EUR/USD – 1H.

Hello, traders! The EUR/USD pair continued to fall on the hourly chart on May 11, after a reversal was performed in favor of the US currency earlier. Thus, despite the consolidation of quotes above the downward trend line, the quotes of the euro/dollar pair can resume the process of falling. However, I recommend using older charts to determine the possible resumption of a downward trend. There are no new graphical constructions on the current chart yet. Meanwhile, a conflict between the European Commission and Germany is brewing in the European Union. A week earlier, the German Constitutional Court ruled that the European Central Bank had no right to implement a program of asset repurchase from the open market through the Bundesbank, as this is contrary to German laws. The court ordered the German Central Bank to stop any bond-buying. At the same time, the ECB, represented by Christine Lagarde, said that it obeys the verdicts of the European Court of Justice only, and not the German one, and the President of the European Commission, Ursula von der Leyen, said that "this issue is severe", and fines and sanctions can be applied to Germany. Whether this is true or not, we will find out in the near future, but now Berlin and Brussels may start to conflict, which does not add to the optimism of buyers of the euro currency.

EUR/USD – 4H.

On the 4-hour chart, the quotes of the EUR/USD pair again performed a reversal in favor of the US dollar and began a new process of falling in the direction of the upward trend line, from which at least three rebounds were performed. Thus, today or tomorrow, the fourth rebound may be performed, which will again work in favor of the EU currency and some growth in the direction of the corrective level of 38.2% (1.0964). However, each subsequent rebound leads to a smaller pullback of quotes up. Thus, I am inclined to believe that the trend line will not stand. Fixing the pair's exchange rate under this line will work in favor of the US dollar and further fall in the direction of the corrective level of 0.0% (1.0638).

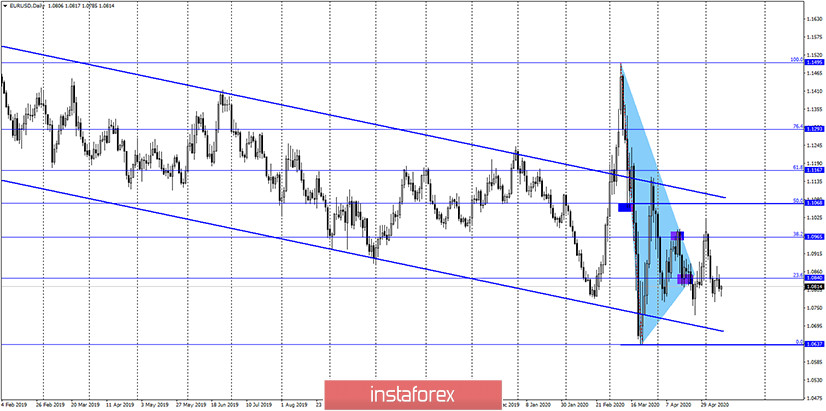

EUR/USD – Daily.

On the daily chart, the EUR/USD pair made a consolidation under the corrective level of 23.6% (1.0840). Thus, the fall can be continued in the direction of the next Fibo level of 0.0% (1.0637). The mood of traders in global terms is characterized as "bearish" due to the downward trend corridor.

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair continues to trade near the bottom line of the "narrowing triangle". The rebound of quotes from this line still allows us to count on some growth in the long term in the direction of the level of 1.1600 (the upper line of the "triangle"). Closing the pair under the "triangle" will work in favor of the US currency and a new, possibly long fall.

Overview of fundamentals:

On May 11, the European Union and America did not publish a single economic report. Thus, there was no background information.

News calendar for the United States and the European Union:

US - consumer price index (14:30 GMT).

On May 12, the US will release a report on inflation for April, which may decrease sharply compared to May, and no reports are expected from the European Union.

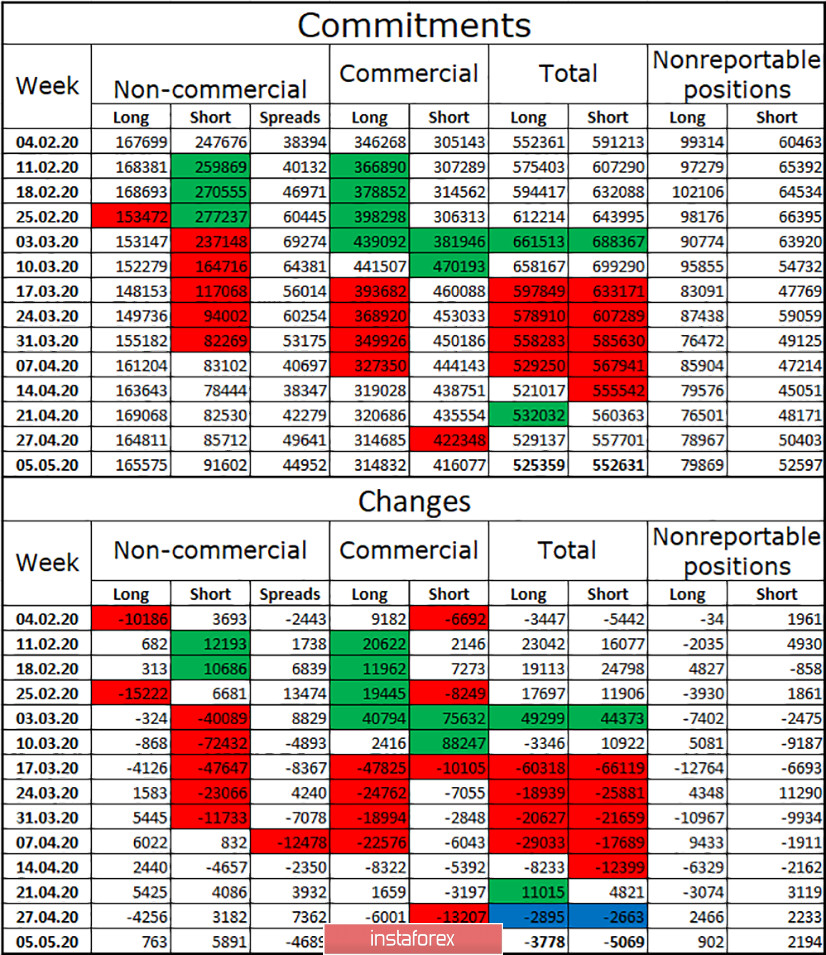

COT (Commitments of Traders) report:

On Friday, a new COT report was released, which again showed minimal changes. For example, it became known that in the reporting week of May 5, professional players increased short-contracts, the number of which increased by almost 6,000. But speculators bought the euro very reluctantly, only +763 contracts. Thus, for three weeks in a row, large speculators have been increasing sales for the euro. At the same time, the total number of long contracts remains twice as high as short, and over the past 7 weeks, the "Non-commercial" group has been increasing them, too. Thus, we can say that both types of contracts are in demand among large traders. As for the "Commercial" group, it is less important for determining trends and forecasting. During the reporting week, this group got rid of short contracts. In general, during the reporting week, the number of both long and short contracts decreased (due to the closing of opposite positions "spreads" and short positions by hedgers). And the overall advantage remains with sales contracts.

Forecast for EUR/USD and recommendations for traders:

I suggest that new sales of the euro be made after the pair closes under the upward trend line on the 4-hour chart with the goal of 1.0638. I do not recommend buying a pair today.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.