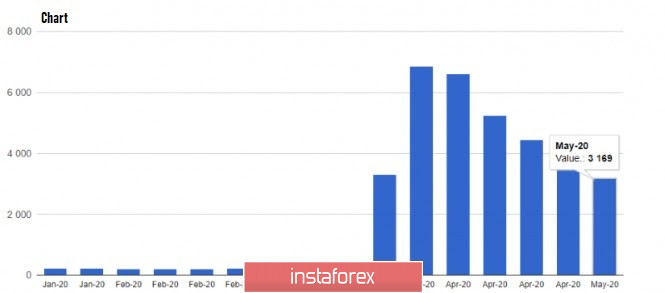

Weak data on the US labor market, which revealed that initial applications for unemployment benefits continued to decline after the surge that occurred during the height of the coronavirus pandemic, increased the demand for risky assets, which rose the euro and the pound against the US dollar . Today, attention will be focused on the NonFarm Employment Change report in the US, where a decrease in the number of jobs by more than 22 million and a surge in the unemployment rate to 16% is expected. However, the data is unlikely to put significant pressure on the markets, since the expected negative indicators are already taken into account in quotes, and changes will occur only if the report is seriously different from the forecasts of economists.

Yesterday, the heads of delegation at the US-China trade talks discussed the possibility of creating favorable conditions for a trade deal between the two countries after the COVID-19 pandemic ends. During a telephone conversation with Vice Premier Liu He, US Trade Representative Robert Lighthizer and US Secretary of Finance Steven Mnuchin agreed to create favorable conditions for the implementation of the first phase of the US-China trade agreement, which was concluded at the end of last year, but never came to its implementation due to the coronavirus outbreak. This infers that US and China do not intend to engage in a direct conflict, which US President Donald Trump has been trying to achieve recently, constantly criticizing China that they are responsible for the spread of the coronavirus.

A telephone conversation between Putin and Trump also took place yesterday, during which the heads of state discussed the situation around the coronavirus pandemic, as well as the situation on the world oil market. The parties agreed that the timely conclusion of the OPEC + deal to reduce production on May 1 of this year already had a practical impact on the stabilization of oil prices. The heads of state also declared the importance of further dialogue and maintaining Russian-American contacts and relations.

Meanwhile, each improvement in the situation of the US market increases the demand for risky assets. A good example of this is yesterday's report on the number of initial applications for unemployment benefits, which, according to the US Department of Labor, over the week from April 26 to May 2, has fallen to 3.2 million. This suggests that the record high number of unemployment applications decreases gradually relative to the decline of the pandemic, which has paralyzed the entire economy.

It is not surprising that the productivity of workers, as well as work time and total production in the US fell sharply in the 1st quarter of this year. According to the report of the US Department of Labor, labor productivity outside of agriculture declined by 2.5% in the 1st quarter, with hourly productivity decreasing by 2.9%, and the number of working hours reducing by 3.8%. Economists expected productivity to drop by 5.5%.

It is not surprising that the productivity of workers, as well as work time and total production in the US fell sharply in the 1st quarter of this year. According to the report of the US Department of Labor, labor productivity outside of agriculture declined by 2.5% in the 1st quarter, with hourly productivity decreasing by 2.9%, and the number of working hours reducing by 3.8%. Economists expected productivity to drop by 5.5%.

As for the technical picture of the EUR / USD pair, volatility should be expected today, due to the release of important reports in the US labor market. Sellers of risky assets will try to tighten the pair at the level of 1.0825, which will lead to the demolition of a number of stop-orders of bulls and a larger sell-off in the region of the 1.0770 and 1.0720 lows. But if buyers turn out to be stronger, the upward correction will continue to the area of the weekly highs at the levels of 1.0890 and 1.0970.

Another important event today is the speech of ECB head Christine Lagarde, which may announce the expansion of the regulator's asset repurchase program. Such decisions will strengthen the position of the euro against the dollar, but if Lagarde does not divulge on it, the market may ignore her statements.

In this regard, recall that just recently, the German Court, although ruling that the quantitative easing program of the ECB does not violate the laws of Germany, announced that the Bundesbank should stop buying government bonds under the ECB program for the next three months. However, it will not be implemented as long as the ECB is able to prove the necessity and usefulness of the program. The decision caused the demand of risky assets to decline earlier this week, which led to a jump in Italian bond yields and a sharp fall of the euro against other currencies. The German court also criticized the decision of the EU court last 2018, when it legalized bond purchases without taking into account all the economic consequences that the program may lead to.

Meanwhile, recent speeches of Fed representatives increased the demand of risky assets, as they uniformly talked about a bright economic outlook.

One of the Fed representatives, Raphael Bostic, said that the actions of the Fed during the crisis (which has apparently ended according to Bostik) were bold and decisive, and if necessary, the regulator will continue to do everything that is required to support the economy. Although the path to economic recovery is extremely uncertain, strong support measures may bring a sharp jump in recovery later, as the market has already improved thanks to the actions of the Fed.

Meanwhile, weak forecasts from Oxford Economics came out yesterday, where general inflation in the US is expected to reach negative territory, which would indicate deflation, the fight against which will take a long time. A temporary basic deflation is expected to be recorded in March, as well as a decline in the PCE index below 0.5%. The duration of a weak inflation will depend on the activity in the private sector.