EUR / USD

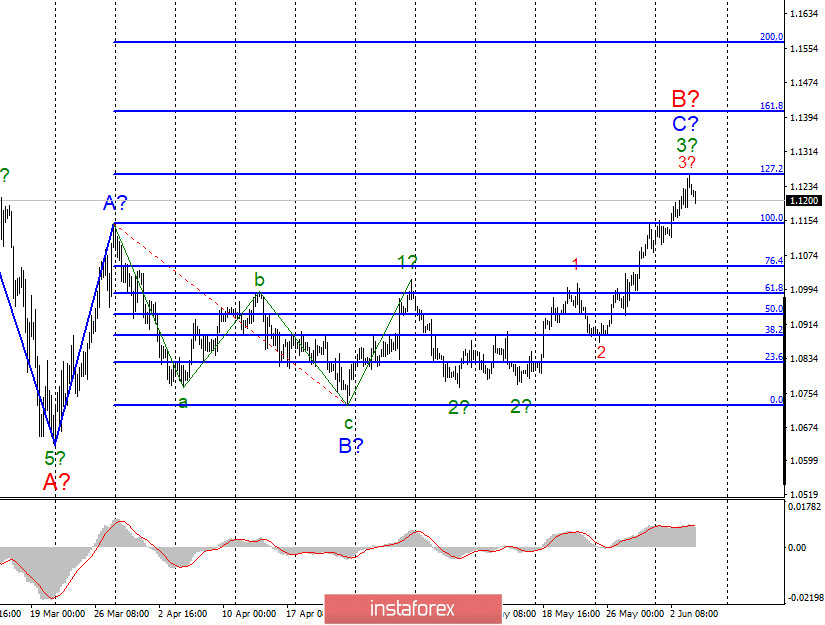

On June 3, the EUR/USD pair gained another 65 basis points and completed the Fibonacci 127.2% level. An unsuccessful attempt to break through this level has led quotes to move away from the highs reached. Thus, the current wave counting means completion of construction of a wave 3 into 3 to C to B. If this is true, then the construction of the downward wave 4 will begin. However, the upward section of the trend does not look complete, which means the euro has a chance of a new increase.

Fundamental component:

On Wednesday, the EUR/USD pair had a lot of interesting information and reports. However, almost all economic data did not attract the attention of the markets. Unemployment rates in Germany and the EU rose as expected. The index of business activity in the services sector of the European Union is the same, but not so much that it is possible to draw a conclusion about the recovery of the industry. More optimistic economic news came from America. The ADP report showed a reduction in the number of private sector workers by just 2.8 million, although markets had expected a fall of 9 million. The index of business activity for the ISM services sector rose to 45.4, but still remains below the 50.0 mark, so I can't draw a conclusion about the recovery of this industry either. OOnly the rate of its decline is slowing down. However, all the most interesting things are still happening now in the United States. And many experts believe that in recent weeks, Donald Trump once again "said one thing and did the other." More precisely, he said one thing, but did nothing. Around the middle of the COVID-2019 pandemic, the U.S. president poured accusations toward China every day. A little later, charges began because of Hong Kong. Donald Trump threatened to impose sanctions, duties against China, Hong Kong, as well as officials of China and Chinese companies. However, he hasn't done anything at the moment. Therefore, the question arises: what is the American president waiting for and is he ready for "military" operations? The same thing with the suppression of internal rebellion. Trump promised to resort to the services of a regular army to disperse the rebels, but neither Democrats, nor Republicans, nor the Pentagon supported his initiative.

General conclusions and recommendations:

The euro/dollar pair presumably continues to build the upward wave C in B. Thus, I recommend buying the instrument with targets located near the calculated levels of 1.1260 and 1.1406, which equates to 127.2% and 161.8% Fibonacci for each new signal "up" MACD. At this time, the instrument can build a correctional wave 4.

GBP / USD

On June 3, the GBP/USD pair gained just about 30 basis points and, thus, around the Fibonacci level of 0.0%, it began to move away from the highs reached. There is reason to believe that the current upward wave completed its construction, and if this is true, then it can not be the wave 3 or C; nevertheless, it can be a wave d in 2 or B, as I have repeatedly warned. If this assumption is correct, then the decline in the instrument's quotes will resume with targets located near the minimum of wave C in 2 or B.

Fundamental component:

There was still no news background In the UK on Wednesday, apart from composite PMI and PMI reports for the service sector. Today, there will be an uninteresting PMI for the construction sector. But all this news does not bother the pound right now. It is only concerned about the suspended state of negotiations between Brussels and London and the riots in the United States. At the same time, the wave pattern is already in favor of the decline of the instrument, so the topic of rebellion and protest in the United States may stop increasing demand for the British currency.

General conclusions and recommendations:

The pound/dollar pair supposedly completed the construction of the rising wave. Thus, I now recommend selling the pound with targets near the level of 1.2068. And only a successful attempt to break through the 0.0% Fibonacci level will indicate that markets are ready for new purchases, and wave 3 or C will resume its construction.