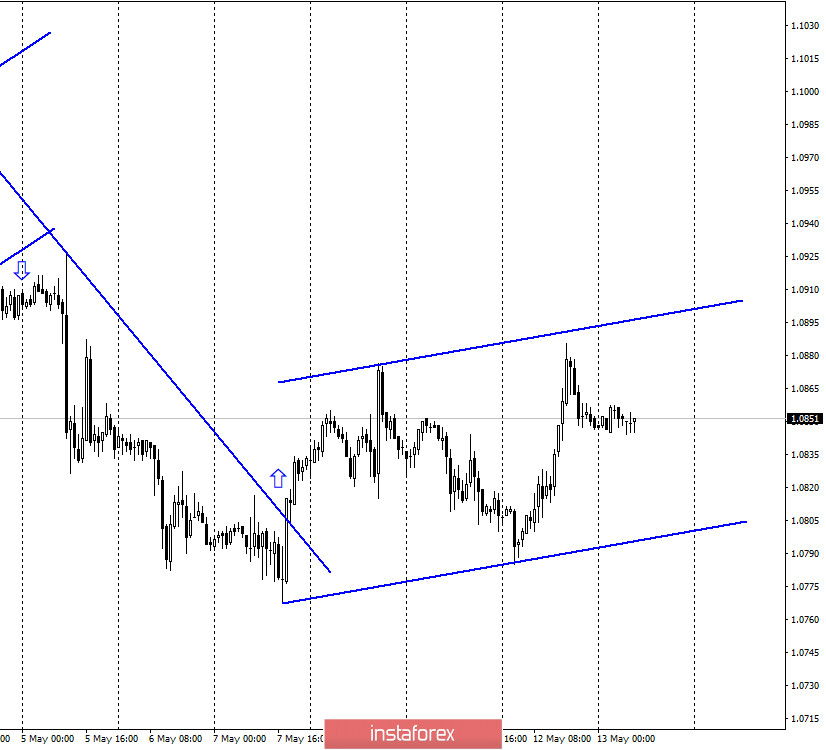

EUR/USD – 1H.

Hello, traders! The EUR/USD pair performed a reversal in favor of the euro on the hourly chart on May 12 and started the growth. The presence of three pivot points allowed me to form an upward trend corridor, which has an insufficiently strong angle to talk about a strong trend. Nevertheless, the mood of traders is now clearly characterized as "bullish". All of yesterday's informational background dealt with the coronavirus epidemic in the world. Let me remind you that many European countries, as well as the United States, are beginning to relax their quarantine measures. However, WHO representatives and US chief epidemiologist Anthony Fauci almost every day make statements that too hasty withdrawal from quarantine can lead to the second wave of the epidemic. In Germany, for example, there is already an increase in new infections with the virus, and the transmission rate has exceeded 1, which means that each infected person infects more than 1 healthy person. Thus, in the near future, a second wave of the epidemic may indeed begin in many countries, since the virus spread relatively freely, even when there were a strict quarantine and self-isolation, now that the epidemic has not ended and the vaccine is still gone, restrictive measures are weakening.

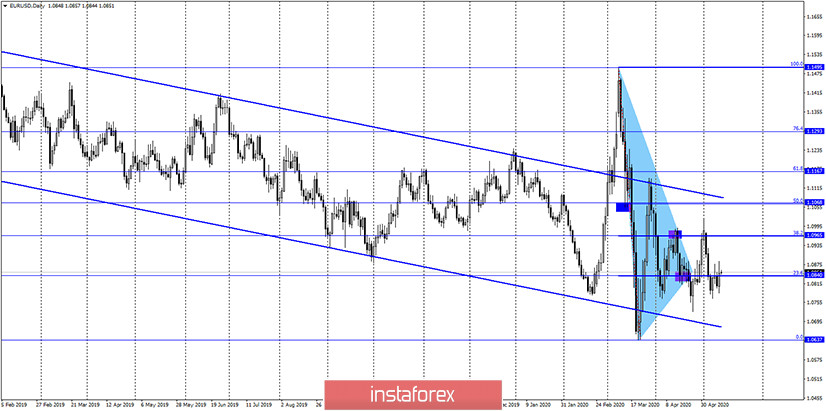

EUR/USD – 4H.

On the 4-hour chart, the quotes of the EUR/USD pair again performed a reversal in favor of the euro, again failing to secure under the ascending trend line. Thus, the "bullish" mood of traders is also preserved on this chart, however, further growth of quotes is not obvious at all. The euro/dollar pair has not been able to continue growing above the level of 38.2% (1.0964) for several weeks. So for now, I don't expect a new upward trend to start out of the blue. More likely, from my point of view, the consolidation of quotes under the trend line and the further fall of the euro. No indicator has any pending divergences today.

