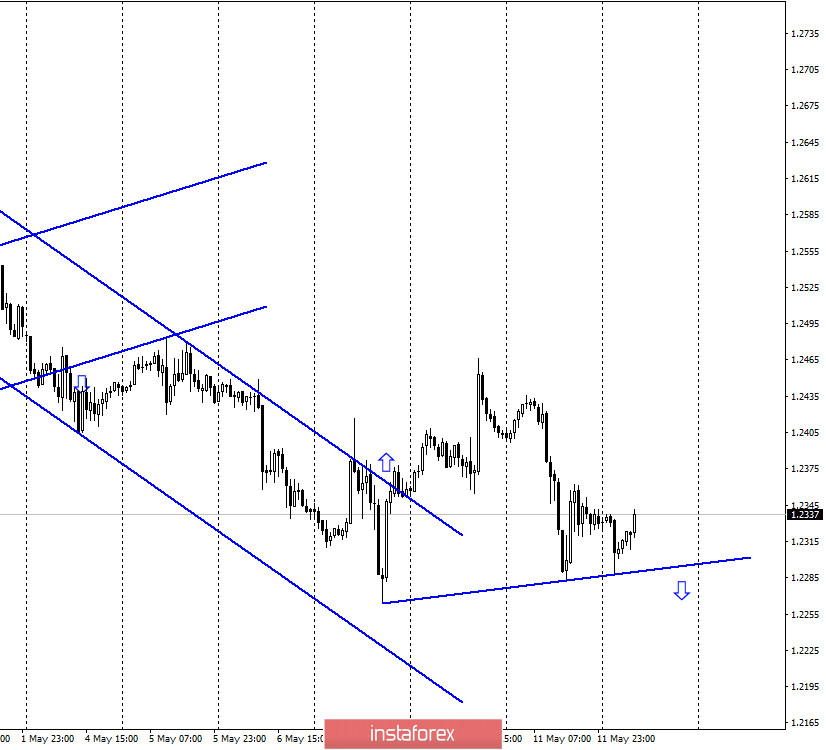

GBP/USD – 1H.

Hello, traders! According to the hourly chart, the GBP/USD pair performed a fall to the minimum of May 7 but failed to consolidate below it. Thus, this gave me the opportunity to build an upward trend line, which now supports bull traders and characterizes the current mood as "bullish". As a result, I believe that growth can continue today. In the UK, meanwhile, there is almost no news. All the economic reports that have been released recently showed a strong drop, which, however, is not surprising in the context of the global pandemic crisis. Since May 13, Boris Johnson has been weakening the quarantine in the country, for which he immediately came under a barrage of criticism, as the UK continues to remain at the top of the list of European countries most affected by the coronavirus. According to the latest data, only Spain has the highest number of cases of infection in Europe. However, in the coming days, the UK may get ahead of it, and new questions will arise for Boris Johnson and his government. How did it happen that a country that was one of the last to start an epidemic came out on top in terms of the number of deaths and infections?

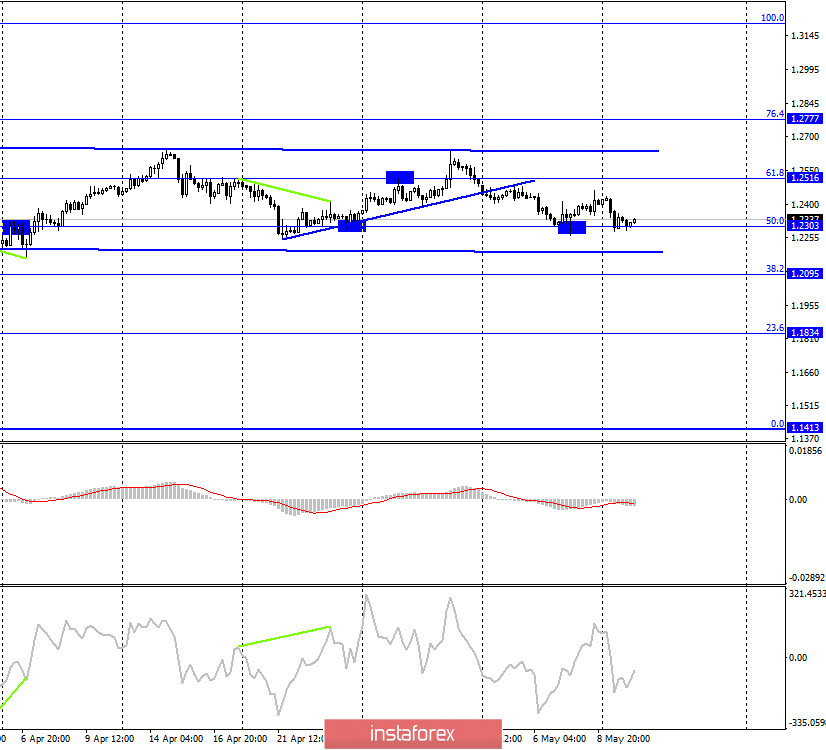

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair performed a reversal in favor of the US dollar and returned to the corrective level of 50.0% (1.2303). A new rebound from this Fibo level will again work in favor of the British currency and begin to grow in the direction of the corrective level of 61.8% (1.2516). Today, the divergence is not observed in any indicator. Fixing the pair's quotes below the level of 50.0% will increase the probability of a further fall, but only to the lower line of the sideways trend corridor. Fixing the pair's rate under the corridor will significantly increase the pair's chances of a new and strong drop in quotes.

