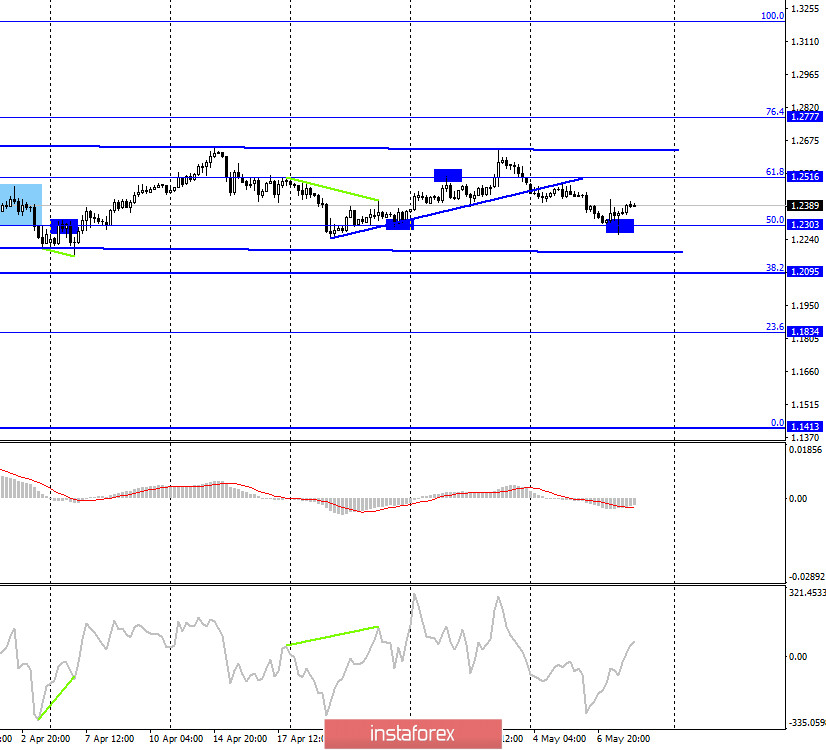

GBP/USD – 1H.

Hello, traders! According to the hourly chart, the GBP/USD pair performed a reversal in favor of the British currency and anchored above the upper line of the downward trend corridor. Thus, for the pound/dollar pair, the mood of traders also changed to "bullish". The information background cannot be said to have contributed much to this change. The growth of the Briton took place in two periods, early in the morning for an hour and in the evening and at night. All the decisions announced by the Bank of England and its President, Andrew Bailey, could hardly cause a zealous desire to buy the pound from traders. All options for monetary policy have remained the same. The only thing is that the Bank of England has hinted at expanding the stimulus program by 100 or 200 billion pounds over the next few months. The Bank of England also noted the strongest economic shock to the UK economy and a drop in economic activity. The Bank of England's forecasts is also disappointing. The Central Bank expects a 14% reduction in GDP in 2020, which is the highest value since 1709. In 2021, the economy is expected to recover by 15% at once.

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair rebounded from the corrective level of 50.0% (1.2303) and turned in favor of the English currency. As a result, the growth began in the direction of the corrective level of 61.8% (1.2516). Today, the divergence is not observed in any indicator. The pair's quotes failed to reach the lower line of the sideways trend corridor yesterday. It is possible that the pair will try to fall to this line again today - 1.2184. Fixing the pair's rate under the corridor will work in favor of the US currency and change the mood of traders on the 4-hour chart from "neutral" to "bearish".

GBP/USD – Daily.

On the daily chart, the pair's quotes performed a reversal in favor of the US currency and anchored under the corrective level of 50.0% (1.2463), which allows us to count on a fall in the direction of the Fibo level of 38.2% (1.2215). However, this is in the long term. On the two lower charts, growth is possible today.

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed a false breakdown of the lower trend line. Thus, until the pair's quotes are fixed under this line, there is a high probability of growth in the direction of the top two trend lines, but in the long term.

