Hello, traders!

Yesterday, the minutes of the April meeting of the Open Market Committee (FOMC) was published, which could clarify the situation regarding investors' attitude to the US currency and the balance of power in the foreign exchange market. They could, but they didn't make it clear. Market participants actually ignored the publication of the Fed minutes, and this reaction is already becoming a kind of trend.

As for the protocols themselves, they put the main emphasis on the negative consequences of COVID-19 for the economy of the United States of America. In particular, the document stated that the pandemic will have a significant impact on economic activity, as well as exacerbate the situation with inflation and employment. In this regard, the Fed will not be in a hurry to indicate its next steps regarding monetary policy, this can be done later. In the current situation, the Fed intends to hold rates at current values until the situation with the damage caused by the coronavirus to the American economy becomes clear, and until it becomes clear that the US economy has recovered from the effects of COVID-19 and is close to the regulator's goal for inflation, which is near 2%.

Members of the Open Market Committee will continue to monitor the situation closely and make appropriate adjustments if necessary. At the moment, the Fed believes that the full range of measures taken will provide the necessary support to the US economy and will not allow it to slide into recession. In general, as usual, the US Central Bank keeps its finger on the pulse and is ready for any turn of events. To tell the truth, market participants did not see anything new in the April protocols, so there was no reaction.

If you look at today's economic calendar, Europe will publish reports on the index of business activity in the manufacturing sector and the service sector. Data on primary applications for unemployment benefits and home sales in the secondary market will be received from the US. Some high-ranking monetary officials from the Fed, including the head of this Department, Jerome Powell, are also expected to speak.

I don't know what else new or unexpected can be said in their speeches, in my opinion, everything has been said a long time ago. I believe that the main currency pair EUR/USD will be more influenced by technical factors. Although there is a chance that another speech by Powell and the number of initial applications for unemployment benefits may have an impact on the course of today's trading.

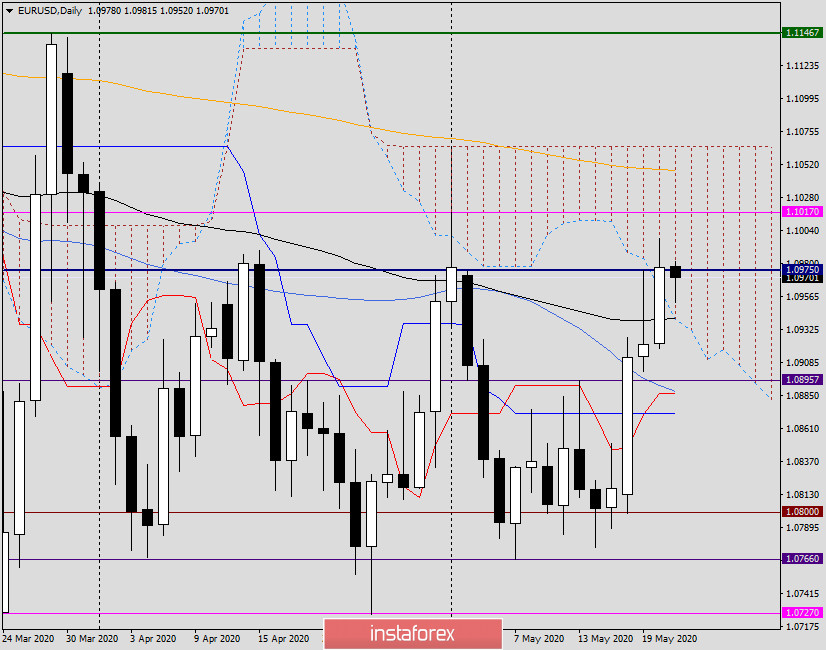

Daily

So, following the results of yesterday's trading, the pair rose and closed the day at 1.0977, that is, 2 points higher than the previous highs of 1.0975. Can this level of resistance be considered truly broken? In my personal opinion, there is no such certainty yet. But, as can be clearly seen on the chart, the black line of the exponent was broken and the euro/dollar is already trading within the cloud of the Ichimoku indicator.

Yesterday, the pair fell just short of the landmark psychological level of 1.1000. Judging by the euphoria of market participants regarding the creation of a fund for the recovery of the EU economy, which was agreed by London and Berlin, the single currency has every chance to continue strengthening. If this happens, the nearest target on the daily chart will be the zone of 1.1047-1.1065, where the 200 EMA is located and the upper border of the Ichimoku cloud passes. I think the selected zone is technically very suitable for opening sales, which will be confirmed by candle signals on lower timeframes.

At the moment, the priority is for purchases that you can try to open on the market (the current price is 1.0960) or after a pullback to the area of 1.0955-1.0925.

Good luck!