The content of the United States Department of Labor report is truly surprising. Only two possible explanations come to mind - either it's a miracle, or someone draws numbers beautifully. Apparently, these oddities with statistics became the main reason for the dollar's sluggish growth. Although, of course, it is impossible to write off the protests, which, although they are decreasing, have not yet ended.

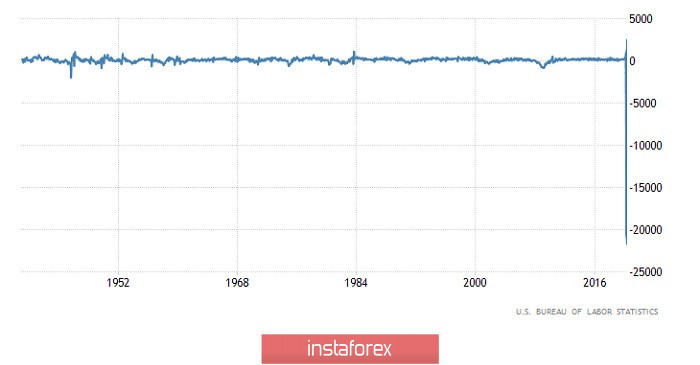

So, the report on the state of the US labor market in May, and let me remind you that this is the same month that we saw an absolute record high number of repeated applications for unemployment benefits, that is people simply can't find work, showed amazing things. In particular, the unemployment rate fell from 14.7% to 13.3%. Although we expected it to grow to 19.5%. The expectations were fully justified, just because of the number of repeated requests for benefits. Moreover, it is alleged that 2,509 thousand new jobs were created in May, which is an absolute record high. But it is completely unclear where the incredible number of repeated applications for benefits came from. That is, we get an amazing picture that the economy creates a huge number of new jobs, but people still can't find a job. Most likely, none of the officials will ever admit that the May report of the United States Department of Labor is not that kind, but they will actively appeal to it, saying that everything in the economy is quickly getting better. And then, gradually, adjustments will be made to this report. And for the worse. But this will be done in early July, when the content of the May report might already be slightly forgotten.

The number of new jobs created outside of agriculture (United States):...

The macroeconomic calendar is completely empty today, and so is the general information calendar. Protests in the United States have almost stopped, so they will no longer put pressure on the dollar. However, there are no other factors that can somehow affect the mood of investors. So it is likely that several people will use today as preparation for the upcoming meeting of the Federal Open Market Committee. So from the point of view of fundamental analysis, the market is expected to calm down.

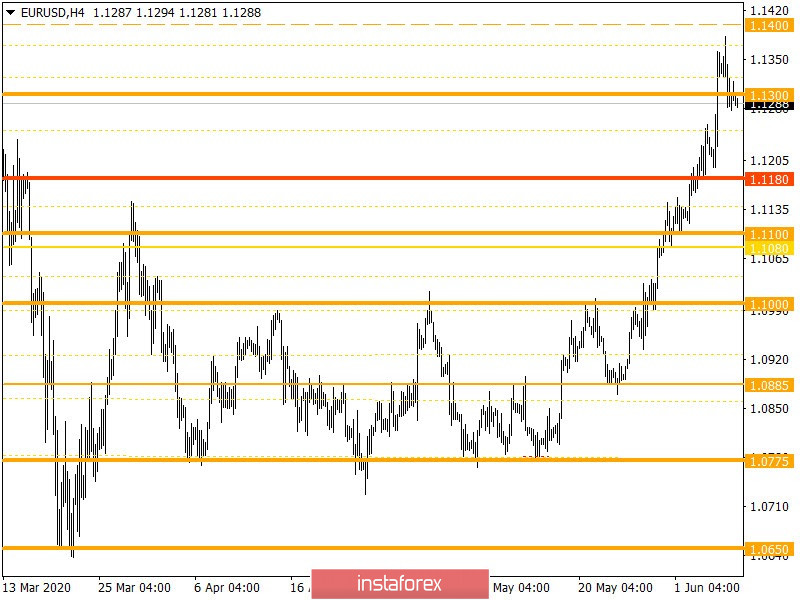

From the point of view of technical analysis, you can see an intensive upward movement, during which the quote managed to reach the level of 1.1380, where there was a slowdown and as a fact a pullback. The overall dynamics was more than 600 points for three weeks, as a result, the clock frequency of the variable flat changed, and it was replaced by a move similar to the movement from February. Regarding the pullback, it is worth highlighting the quote's return to the limits of the 1.1300 level, where another stagnation of 1.1280/1.1320 was formed.

In terms of a general review of the trading chart, the daily period, the price converges with the area where trade forces interact at 1.1440/1.1500 is recorded, which puts pressure on long operations.

It can be assumed that the quote will continue to fluctuate for some time within the range of 1.1280/1.1320, where the best tactic will be the method of working on the breakout of established boundaries.

We specify all of the above into trading signals:

- We consider long positions in case of price taking higher than 1.1325, with the prospect of a move to 1.1350-1.1380.

- We consider short positions in case of price taking lower than 1.1277, with the prospect of a move to 1.1250-1.1200.

From the point of view of a comprehensive indicator analysis, we see that the indicators of technical instruments on four-hour and daily periods still signal a purchase, which reflects an earlier inertial move.