EUR/USD – Daily.

On the daily chart, the EUR/USD pair performed a reversal in favor of the euro currency and fixed above the corrective level of 23.6 (1.0840), which is not a strong level at the moment. Thus, on the third chart in a row, we have a signal to buy.

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair continues to trade near the bottom line of the "narrowing triangle". The rebound of quotes from this line still allows us to count on some growth in the long term in the direction of the level of 1.1600 (the upper line of the "triangle"). Closing the pair under the "triangle" will work in favor of the US currency and a new, possibly long fall.

Overview of fundamentals:

On May 12, in America, the consumer price index for April is higher, which slowed to 0.3% y/y. This value has disappointed traders and they were quick to start selling of the American currency.

News calendar for the United States and the European Union:

US - Federal Reserve Board of Governors Chairman Jerome Powell will deliver a speech (15:00 GMT).

Federal Reserve President Jerome Powell is scheduled to speak in the US on May 13. This event is interesting because Powell can touch on the topic of monetary policy and rates. Traders always react quite cheerfully to this information.

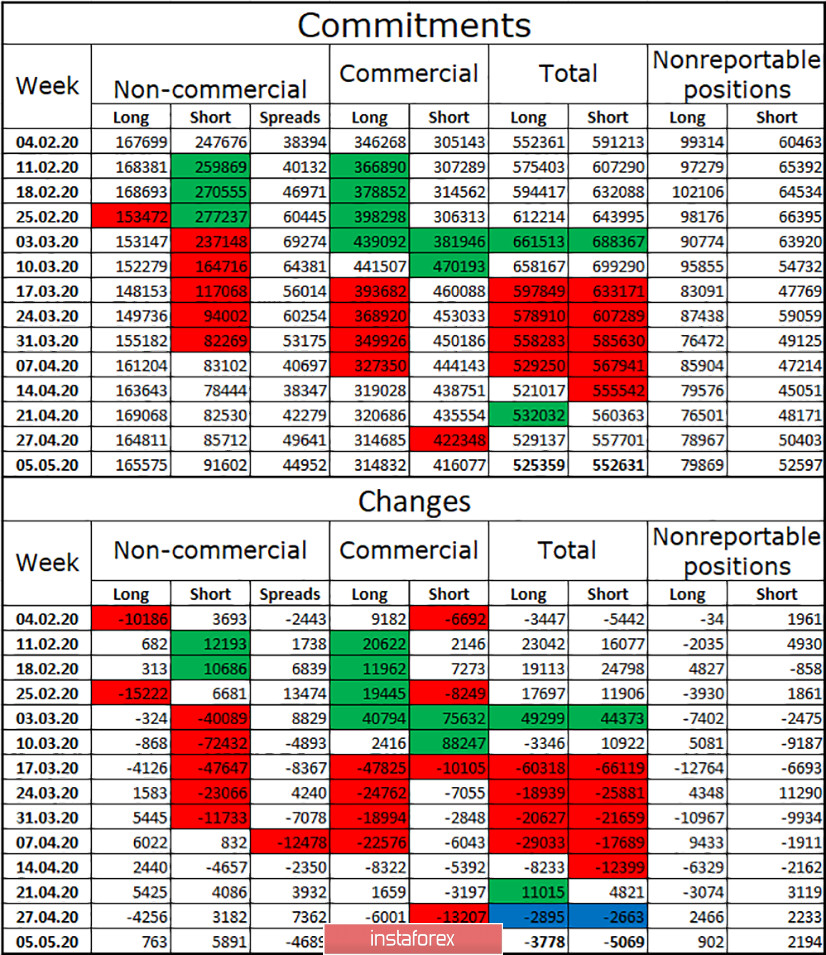

COT (Commitments of Traders) report:

On Friday, a new COT report was released, which again showed minimal changes. For example, it became known that in the reporting week of May 5, professional players increased short-contracts, the number of which increased by almost 6,000. But speculators bought the euro very reluctantly, only +763 contracts. Thus, for three weeks in a row, large speculators have been increasing sales for the euro. At the same time, the total number of long contracts remains twice as high as short, and over the past 7 weeks, the "Non-commercial" group has been increasing them, too. Thus, we can say that both types of contracts are in demand among large traders. As for the "Commercial" group, it is less important for determining trends and forecasting. During the reporting week, this group got rid of short contracts. In general, during the reporting week, the number of both long and short contracts decreased (due to the closing of opposite positions "spreads" and short positions by hedgers). And the overall advantage remains with sales contracts.

Forecast for EUR/USD and recommendations for traders:

I suggest that new sales of the euro currency be made after the pair closes under the upward trend line on the 4-hour chart with the goal of 1.0638. I still do not recommend buying the pair, since the quotes are located in the upper area of the trend corridor on the hourly chart.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.