Crypto Industry News:

Icelandic national electricity company Landsvirkjun has limited the amount of power it will provide to certain industries, including Bitcoin miners.

A representative of the energy company informed that he had been forced to reduce energy allocations, among others for Southwestern BTC miners due to power plant problems such as low water levels and access to energy from an external supplier.

The country has long attracted mining activities due to the abundance of geothermal energy that is sourced to create cheap and plentiful renewable energy. But from Tuesday until further notice, any new electricity orders from mining operations will be rejected, Landsvirkjun said.

Canadian Hive Blockchain Technologies, Genesis Mining and Bitfury Holding are the three major Bitcoin mining companies that have opened their facilities in Iceland.

For almost a decade, miners have been trying to fulfill the promise of environmentally friendly Bitcoin mining in Iceland. In 2013, Cloud Hashing moved 100 miners to Iceland. In November 2017, the Austrian company HydroMiner GmbH raised approximately $ 2.8 million in its bid to install mining platforms directly at Icelandic power plants.

Technical Market Outlook

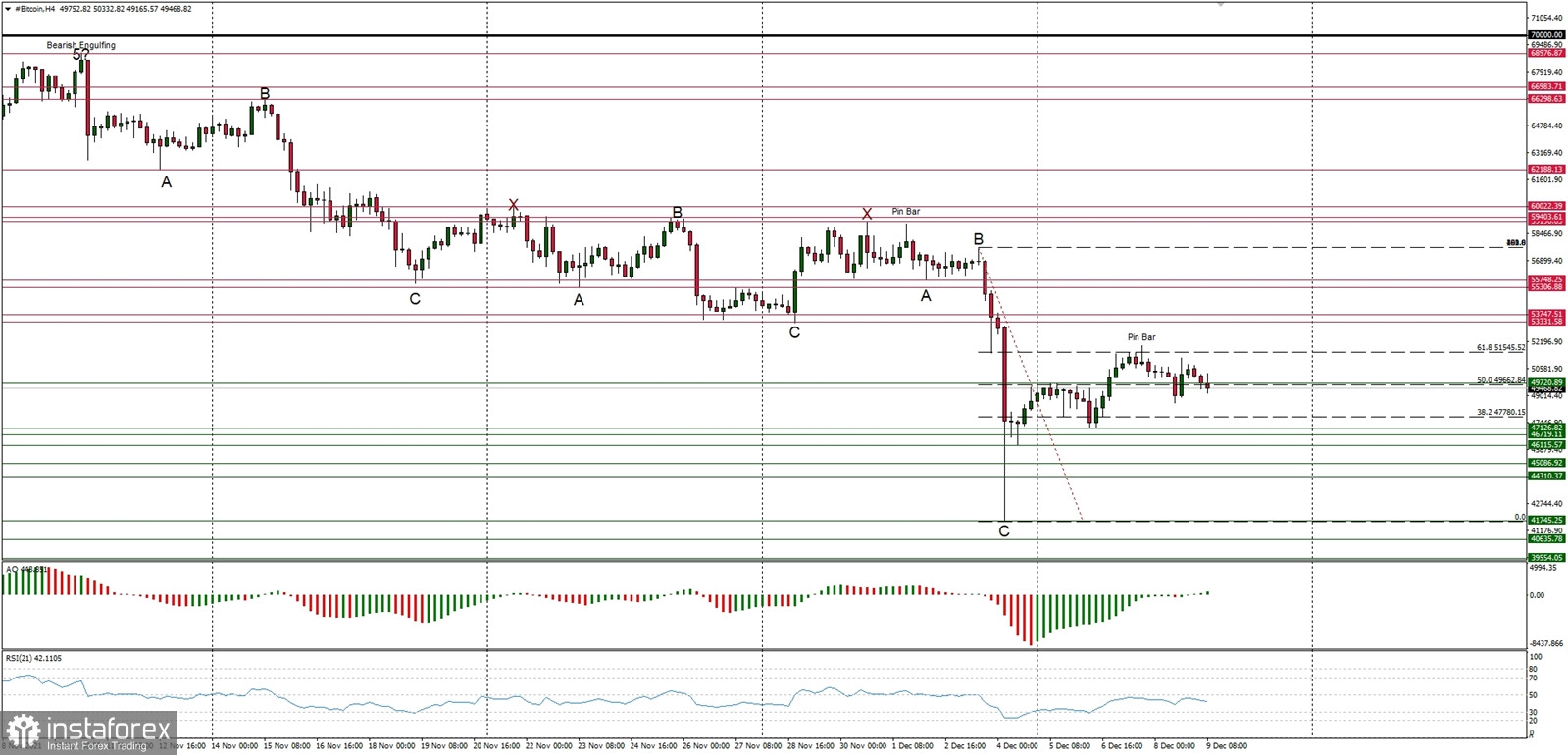

The BTC/USD pair has hit the level of $51,545 which is the 61% Fibonacci retracement of the last wave down and reversed lower towards the technical support seen at $49,720. The next technical resistance is located at $53,333. The momentum is picking up from the oversold conditions, currently hovering around the level of fifty on the RSI (14) indicator. Despite the recent complex and time consuming corrective decline in form of ABCxABCxABC pattern, the larger time frame trend remains up.

Weekly Pivot Points:

WR3 - $75,308

WR2 - $67,229

WR1 - $57,614

Weekly Pivot - $49,717

WS1 - $40,054

WS2 - $31,972

WS3 - $22,000

Trading Outlook:

The ABCxABCxABC complex corrective cycle might be terminated at the level of $41,678 and the market is ready to continue the up trend. According to the long-term charts the bulls are still in control of the Bitcoin market and the next long term target for Bitcoin is seen at the level of $70,000. This scenario is valid as long as the level of $39,474 is clearly broken on the daily time frame chart (daily candle close below $39,000 would be considered as a long-term trend change due to the lower low placement).