Economic calendar (Universal time)

The focus of today's economic calendar is on US unemployment rates and the number of people employed in the non-agricultural sector (USA). The publication of data is expected at 12:30.

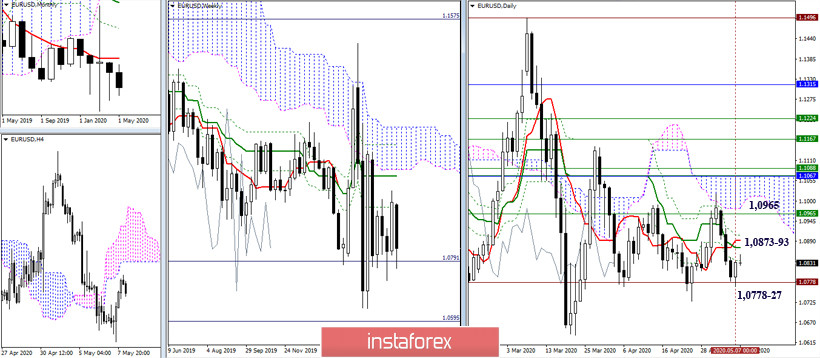

EUR / USD

After reaching the historical support of 1.0778, the pair indicated a slow down once again. Therefore, for the bears in this area, the support zone of 1.0778 - 1.0727 (historical level + minimum extremum) remains significant. For players to increase, it is important to turn the current slow down into a full-fledged upward correction with far-reaching plans. The resistance of the daily Fibo Kijun is currently being tested (1.0839), then the resistances are located in the area of 1.0873-93 (Tenkan + Kijun), but the resistance of the weekly Fibo Kijun will continue to be of primary importance for the further restoration of bull positions and interests (1.0965) and daily cloud.

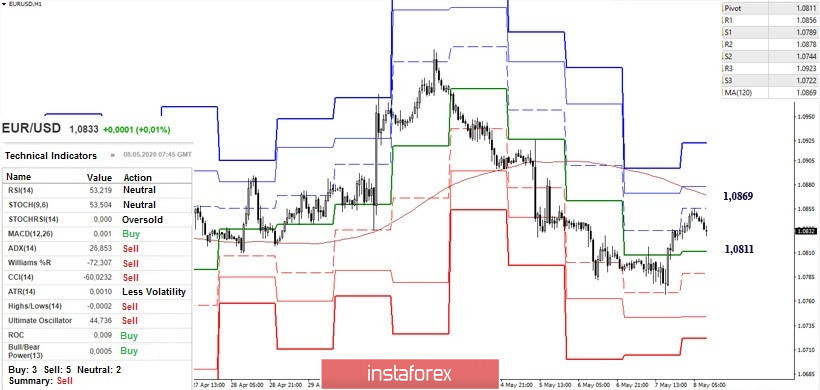

On the other hand, the players to increase still managed to capture the central pivot level of the day yesterday after a long confrontation. This level turned now into a significant support at 1.0811. At the moment, we are seeing a pullback from the resistance R1 (1.0856). In the case of an upward correction, the main benchmark in the lower halves will be focused on breaking through the weekly long-term trend (1.0869).

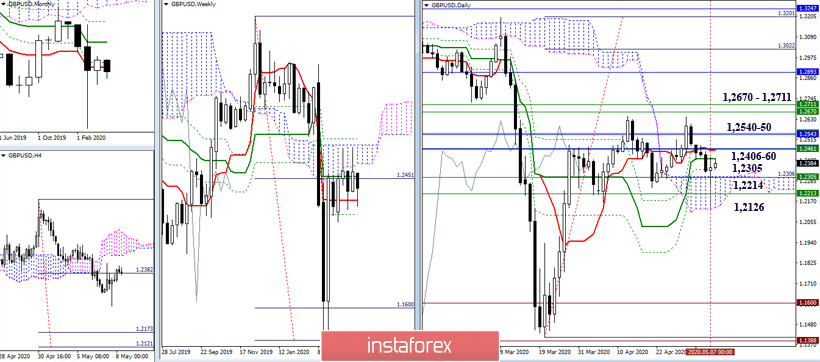

GBP / USD

Returning to the support of the daily cloud, which is currently strengthened by the weekly Tenkan (1.2305), the pair indicated a slowdown. At the same time, the resistance in this situation remains the same - 1.2406 (daily Kijun) - 1.2460 (daily Tenkan + weekly Kijun + monthly Tenkan) - 1.2540-50 (monthly Fibo Kijun + weekly Senkou Span A) - 1.2670 - 1.2711 (weekly Fibo Kijun + Senkou Span B). The nearest support is also still retaining its location of 1.2214 (weekly Fibo Kijun) and 1.2126 (lower boundary of the daily cloud + target for breakdown of the H4 cloud).

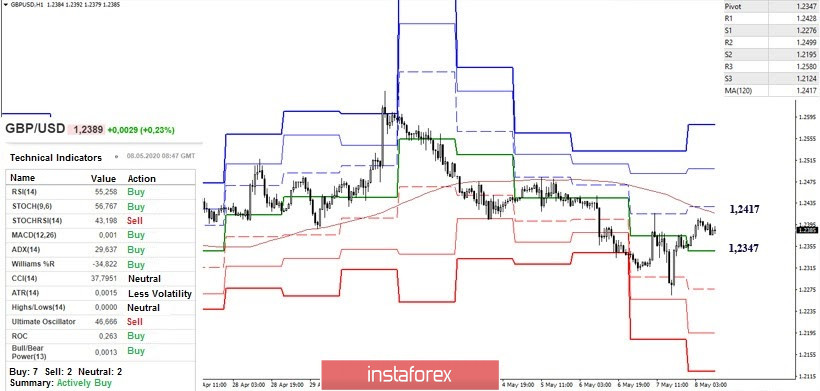

At the time of analysis, the pair at lower time intervals is in the correction zone and is close to testing the main correction target - the weekly long-term trend, which is now at the level of 1.2417. A reliable consolidation above will change the balance in favor of players to increase, opening up new perspectives for them. The following upsides inside the day today may be 1.2499 (R2) and 1.2580 (R3). With the loss of support for the central Pivot level (1.2347), there might be a chance to restore the downward trend. In this case, support within the day will be 1.2276 (S1) - 1.2195 (S2) - 1.2124 (S3).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)