GBP/USD

Analysis:

The direction of the short-term trend of the British pound is set by the algorithm of the rising wave from March 18. Over the past month and a half, the price has moved sideways in a wide price range. Simplified wave analysis shows that the wave that started on April 30 completes the correction in the main wave. The structure lacks the final section.

Forecast:

Mostly sideways movement is expected over the next day. In the first half of the day, the price is likely to rise to the borders of the resistance zone. At the end of the day, you can expect a change of course and a second decline.

Potential reversal zones

Resistance:

- 1.2400/1.2430

Support:

- 1.2330/1.2300

Recommendations:

Trading the pound on the market today is possible only within the intraday style. When buying, you should take into account the limited potential for recovery. It is more reasonable to reduce the size of the trading lot.

USD/JPY

Analysis:

The algorithm of the rising wave from March 9 sets the features of the movement of the major Japanese yen. The price has been adjusted for the last month and a half. By now, the price has reached the upper limit of the strong potential reversal zone. There are no signals of an early change of course yet.

Forecast:

In the coming sessions, it is expected to complete the downward movement of the price, up to the end of the entire bearish wave. By the end of the day, you can expect the formation of a reversal and the beginning of a price rise. A change in direction may be accompanied by increased volatility.

Potential reversal zones

Resistance:

- 106.80/107.10

Support:

- 106.00/105.70

Recommendations:

Before the appearance of reversal signals, purchases are not recommended. The main focus should be on sales of the instrument.

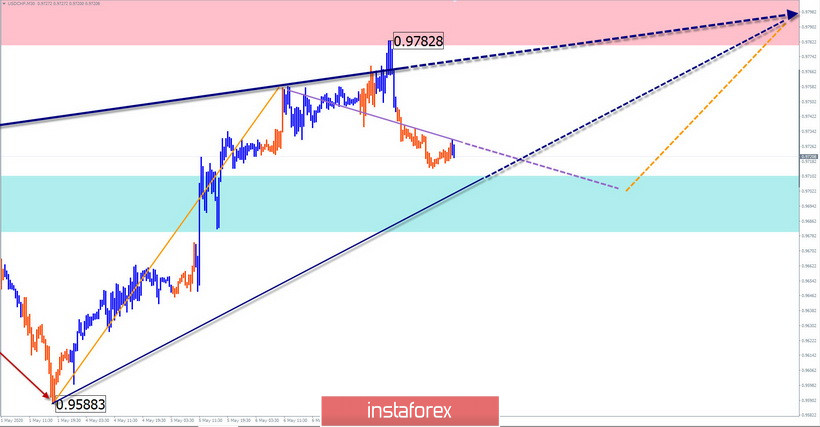

USD/CHF

Analysis:

The direction of the Swiss franc major is set by the upward wave from March 9. In the structure of the wave, the preparation for the final upward leap is completed. The last section of the wave trend started on May 1. Since yesterday, the price forms a correction.

Forecast:

Today, the franc market is expected to complete preparations for a new wave of the trend. The end of the downward movement is likely in the area of calculated support. Then, by the end of the day, you should wait for the formation of a reversal and the beginning of a price rise.

Potential reversal zones

Resistance:

- 0.9780/0.9810

Support:

- 0.9710/0.9680

Recommendations:

Selling the pair today can be risky. It is recommended to refrain from trading until the reversal signals appear. Next, you should focus on finding the points of purchase of the instrument.

Explanation: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of arrows shows the formed structure, and the dotted ones show the expected movements.

Note: The wave algorithm does not take into account the duration of the tool movements in time!