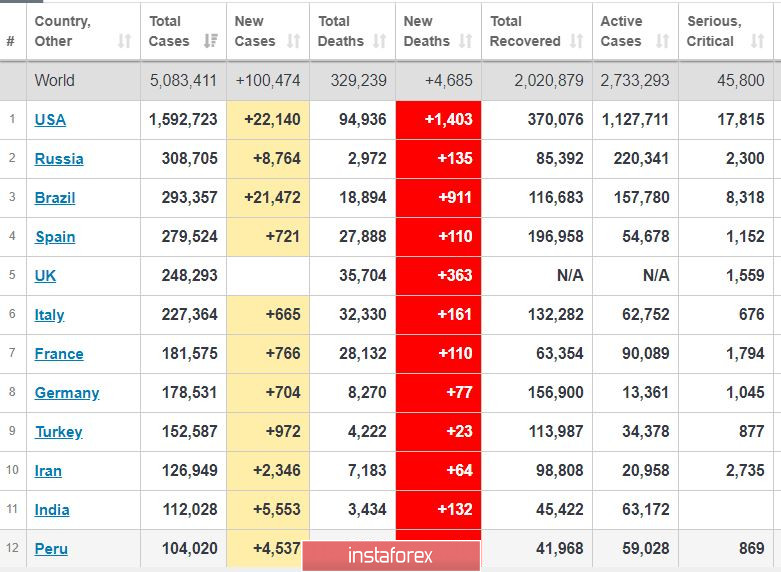

Coronavirus updates as of May 21:

Brazil recorded a sharp increase in new infections yesterday, at plus 21 thousand new cases, almost on par with the US. Tomorrow, Brazil is likely to overtake Russia and become second place in the highest number of cases in the world.

In India and Peru, the daily increase of new cases is 4.5 and 5.5 thousand new infections per day.

Worst case scenario, a third peak of the pandemic will occur in these countries.

In the US, the pandemic is receding, but slowly. The daily increase of new cases is still high at about 20 thousand per day, the highest among other countries, and the number of deaths is more than 1,000 per day. In total, the number of casualties in the US is almost 100 thousand.

In Russia, a sharp decline in new cases has been recorded for three days, pushing the theory that the country has passed the peak of the pandemic. The upcoming data are important for such assessment, but nevertheless, Russia is forecast to steadily pass the peak of the pandemic in early June.

S&P 500 daily chart.

The market is at highs after the onset of the crisis. However, growth is clearly running out of steam.

Today, at 13:30 (UTC+1), the weekly report on US unemployment will be published, which forecasts 2.2-2.4 million new unemployed, and 22.8 million total unemployed.

Such data may pull the market down, but the promises of new liquidity injections may combat it and resume the current upward trend. Sell positions at current prices are more profitable in the US market at the moment, taking stops at highs.

EUR/USD: The euro stopped growing. Attempts of overcoming the resistance area of 1.0980 - 1.1020 are being conducted.

Open buy positions from 1.0855 to trigger a breakout to 1.1000.

Buy positions may also be opened from 1.0950.