The United States delivered an unexpectedly strong labor market report. The number of jobs rose by 2.509 million (forecast -8 million). Unemployment fell to 13.3% from 14.7%, while the labor force participation rate and the average work week increased.

The market did not expect such results. None of the 70 economists surveyed by Bloomberg predicted a positive outcome. It could not have been otherwise. All key indicators showed further stagnation of the labor market.

Firstly, he ADP jobs report: the private sector lost 2.76 million jobs in May, while the services sector recorded a 1.967 million drop. This is still a sign of a strong slowdown in the labor market, rather than growth.

Secondly, ISM. The employment index in the manufacturing sector in May was 32.1%, while the services sector was 31.8%. Both readings indicate reduction, since they remain below 50%.

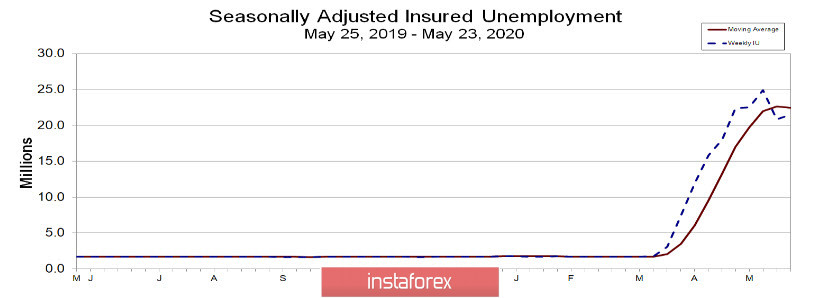

Thirdly, jobless claims. As of May 29, 1.877 new applications for unemployment benefits were filed, which, of course, is less than in April, but still much higher than normal levels. At the same time, the number of repeated applications increased to 21.5 million from 20.8 million.

Was it possible to give a correct forecast for Nonfarm payrolls based on published data? It was impossible as confirmed by the Bloomberg poll.

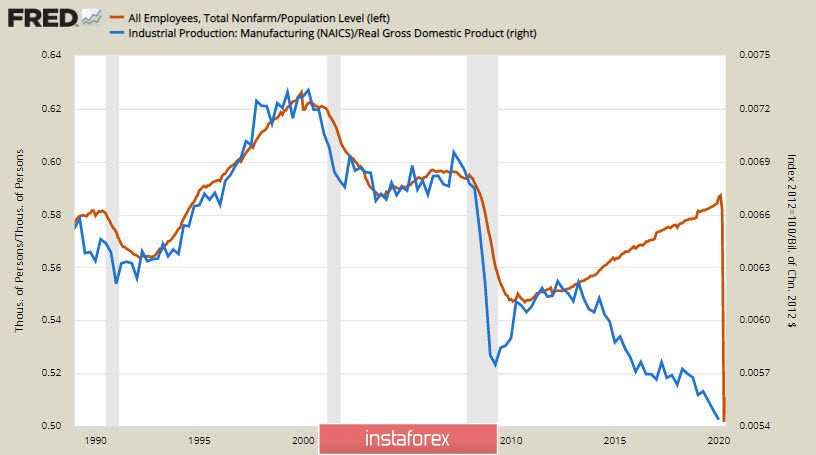

However, there is another indicator that explains a lot. The chart below clearly shows that the state of the US manufacturing sector and employment relative to the total population since the 90s has had a clear correlation. Manufacturing is growing - employment is growing, and vice versa. The chart shows periods of economic ups and downs.

A noticeable divergence began only after 2013. The industrial sector continued to decline, while employment was confidently recovering. The coronavirus crisis dropped the level of employment to its natural state, clearly demonstrating that the labor market growth during the recovery period after the 2008-2009 crisis was hollow, and the sectors of the economy that provided this growth as part of the concept of postmodernism were of no worth.

US employment is currently at a reasonably low level, which is ensured by the economy. Thus, an unprecedented few trillion dollars financial support of the economy by the Fed and the government is not a temporary but a permanent phenomenon. The US economy is no longer capable of growing without this financial aid.

Thus, in the coming months, the dollar exchange rate will be determined by the growing political struggle on the eve of the presidential election as well as by the regulation of currency corridors by the Fed and several other central banks in the framework of a cartel agreement and not by fundamental economic indicators.

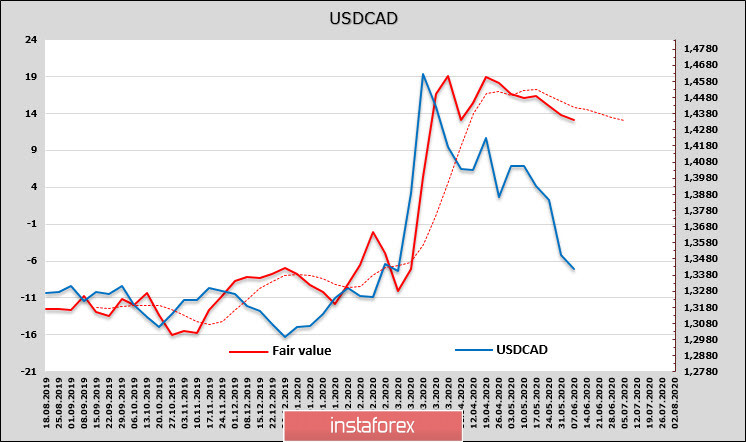

USDCAD

The employment report in Canada was as optimistic as the US, which allowed the Canadian dollar to continue strengthening.

The CFTC report has not shown such rapid optimistic growth yet. The aggregate short position decreased by 13 million to -2.451 billion. Despite the fact that the estimated price is directed downward and supports the trend, the probability of correctional growth has increased.

The nearest resistance zone is 1.3290/3310. base formation is possible followed by a pullback to 1.3610/40. The USDCAD pair may continue declining only in case of a steady increase in optimism, which is still unlikely at this stage.

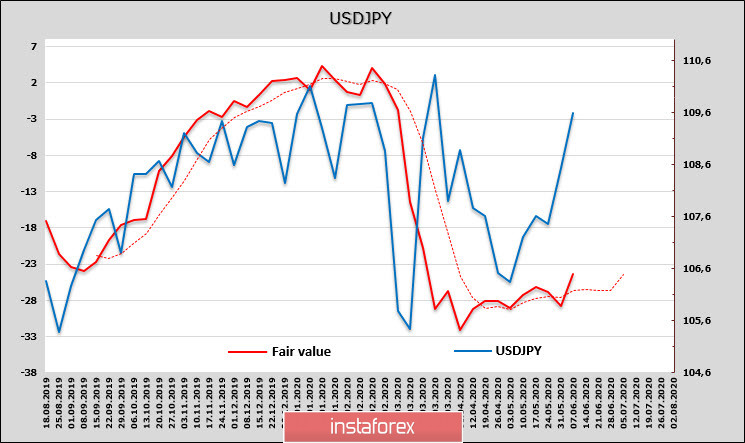

USDJPY

The revised GDP data for the 1st quarter was published today. However, it did not cause a market reaction as it was outdated even before publication. Meanwhile, Eco Watchers' forecast turned out to be positive and contributed to the weakening of the yen.

The long position in the yen has fallen by $275 million, which is a serious reduction, indicating that major players are reducing the level of risk in their calculations. The estimated price has turned upward, which increases the chances of continued growth of USDJPY.

At the moment, the price attempts to consolidate above 109.40. If the price manages to consolidate above this level, it is likely to rise to 111.72. From the market's point of view, the chances that the yen may strengthen are declining. Growth is possible even without correction.