A negative report on inflation from China stopped the positive growth on Tuesday morning, according to which, prices rose in April by 3.3%, which turned out to be worse than the forecast of 3.7%. The demand for risk that has dominated the markets in the last two weeks may end today.

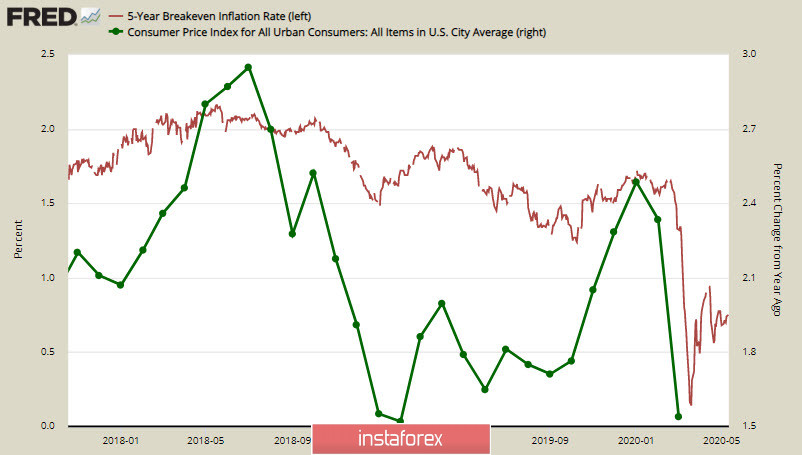

The US inflation report for April will be the main event of Tuesday and judging by the dynamics of Tips bonds, it should not be expected to fail, which will ultimately support the dollar.

In the coming days, the US dollar will be the market's favorite, and there is likely to be renewed demand for protective assets.

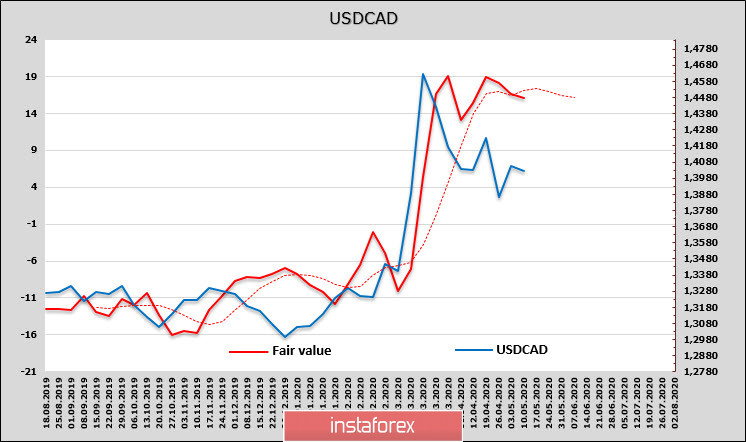

USD/CAD

The April employment report for Canada was just as ignored by the market as the similar report in the USA. It seems that the players proceed from the assumption that since the crisis came from the arrival of the coronavirus, the economy will recover as quickly as possible after the virus leaves, as it fell during the pandemic.

Meanwhile, unemployment in Canada rose to 13% (expected 18%), and 1.994 million jobs were lost, which in percentage terms roughly corresponds to a fall in jobs in the United States. But it can be recalled that there were losses of 1 million jobs in March, then the Canadian economy lost 3 million in a total of 2 months, which is already noticeably worse than in the United States. It should also be noted that about 2.5 million people worked less than half of their usual time, which against the backdrop of 30 million residents in the country looks absolutely disastrous. The economy was essentially supposed to stop almost completely, but exchange rate fluctuations are so small that they leave no doubt about the artificial smoothing by the Central Banks through the system of currency swaps.

The CFTC report is not in favor of the Canadian currency, the worsening short position has increased, but the negativity is canceled out by a general increase in demand for risk due to a gradual exit from restrictive measures and stopping the fall in oil prices.

According to a combination of factors, the estimated price level is higher than the current one, but the dynamics is weak, and the most likely scenario for the next few days is to continue trading in the range. If the demand for risk persists, we can expect a decline to the support of 1.3900 and further to 1.3850, but an exit from the range is unlikely. Rather, a new wave of sell-offs should be expected in the future of two days, which will lead to an increase in demand for protective assets, and the loonie will go to 1.4170 and indicate an intention to test resistance.

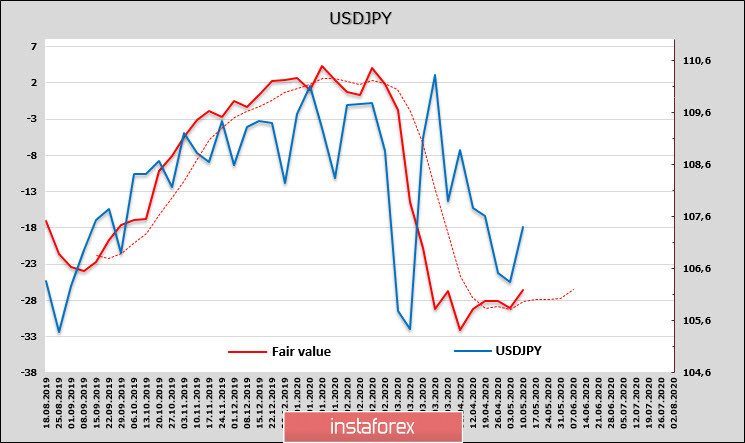

USD/JPY

The Bank of Japan has published forecasts for economic growth and inflation. In the 5-page document, COVID-19 was mentioned 16 times, almost more often than the words "money" or "economy", which leads us to conclude that the culprit in the fact that the Japanese economy is slowing down, despite everything being done efforts have been found, and this is not an economic crisis, but a virus, which will be responsible for everything in the end.

In addition, BoJ predicts that the situation will remain difficult even after the end of the influence of the virus on the global economy, demand will recover for a long time, inflation will be very low and will go to negative territory until fiscal year 2021. As a result, it is necessary that the Bank continues to increase monetary pressure, new measures are needed to maintain liquidity, since the situation may suddenly worsen at any time. Purchases of Japanese government bonds and treasury discount accounts will increase as it is necessary to keep interest rates at a minimum due to a sharp deterioration in the balance sheets of financial institutions.

The expansion of liquidity will lower demand for the yen and will contribute to its weakening. According to the CFTC report, the long position on the yen declined by 0.589 billion. This is the strongest decline among all the currencies recorded in the report, the estimated fair level of USD/JPY began to increase.

As expected, the yen went below support 106.30 / 40, but the chances of a further decline significantly declined. A downward pullback is possible from the resistance zone 107.90/108.10, but a minimum update is unlikely. It is more likely to move to the side range and try to break through the resistance 107.90/108.10 amid growing demand for risk.