Cases of new, repeated coronavirus infections in Asia have raised the topic of a high probability of a second wave of pandemic. Against this background, investors' attention has again shifted partly to defensive assets and from currencies to the US dollar.

After stock markets recovered about half of the March losses amid hopes for an early relaxation of quarantine measures, May began with a correction, and the reason for which was explained by investors. On the one hand, with the risks of the second wave of the pandemic and, on the other, with the growing confrontation between the US and China due to the accusation on the part of D. Trump who said that China was responsible for not only the occurrence of COVID-19, but also its distribution around the world.

In the wake of these events, the US dollar received support, and its ICE index, which reflects the dynamics of a basket of major currencies, is above the key mark of 100 points again. In connection with the emerging market sentiment, the question arises: what should be expected in the short-term?

We believe that this dynamics will be most likely temporary, since governments in some Asian countries, as well as in Europe have announced restrictions again after releasing the reins of the quarantine, which, of course, will affect the spread of this infection, reducing its impact. The main negativity for the demand for risky assets and the incentive for the weakening of the US currency will be the easing of pressure from COVID-19. However, if this pandemic is quite active, then fading, then increasing again, countries will face the most difficult and simply unsolvable problem of the normal existence of society and economy. This state of Affairs will be even more devastating than the collapse of economic activity and financial markets in the first quarter of this year.

As for the likely behavior of the currency market this week, it can be assumed that the main currencies will consolidate in the ranges in anticipation of new, clearer signals about the risk of the second wave of the coronavirus pandemic.

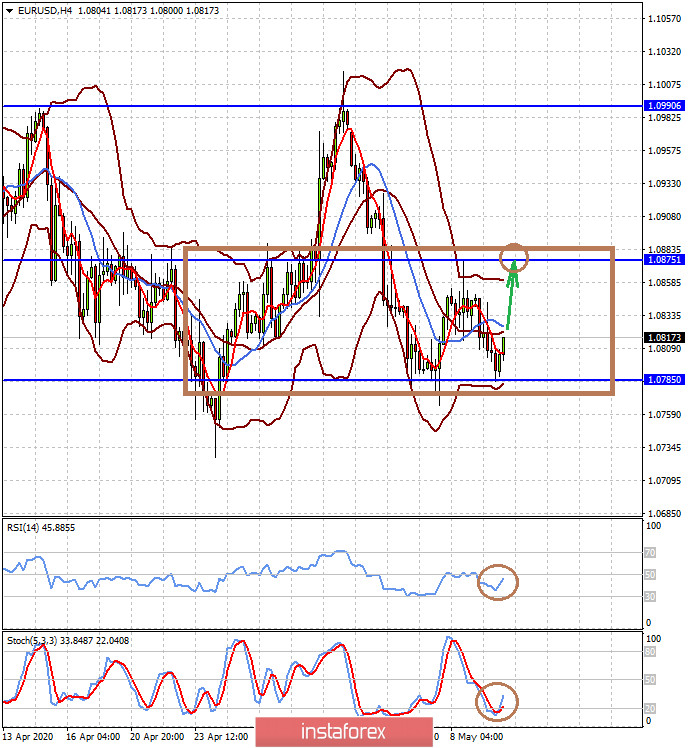

Forecast of the day:

The EUR/USD pair is consolidating in the side range 107.85-1.0875. We believe that it will remain in it today, growing up to its upper boundary.

The AUD/USD pair is also consolidating in the range of 0.6375-0.6570. The news that China has reduced meat purchases in Australia is putting pressure on the local currency, which, combined with a decline in demand for risky assets, is putting pressure on it. A price drop below the level of 0.6440 will also lead to its local decline to 0.6375.