GBP/USD – 1H.

Hello, traders! According to the hourly chart, the GBP/USD pair performed a consolidation under the ascending trend line. Thus, the mood of traders again changed to "bearish". Also, the current graphical picture allowed me to build a downward trend corridor, which gives a clear framework within which the trading of the pound/dollar pair takes place. If the European currency is not growing fast, then the British dollar has again rushed down. It seems that traders took a very negative view of the information that the UK came out on top in Europe in the number of cases of coronavirus infection and in the first place in the number of deaths. However, despite this, Boris Johnson intends to weaken the quarantine measures, as they do in many other countries. According to the latest statistics and forecasts, the UK may be the most affected by the COVID-2019 pandemic. And first of all, we are talking about the economy, which has already been severely weakened in recent years due to Brexit. Thus, the British once again open up very unpleasant prospects of a fall against the US currency.

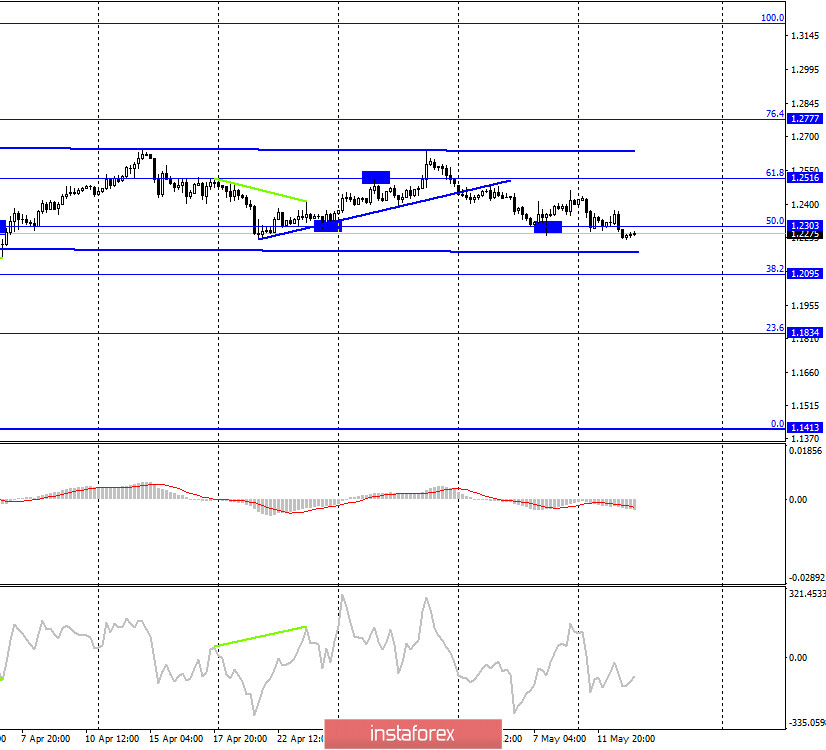

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair performed a new reversal in favor of the US currency and anchored under the corrective level of 50.0% (1.2303). Thus, the process of falling quotes can be continued in the direction of the lower line of the sideways trend corridor, which continues to determine the current mood of traders as "neutral". Closing the pair's exchange rate with a corridor will significantly increase the probability of further falling of the pair in the direction of the next corrective levels on the current Fibo grid. No indicator has any pending divergences today. The rebound of quotes from the lower line of the corridor will work in favor of the English currency and the beginning of growth.

GBP/USD – Daily.

On the daily chart, the pair's quotes performed a reversal in favor of the US currency and anchored under the corrective level of 50.0% (1.2463), which allows us to expect a continued fall in the direction of the Fibo level of 38.2% (1.2215).

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed a false breakdown of the lower trend line. Thus, until the pair's quotes are fixed under this line, there is a high probability of growth in the direction of the top two trend lines, but in the long term.

Overview of fundamentals:

On Tuesday, there were no important economic reports in the UK, and only the inflation report in the US, which did not affect the mood of traders who continued to get rid of the British currency.

The economic calendar for the US and the UK:

UK - change in GDP (08:00 GMT).

The change in the volume of industrial production (08:00 GMT).