Overview of fundamentals:

On Thursday, the results of the Bank of England meeting were summed up in the UK, as I mentioned at the beginning of the article. In America, a report on applications for unemployment benefits was released, which again showed a strong increase in the number of Americans who lost their jobs.

The economic calendar for the US and the UK:

US - unemployment rate (14:30 GMT).

US - change in the number of people employed in the non-agricultural sector (14:30 GMT).

US - change in average hourly earnings (14:30 GMT).

Today, May 8, the news calendar in the UK is empty, and in America, there will be important data on unemployment and Nonfarm Payrolls with very weak forecasts. Thus, in the second half of the day, the US dollar may be under pressure from traders.

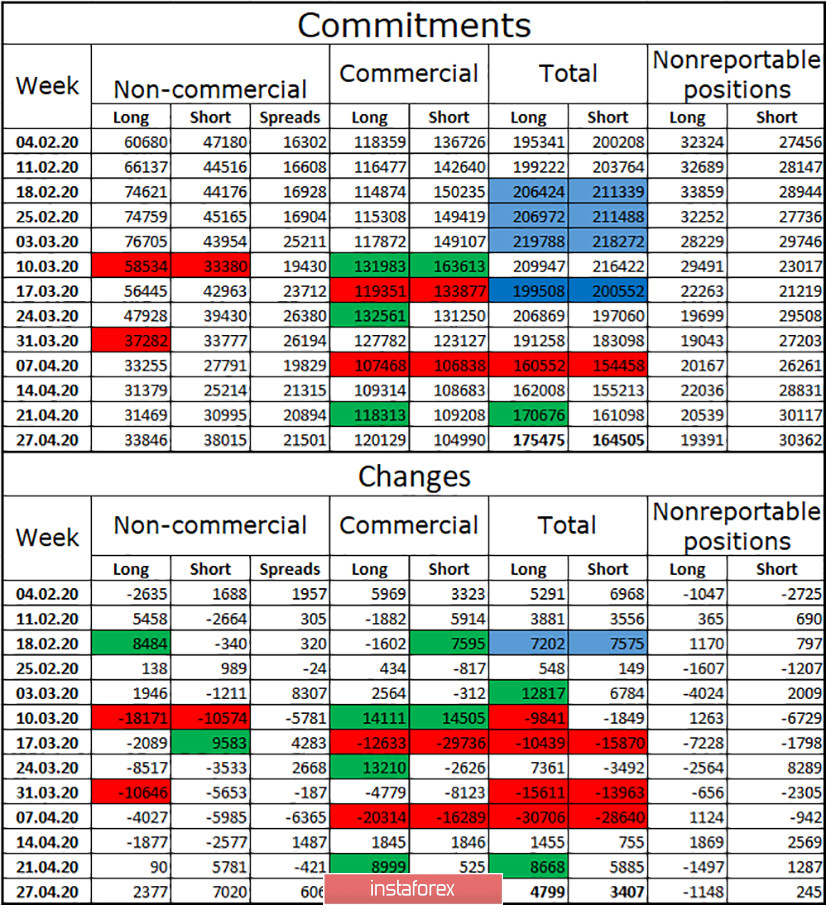

COT (Commitments of Traders) report:

The latest COT report showed that interest in the pound among major players is gradually growing. Judging by the trading this week, I can't say that the activity of major market players has increased. For most of the week, the pound was prone to fall, so the "Non-commercial" group could continue to build up short-contracts, the total number of which, focused on their hands, already exceeds the total number of long-contracts. Thus, the closing of quotes under the side corridor on the 4-hour chart, together with a further increase in the number of contracts for sale from speculators, may be the beginning of a new strong fall in the British pound.

Forecast for GBP/USD and recommendations to traders:

I recommend buying the pound today with a target of 1.2516, as the hourly chart was completed closing above the trend corridor, and on the 4-hour chart - rebound from the level of 50.0%. I do not recommend selling the pound yet, as there are no signals for this now.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.