Good day, dear traders!

Following its meeting yesterday, the Bank of Canada decided to keep the main interest rate at 0.25%. At the same time, the bank believes that the negative impact of COVID-19 on the economy of the Maple Leaf Country has passed its peak and has not become as negative as it might have been.

It is characteristic that yesterday's meeting of the Canadian Central Bank coincided with the appointment of Bank of Canada Governor Tiff Macklem. Let me remind you that the Bank of Canada was headed by Stephen Poloz for seven years, but time is running out, and the former head of the bank has come to retire.

As for keeping the interest rate at the same level, I would like to emphasize once again that the Bank of Canada has cut the main rate three times before, and yesterday's decision of the Canadian regulator was expected. As you know, in the context of the coronavirus pandemic, almost all the world's leading central banks have taken steps to support the economy in their countries. The Canadian Central Bank was no exception, as it launched a large-scale bond-buying program in addition to cutting rates three times.

However, COVID-19 had a significant impact on the decline in production and resulted in significant job losses. Unfortunately, Canada is not alone in this regard. Almost all advanced economies have had to face similar problems.

In an accompanying statement, the Bank of Canada noted that if it is necessary to raise inflation to the target level of 2%, the stimulus program can be expanded.

To conclude the fundamental part of this review, let me remind you that today at 13:30 (London time), the balance of Canada's foreign trade balance will be published, and tomorrow at the same time, data on the Canadian labor market will be received. Regarding American statistics today, it is worth paying attention to the number of applications for unemployment benefits. The main event of this week is the labor statistics from the United States, which will be released tomorrow at 13:30 London time.

Turning to the technical analysis of the USD/CAD currency pair, I will start with the results of the recently completed last spring month.

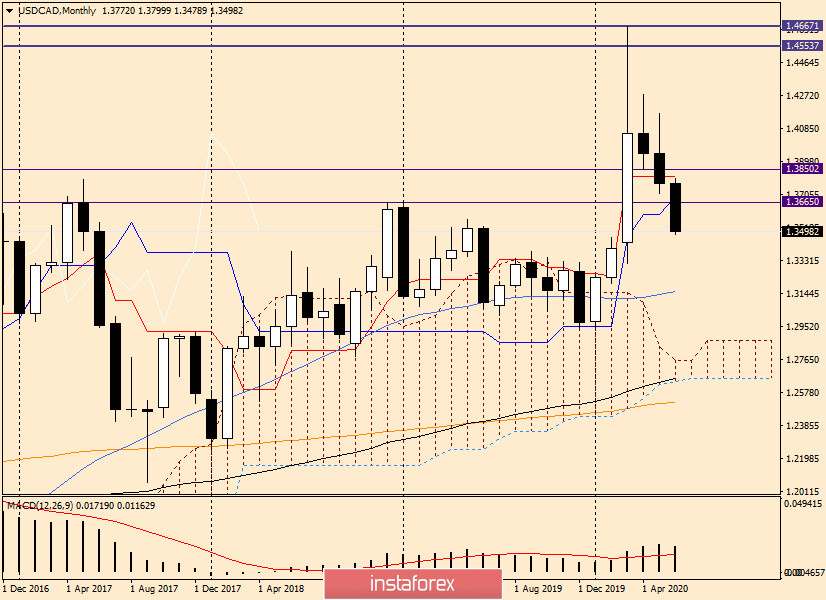

Monthly

As you can see, after the March candle with a very long upper shadow, doubts arose about the further ability of the pair to move in a northerly direction. These doubts were not in vain, as the pair showed a downward trend over the next two months. As a result of the decline, the Tenkan line of the Ichimoku indicator was broken, and at the moment the pair is trading below the Kijun line. If the bearish scenario continues, the next target on the monthly chart may be the 50 simple moving average, which passes at the level of 1.3155. If the June candle turns out to have a long lower shadow and the closing price is higher than Tenkan, the breakdown of this line will be considered false, after which there will be a high probability of resuming the upward dynamics.

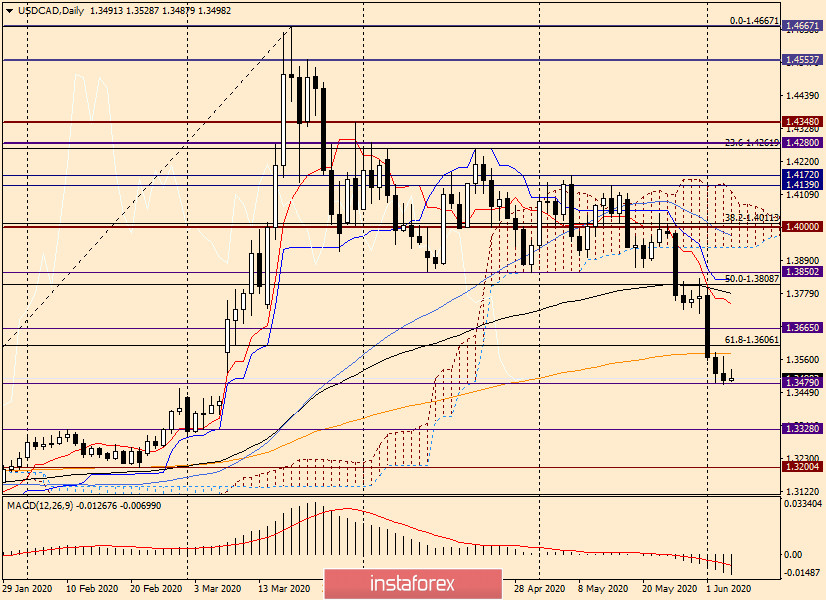

Daily

On the first day of summer, the pair marked a strong fall and broke through the mark of 1.3580, where the 200 exponential moving average is located. In the next two days, the quote was fixed at 200 EMA, which will now prevent attempts to grow and provide resistance to the quote. However, to do this, a pullback must occur to the 200 exponential, the probability of which is currently under great question. The pair is under selling pressure, and in the event of a breakdown of the support of 1.3479, it will head to the strong technical zone of 1.3430-1.3400. I consider it premature to talk about further goals below. A very important week for USD/CAD, where everything will be decided on the last trading day when data on the US and Canadian labor markets will be released at the same time.

Trading recommendations for USD/CAD:

Since the pair is in a downward trend in the current situation, the main trading idea is to sell, which is desirable to open after corrective pullbacks to 1.3560, 1.3575 and 1.3600. If there are no rollbacks and the decline continues from the current prices (1.3492), I recommend waiting for the breakdown of the support level of 1.3479, fixing under it, and then consider options for opening short positions on the rollback to the price zone of 1.3475-1.3500. Right here and now, I consider it risky to open deals on USD/CAD, especially since tomorrow we expect very important statistics from the US and Canada.

Good luck!