US - Federal Reserve Board of Governors Chairman Jerome Powell will deliver a speech (15:00 GMT).

On May 13, the UK has already released GDP data for the first quarter and March, which, unexpectedly for many traders, turned out to be better than expected. GDP in the first quarter decreased by 1.6% y/y, 2.0% q/q/ and 5.8% m/m. Economists had expected a stronger fall in these indicators. Industrial production also fell less than traders expected, -8.2% y/y.

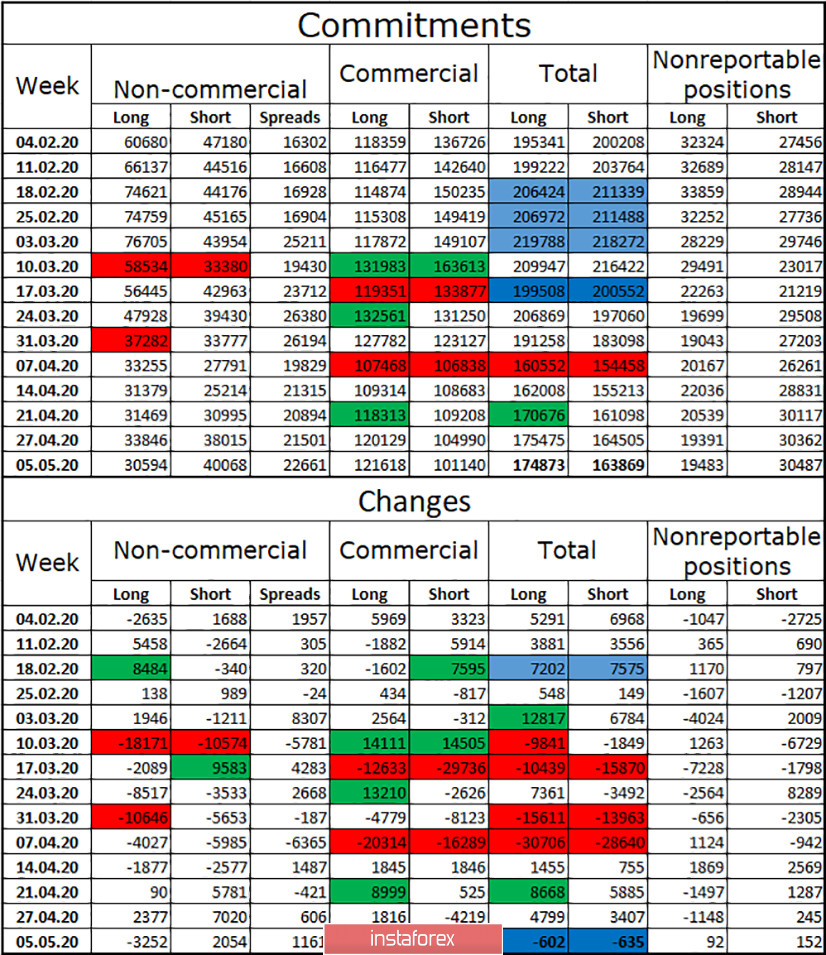

COT (Commitments of Traders) report:

On Friday, a new COT report for the week of May 5 was released. According to this report, professional market players were getting rid of long contracts (-3,252) and increasing short (+2,054). However, in general, all changes in the number of contracts in all groups of traders are minimal. Major players continue to dislike the pound with their attention. The "Commercial" group was mainly engaged in reducing short contracts, and in general, during the reporting week, both types of contracts lost only 600 units, that is, almost equal and at the same time the minimum number. The overall advantage remains with buyers, but it is also absolutely very weak. The total number of contracts in the hands of professional traders does not exceed 100,000. For comparison, in euros - almost 300,000. Thus, the "neutral" mood of traders and not too active trades correspond to the nature of the COT report.

Forecast for GBP/USD and recommendations to traders:

I recommend selling the pound in the current conditions only after closing at 1.2188 (the lower line of the corridor) with the goals of 1.2095 and 1.1834. I still do not recommend buying the British currency, although statistics from the UK today can support this currency.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.