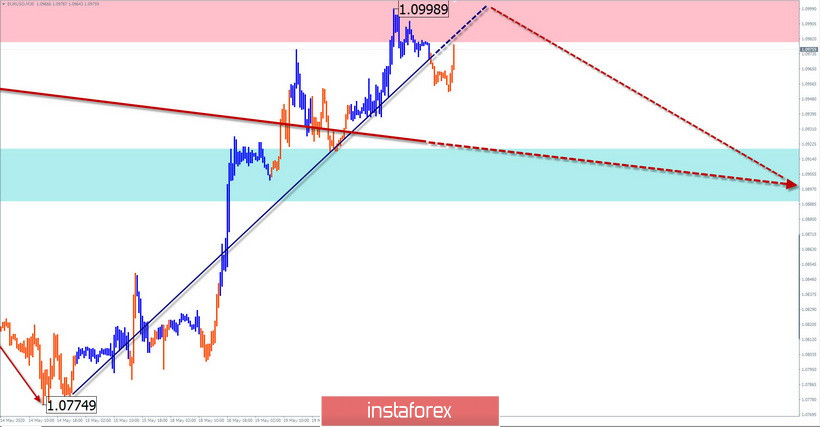

EUR/USD

Analysis:

The dominant trend direction of the European currency is set by the upward wave from March 20. The formation of a correction plane in the last 2 months led to the formation of a price corridor. The last correction section has been reporting since May 6. The price reached the upper limit of the formed price range.

Forecast:

During the next day, the end of the upward movement rate, the formation of a reversal, and the beginning of a decline are expected. A breakout of the lower support limit is unlikely today.

Potential reversal zones

Resistance:

- 1.0980/1.1010

Support:

- 1.0920/1.0890

Recommendations:

Today, trading the euro on the market will be effective within the intraday style. Purchases are not very promising. After the appearance of reversal signals, the main attention is offered to search for points of sale of the instrument.

AUD/USD

Analysis:

Since March 19, the major of the Australian dollar forms an upward wave of the daily scale. The wave develops along with the impulse type with minimal pullbacks. The last section of the main trend started on May 4. Since the beginning of the current week, the price forms an intermediate pullback between the nearest counter zones.

Forecast:

Today, the general flat mood of the pair's movement is expected to continue. After the end of the decline, a reversal and the beginning of a price rise is possible.

Potential reversal zones

Resistance:

- 0.6590/0.6620

Support:

- 0.6520/0.6490

Recommendations:

Short-term intraday deals are possible today. It is most safe to refrain from entering the pair's market, waiting for the end of the current pullback, and look for signals to buy the pair at its end.

GBP/JPY

Analysis:

In the pair's market, the upward wave from March 17 sets the trend. The day-to-day price rate is set by a downward correction algorithm. Its last section has been reporting since April 30 and has reached the final phase. After the intermediate correction is completed, conditions are created for the final decline.

Forecast:

In the morning, a short-term pullback is possible today. By the end of the day, it is expected to return to the downward movement rate. The lower limit of the daily course of the pair is the calculated support.

Potential reversal zones

Resistance:

- 131.80/132.10

Support:

- 130.80/130.50

Recommendations:

When buying a pair today, you should be careful and reduce the lot. We recommend that you pay attention to searching for sell signals in the calculated resistance zone.

Explanation: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of arrows shows the formed structure and the dotted ones show the expected movements.

Note: The wave algorithm does not take into account the duration of the tool movements in time!