The data on US employment published on Friday, although they were expectedly bad, but if we consider them in terms of absolute numbers, they turned out to be slightly better than extremely negative forecasts. In general, the presented economic statistics no longer clearly concentrates on the market, which focused on three main parameters, which, according to investors, will have a significant impact on the situation.

The first and so far the main event, which is the most influential, is the situation around the coronavirus, the process of gradual exit of economically developed countries from the pandemic. Despite all the fears, real and imaginary around this infection, the countries of Europe, Asia and North America are forced to gradually open their economies in an effort to avoid an economic collapse, which will be even more destructive in its consequences. In this case, the restoration of economic activity will lead to an improvement in the situation on labor markets and in the economies of these countries.

The second factor, which was initiated by D. Trump and is significant in its riskiness, is the aggressive attacks of America and a number of its satellites on China with accusations that it is guilty of not only a pandemic, but also of allegedly hiding it. Now, this topic has somewhat faded into the background, as the American President and his entourage have stopped pedaling it. But it is a fact that it remains the focus of the current administration. It would be a mistake to ignore the possibility that the US will not deploy it again.

Therefore, the dynamics of the markets last week clearly indicate that investors still believe that the global economic crisis caused by the coronavirus pandemic will be V-shaped. We also believe that this probability remains high, but only if two global causes are combined. Firstly, there will be a new global wave of the COVID-19 pandemic against the backdrop of the smooth exit of countries from hard quarantine, and the second is Trump's decision to postpone the resumption of active "military" actions regarding the demonization of China.

Given this probability of developments, as well as a positive attitude in the financial markets, it can be assumed that the US dollar will remain under moderate pressure this week, but so far we do not expect its significant growth against major currencies.

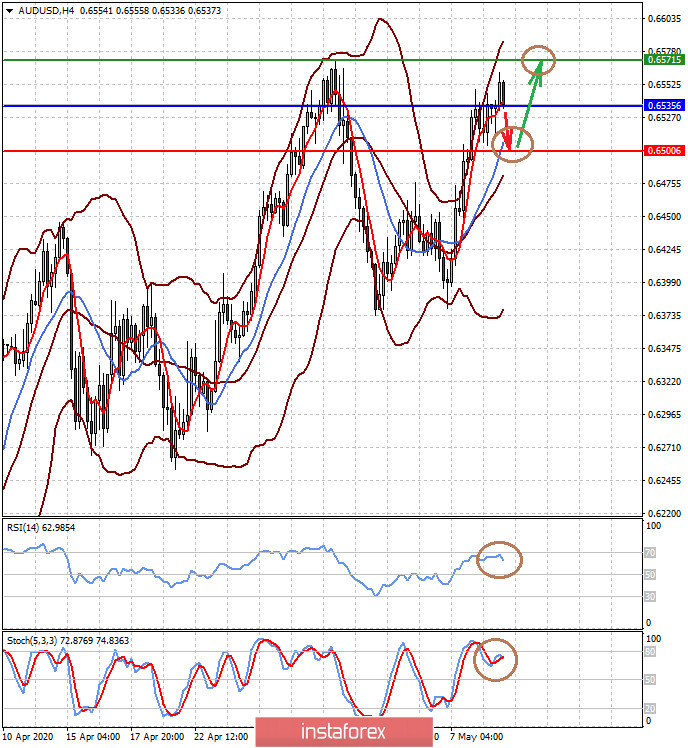

Forecast of the day:

The AUD/USD pair may correct down to the level of 0.6500 before continuing to increase to 0.6570.

The USD/JPY pair broke through the resistance level of 107.00. In case of consolidation above which, it will have the potential for further growth to the level of 108.00. The pair is supported by the demand for risky assets and moderate optimism regarding the global economic recovery amid the weakening impact of the coronavirus pandemic.