working out the weekly target for the breakdown of the cloud (1.0595). The formation of another rebound from the met support can lead again to the fact that the players on the increase will try to restore their positions. The nearest resistance will be the levels of the daily cross, led by Kijun (1.0873) and Tenkan (1.0901), but the weekly Fibo Kijun resistance area (1.0965) will continue to be the most significant.

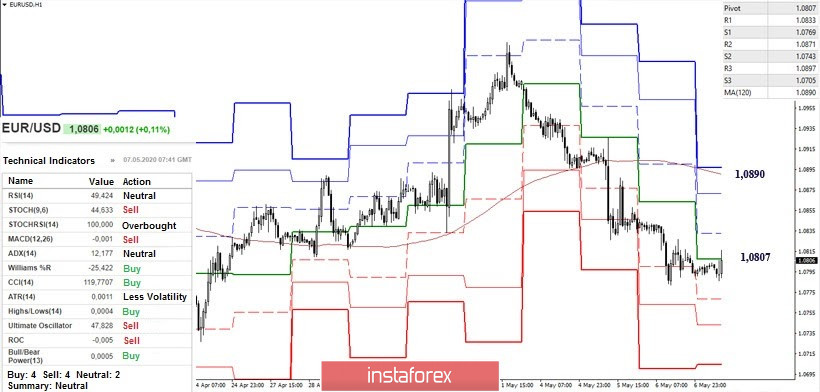

At the moment, on H1, the pair is in the zone of upward correction. The duration of the corrective movement has already led to the fact that neutrality is observed in the camp of the analyzed technical indicators. In addition, players for an increase test the first important level of resistance in the lower halves - the central Pivot level of the day (1.0807). Now, a reliable consolidation above will allow considering recovery to the next key resistance - the weekly long-term trend (1.0890), but since this level is located far enough from the price chart, the nearest resistances R1 (1.0833) and R2 (1.0871 ) may interfere with the performance of the work. If the pair leaves the correction zone and the downward trend is restored, support can be noted today at S1 (1.0769) - S2 (1.0743) - S3 (1.0705).

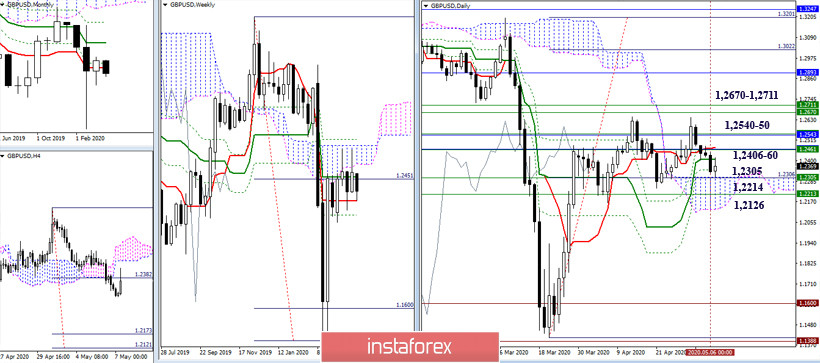

GBP / USD

The pair is currently testing the strength of 1.2305 (weekly Tenkan + daily Senkou Span B). A breakdown of support will allow us to expect testing of the following supports at 1.2214 (weekly Fibo Kijun) and 1.2126 (lower border of the daily cloud). The rebound formation from the encountered supports will return the pair to resistances that retain their value, strength and location - 1.2406-60 (daily Kijun + Tenkan + weekly Kijun + monthly Tenkan) - 1.2540 - 50 (monthly Fibo Kijun + weekly Senkou Span A ) - 1.2670 - 1.2711 (weekly Fibo Kijun + Senkou Span B).

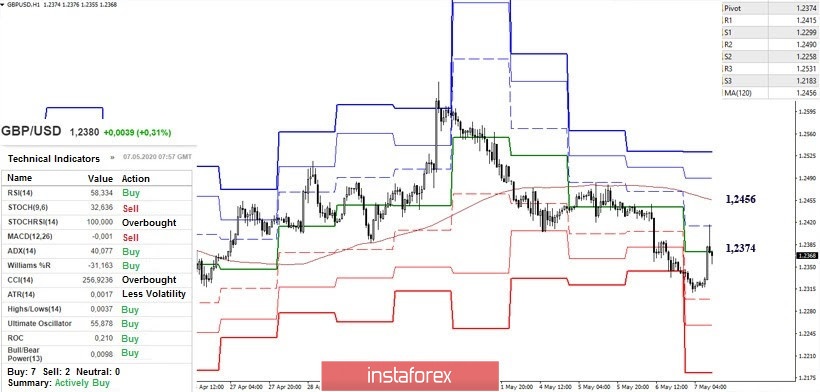

On H1, an upward correction is now developing, which has led to a confrontation for possessing the central Pivot level of the day (1.2374). The next important resistance responsible for the distribution of forces is at the moment of analysis at 1.2456 (weekly long-term trend). A consolidation the above will allow us to consider the possibility of further restoration of positions by players on the rise, which in this case will most likely implement the rebound from the support they met in high times. Meanwhile, the downward trends within the day today are located at 1.2299 (S1) - 1.2258 (S2) - 1.2183 (S3).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)