EUR/USD – 1H.

Hello, traders! The EUR/USD pair performed a reversal in favor of the European currency on the hourly chart on May 7 and started the growth. Thus, the mood of most traders changed during yesterday's day to "bullish". There are no new graphical constructions at the moment because the growth period is too small. The information background on Thursday did not cause any reaction from traders. Most of the news was again reduced to "general" topics, which at this time it is unclear how to respond in principle. For example, the European Union is increasingly receiving alarming reports that the coronavirus pandemic can cause irreparable damage to the economy and even lead to collapse. The main problem is that there is too much difference between the northern and southern countries of the bloc. The former has not suffered too much from the epidemic and has the necessary resources to support their economies, industrial sectors, and small and medium-sized businesses. The latter is not so rich countries and has suffered much more from the pandemic. They demand assistance, which the northern countries refuse to provide.

EUR/USD – 4H.

On the 4-hour chart, the quotes of the EUR/USD pair performed a reversal in favor of the EU currency near the uptrend line, which continues to support bull traders. Thus, the "bearish" prospects are put aside for now. At the moment, the quotes have returned to the corrective level of 23.6% (1.0840). If there is also a reversal in favor of the US currency around it, the chances of consolidation under the trend line will increase. By itself, closing above the Fibo level of 23.6% allows traders to expect some growth in the direction of the corrective level of 38.2% (1.0964). Fixing the pair's rate under the trend line will allow us to expect a further fall in the direction of the Fibo level of 0.0% (1.0638). No indicator has any pending divergences today.

EUR/USD – Daily.

On the daily chart, the EUR/USD pair made a consolidation under the corrective level of 23.6% (1.0840). Thus, the process of falling quotes can be continued in the direction of the next Fibo level of 0.0% (1.0637). Despite the fact that the euro/dollar pair twice went beyond the downward trend corridor, it is now trading inside it, so the mood of traders is still "bearish".

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair continues to trade near the bottom line of the "narrowing triangle". The rebound of quotes from this line still allows us to count on some growth in the long term in the direction of the level of 1.1600 (the upper line of the "triangle"). Closing the pair under the "triangle" will work in favor of the US currency and a new, possibly long fall.

Overview of fundamentals:

On May 7, ECB President Christine Lagarde made a speech in the European Union, during which she did not make any statements regarding monetary policy. In America, a report was released on primary and secondary applications for unemployment benefits, each of which increased by several million more.

News calendar for the United States and the European Union:

EU - ECB President Christine Lagarde will deliver a speech (13:00 GMT).

US - unemployment rate (14:30 GMT).

US - change in the number of people employed in the non-agricultural sector (14:30 GMT).

US - change in average hourly earnings (14:30 GMT).

On May 8, the US will release important reports on Nonfarm Payrolls, wages, and unemployment. Wages in America may grow by a stable three percent, but the other two indicators will collapse and definitely disappoint the dollar bulls. There will be another speech by the ECB President in the EU.

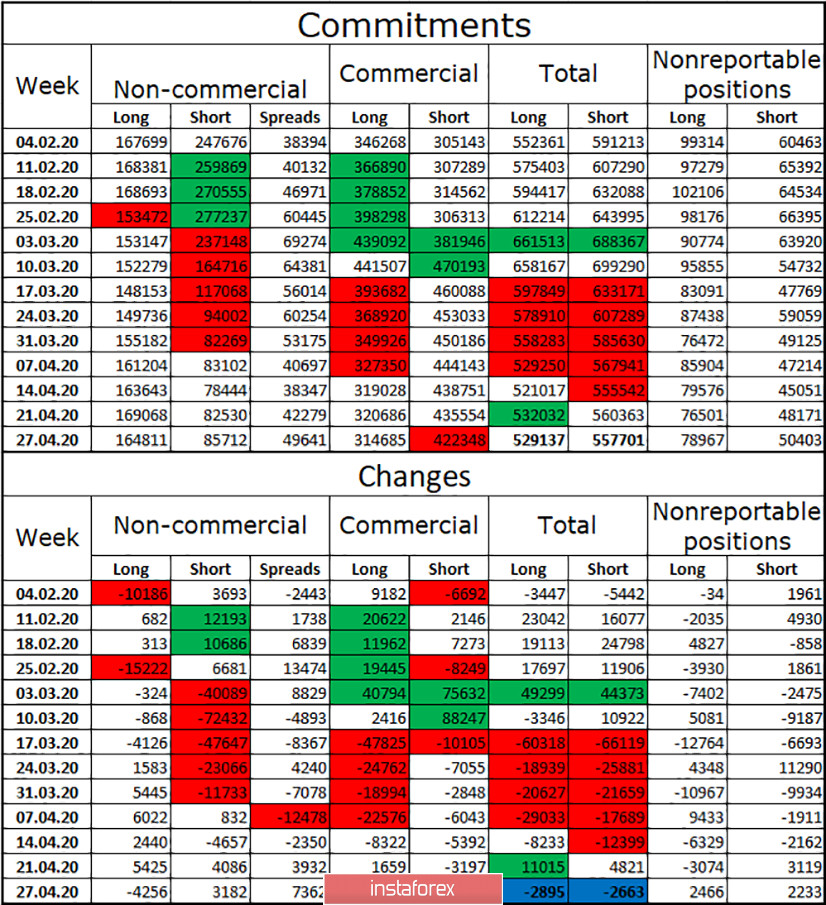

COT (Commitments of Traders) report:

A new COT report will be available this afternoon. According to the latest report, speculators were getting rid of long contracts and increasing short. However, this was a week ago. The total number of sales contracts for the Non-commercial group was still quite high. Thus, this week, speculators had to again reduce contracts for sale and increase contracts for purchase. Then the trend will continue and we can expect a further fall in the euro currency quotes. For most of the week, the pair was in the process of falling, so I believe that professional players continued to look towards sales.

Forecast for EUR/USD and recommendations to traders:

I suggest that new sales of the euro currency be made after the pair closes under the upward trend line on the 4-hour chart with the goal of 1.0638. Certain buy signals are available at this time. You can buy euro currencies with a short stop at 1.0840 and a target of 1.0964.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.