Trading of the euro halted ahead of the release of the US inflation data, which can determine the further short-term direction of the EUR/USD pair this week.

Many expect inflation to remain weak in the coming years, even in the event of a strong economic reaction to the coronavirus. Injecting liquidity, which could trigger an inflationary leap, can be adopted, but you need to understand the difference between loans for investments, and loans that will save businesses, pay wages and compensate for lost income. Otherwise, such a record flow of money would lead to a significant spike in inflation, if interest rates were zero.

Data on inflation in the US will be published today, from which it will become clear how close the country is to the deflationary level. A significant drop is expected in the index, the reason of which is the low energy prices, so it is best to pay closer attention to core inflation, where economists do not expect such a significant reduction. If the report is better than economists' forecasts, demand for risky assets, such as the euro and the pound, may increase, but a bullish mood is unlikely to be lasting. On the other hand, if the data turn out to be worse, demand for safe haven assets will increase, and the EUR / USD and GBP / USD pairs will be pushed even further down the trend.

Reasons why the euro will remain under pressure in the medium term:

The discourse between the German and European courts puts pressure on the European currency. Last Friday, the European court stated that it alone had the power to make decisions regarding violations of the rules in the EU institution. This was a response to the decision of the German court the Monday before, when it ruled out that the quantitative easing program of the ECB does not violate the laws of Germany, and said that the purchase of bonds by the ECB do not violate the ban on financing governments through monetary policy. However, the decision also said that the Bundesbank should stop buying government bonds under the ECB program over the next three months, which will be followed unless the European regulator is able to prove the necessity and benefit of its program to the hard-line supporters in the German court.

Such situation exacerbates relations within the ECB, and widens the split in the European Union. The volume of the ECB bond purchase program, as well as its increase, which will most likely happen in the future, will only add to the intensity of the conflict, which could trigger a new cycle of decline in the EUR / USD pair.

Another problem that threatens to put pressure on the euro is the earlier lifting of the quarantine regime in the eurozone countries, which could provoke a re-outbreak of the coronavirus. The probability of such has been repeatedly pointed out by experts in this field, and any signs of a re-outbreak may return restrictive measures as tough as the past, which will further damage the economy.

Industrial production in Italy declined at the fastest pace in its history, due to the quarantine measures introduced to combat the pandemic. Data in Germany and France are also not better.

The data published by Istat revealed that industrial production in Italy decreased by 28.4% in March, much worse than economists' forecast of 17%. Compared to March last year, the decrease in the index was 29.3%. The bigger-than-expected drop was due to the quarantine measures implemented, as well as the low domestic demand caused by the coronavirus. In the index, production of equipment and clothing collapsed by 50%.

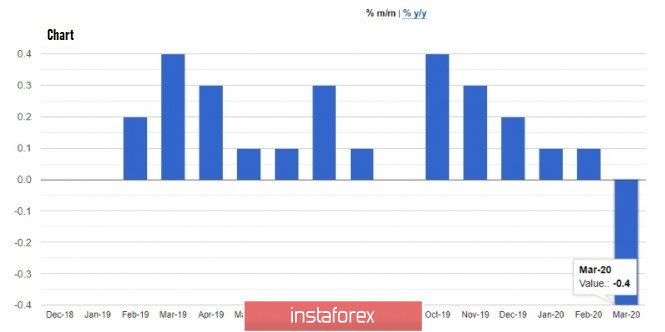

Germany also recorded a 9.2% decline in industrial production, while France recorded 16.2%.

Meanwhile, the data released yesterday on the state of the US economy did not significantly affect the market. According to the report of the Conference Board, the employment trend index turned out to be 43.43 points in April 2020, lower than the March value of 57.87 points. Compared to the same period last year, the index fell by 60.2%. With such data, the main task of the government now is to return people to work, while minimizing the spread of the coronavirus.

US Secretary of Treasury Steven Mnuchin made a speech yesterday discussing the need to support the economy. According to Mnuchin, the federal government should not buy back debts that existed before the virus, the mortgage market in particular, since the Fed lending programs are not designed for this.

The New York Fed also published a survey yesterday, which revealed that households already saw a 20% chance of losing their jobs in 2021, and more than 39% of consumers said that their financial situation worsened compared to last year.

As for the technical picture of the EUR / USD pair, bears continue to achieve a smooth decline to the level of 1.0770, a breakout of which will provide the pair with free access to the lows of 1.0720 and 1.0640. However, if bulls manage to return the quotes to the resistance level at 1.0820 today, a number of stop orders will be knocked down, and a larger upward correction to the highs of 1.0880 and 1.0970 is possible. Much will depend on the US inflation report.

GBP / USD

The British pound continued to decline against the US dollar amid a lack of guidance on when isolation measures will be relaxed, as the UK government's three-step plan raises concerns among market participants. This Sunday, British Prime Minister Boris Johnson presented a plan to gradually lift restrictions, but it does not contain specific rules for social distance, which could lead to a new outbreak of the pandemic. The pound also remains under pressure amid the absence of any prospects related to the resumption of trade negotiations between the UK and the European Union.

As for the technical picture of the GBP / USD pair, bears are facing a problem in the form of the support level of 1.2280, a breakout of which will descend the pair to the area of the 1.2200 and 1.2160 lows, from which the 20th figure is located below. For a more powerful bullish momentum, buyers need to return the quotes to the resistance level of 1.2360, the result of which will lead to a correction to the area of highs at 1.2360 and 1.2560.