GBP/USD – Daily.

On the daily chart, the pair's quotes performed a reversal in favor of the US currency and anchored under the corrective level of 50.0% (1.2463), which allows us to count on a fall in the direction of the Fibo level of 38.2% (1.2215). However, this is in the long term. The new growth of quotes is expected on the two lower charts.

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed a false breakdown of the lower trend line. Thus, until the pair's quotes are fixed under this line, there is a high probability of growth in the direction of the top two trend lines, but in the long term.

Overview of fundamentals:

On Monday, there were no important economic reports in the UK, and the same was true in the US. Thus, there was no information background, which did not prevent traders from actively buying the US dollar in the afternoon.

News calendar for the US and UK:

US - consumer price index (14:30 GMT).

On May 12, the US will release a report on inflation for April, which may sharply decrease compared to the previous month, and in the UK today, the news calendar is empty.

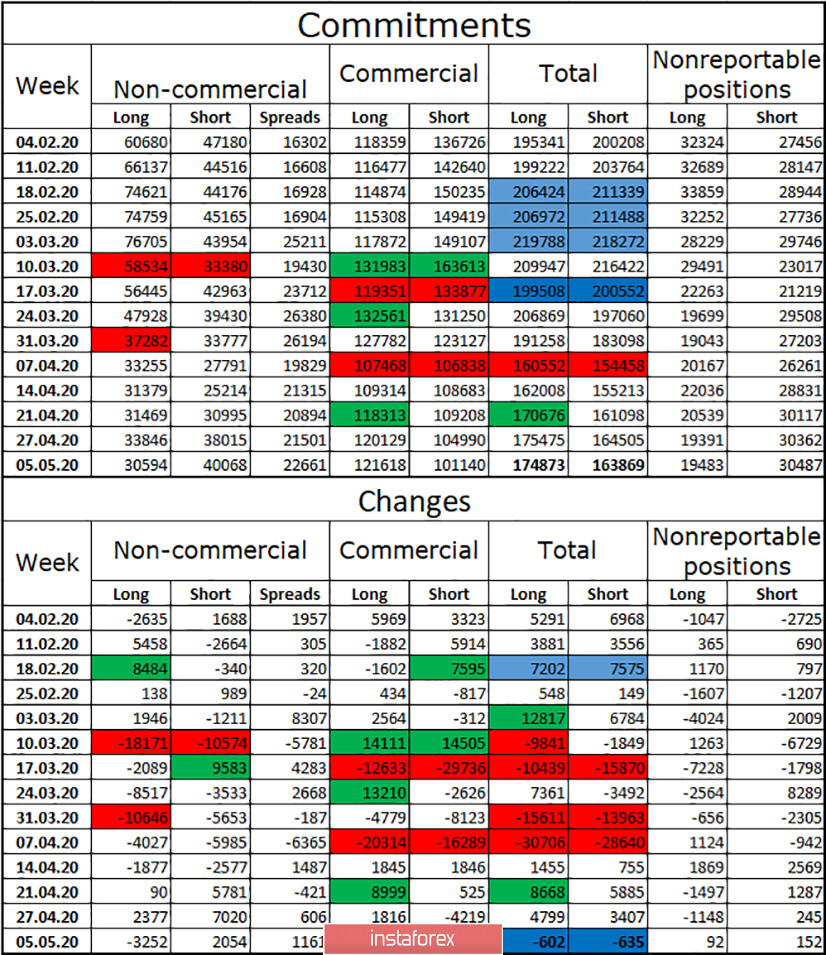

COT (Commitments of Traders) report:

On Friday, a new COT report for the week of May 5 was released. According to this report, professional market players were getting rid of long contracts (-3,252) and increasing short (+2,054). However, in general, all changes in the number of contracts in all groups of traders are minimal. Major players continue to dislike the pound with their attention. The "Commercial" group was mainly engaged in reducing short contracts, and in general, during the reporting week, both types of contracts lost only 600 units, that is, almost equal and at the same time the minimum number. The overall advantage remains with buyers, but it is also absolutely very weak. The total number of contracts in the hands of professional traders does not exceed 100,000. For comparison, in euros - almost 300,000. Thus, the "neutral" mood of traders and not too active trades correspond to the nature of the COT report.

Forecast for GBP/USD and recommendations to traders:

I recommend buying the pound today with a target of 1.2516 since a rebound from the ascending trend line was made on the hourly chart, but I also recommend waiting for the rebound on the 4-hour from the level of 50.0% (1.2303). I do not recommend selling the pound yet, as there are no signals for this now.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial"- commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.